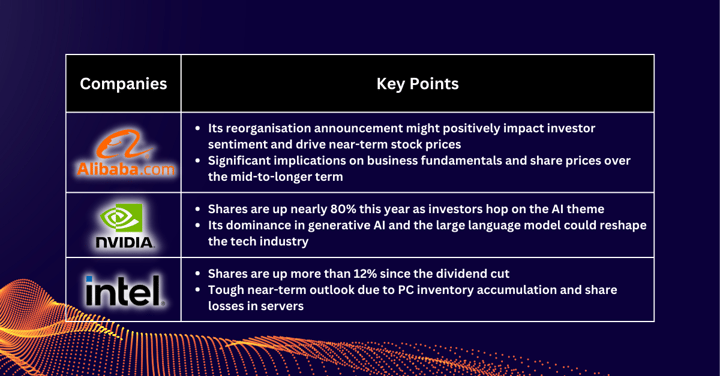

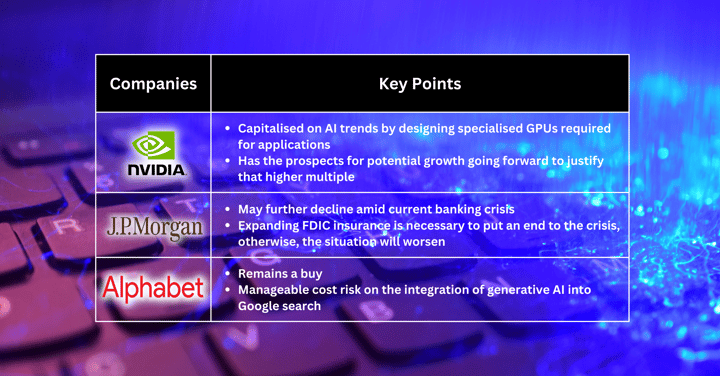

Stocks Pick of The Week - Tech Companies Boost Sentiment Amid Debt-Ceiling Concerns

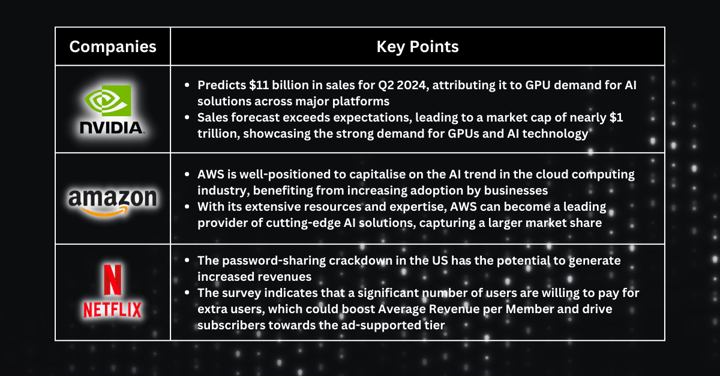

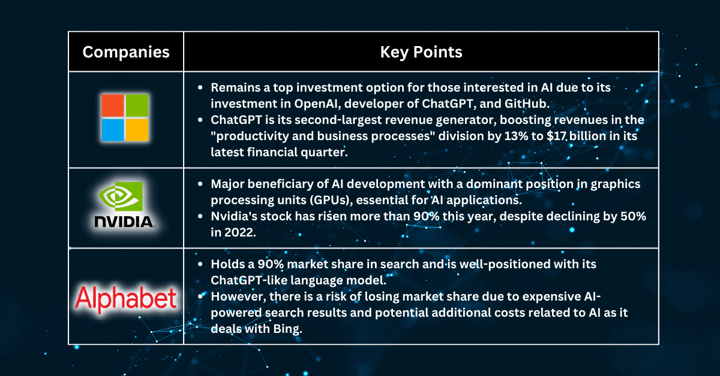

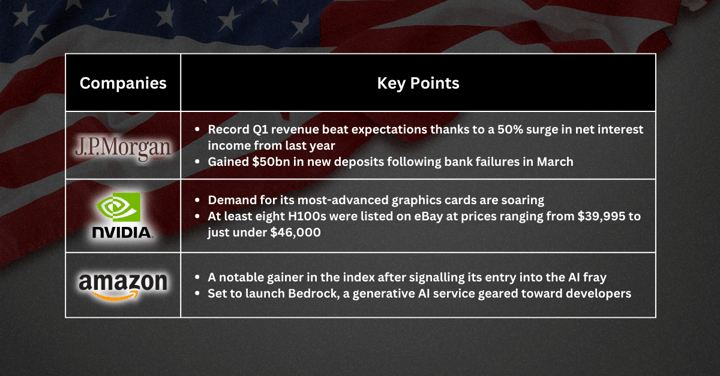

The Nasdaq Composite experienced a notable surge following Nvidia's strong sales forecast, fueled by the increasing demand for artificial intelligence technology. Nvidia's stock soared by 25%,...