Do you want to be a profitable trader?

Choose a trading style that suits you best.

Unfortunately, this is easier said than done, especially for new traders. However, this is necessary if you want to set yourself up for long-term success in Forex.

Trading psychology suggests that your success in the financial markets heavily relies on how you're wired cognitively, emotionally, and socially. If your decisions run counter to your wiring, you'll end up frustrated and performing inconsistently.

This makes self-knowledge vital to this entire exercise. More on this later.

Ready to discover what kind of trader you are?

What types of traders are there?

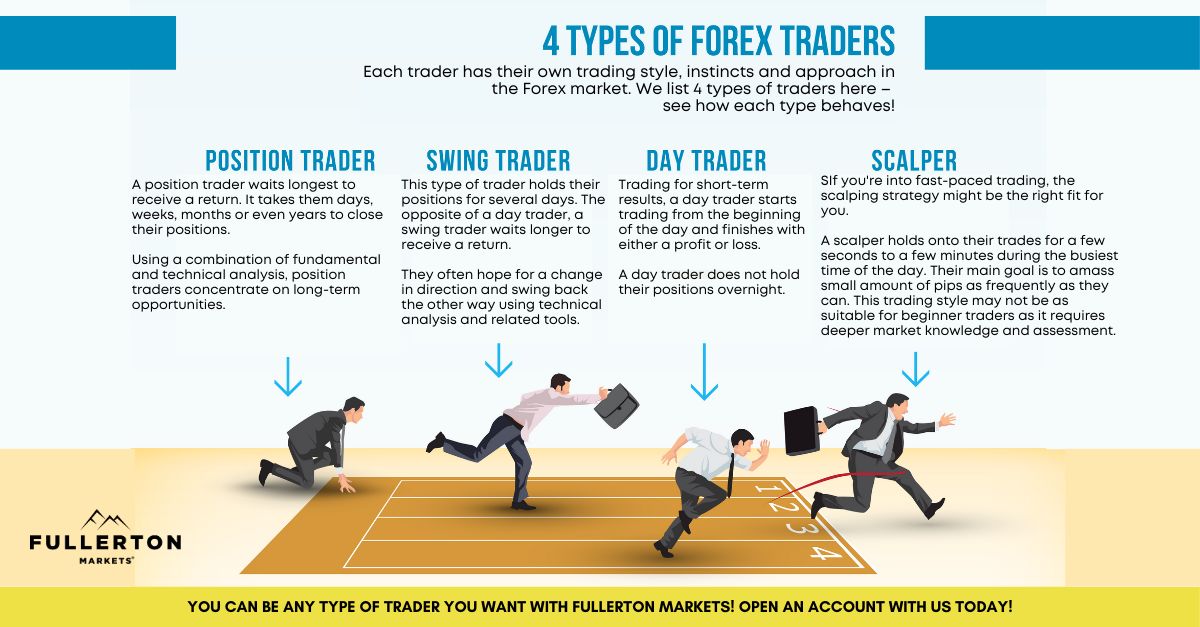

Below are four of the most common types of Forex traders.

Traders are further categorised based on the tools or styles they use to trade in the foreign exchange market.

An algorithmic trader, for example, uses computer programs to open trades at the best possible prices. They use either high-frequency trading algorithms or defined instructions to trade. An event-driven trader, on the other hand, prefers fundamental analysis over technical charts to make trading decisions. They stay updated with world news to identify how some events affect the Forex market.

There are also trend traders, range traders, momentum traders, and breakout traders, among others.

Now, let's further dissect each of the 4 most common types of traders.

Trader Type: Personality Trait, Time Frame of Trade, and More

Position Traders

Position traders hold trades over a longer time frame, waiting for weeks to months before closing open trades. They're more interested in a currency pair's sustained performance and less on short-term price fluctuations. This is why they hold fewer trade positions, even over a 12-month period.

Fundamental analysis is their main trading strategy but they usually time their entries using technical analysis.

Should you consider this trading style?

If you have the patience to wait for a longer time to profit or receive returns from your investment, then yes. The good news is you don't need to spend a lot of time trading since you're trading off a higher time frame and not necessarily on a daily basis. This makes position trading a suitable approach if you have a full-time job.

You need to have thorough knowledge of the fundamental factors that can impact the markets to make a profitable trade. It will also help if you're systematic and strategic in your trading decisions.

Pros and Cons of Position Trading

Pros

- Lesser time spent on trading because of long-term trades

- Frees the rest of your time to build other aspects of your portfolio

- Spares you from stressing over short-term price fluctuations

- Offers favourable risk-reward ratio

- Works across major currencies

Cons

- Requires thorough knowledge of the fundamental factors that drive the market

- Requires a larger capital base because of a wide stop-loss

- May result in lower profitability due to the lower number of trades

Swing Traders

Swing traders hold positions over the short- or medium-term, anywhere from overnight to several days. The goal is to capture a swing or single move in the Forex market. They usually buy when the market shows an upward swing and sell when the price swing stops, or buy support and then sell resistance. They also trade the bounce of a moving average or trade breakouts and pullbacks.

It's vital for a swing trader to learn technical concepts such as moving average, candlestick patterns, and support and resistance. This type of trader also favours technical analysis over fundamental analysis.

Learn more about whether to Use Support or Resistance in Forex Trading

Should you consider this trading style?

If you’re able to spend one to two hours a day to trade the markets, then yes. You must be focused, with an eye for detail when analysing the charts. You also need to be selective of your trades. This trading approach is less frantic than scalping, so you can stay calm but alert enough to capture high and low extremes.

Pros and Cons of Swing Trading

Pros

- More trading opportunities, resulting in higher profitability

- Can trade and keep a day job at the same time

- Able to play positions in liquid currency pairs

Cons

- Requires a mix of fundamental and technical analysis, as well as macroeconomic and day-to-day trend analysis

- May come with overnight risks

- May miss opportunities on big trends

Day Traders

Day traders, as the name suggests, trade on a daily basis and will close all positions at the end of every trading day. This doesn't necessarily mean they need to spend all day in front of their computer since trading can be done anywhere from five to 15 minutes.

Their goal is to capture the intraday volatility, using a variety of techniques and strategies. Profit can be made from buying support and selling resistance, trading breakouts and/or pullbacks, and trading through day averages.

Day traders usually pair volatile currencies that show large movements over a short period of time. GBP/AUD, GBP/CAD, GBP/JPY, and GBP/NZD have the highest volatility, moving an average of 100 points or more per day.

Should you consider this trading style?

If you want Forex trading to be your only source of income and you’re highly skilled and knowledgeable of the Forex market, then this might be for you. Because you can make a profit on quick turnover rates, you need to make quick trading decisions as well. This means you'll need to be instinctive and observant in analysing data over a short time frame.

Pros and Cons of Day Trading

Pros

- High volume trading

- Make money on most months

- No overnight risks

Cons

- Can lead to stress while watching the markets constantly

- Can come with huge losses in the event of a massive slippage due to Black Swan events

- Inconsistent income

Scalpers

Scalpers hold positions anywhere from one minute to one day. The goal is to make small gains at the busiest times, which involves high-frequency trading throughout the day.

They need to react to rapid market changes so they must be quick-witted and highly instinctive and observant to make sound trading decisions and to remain stoic under pressure.

The trading tool they'll likely use is order flow that shows the market's buy and sell orders. Every scalper must identify market conditions before they trade.

Should you consider this trading style?

If you have the ability to spot profitable positions and react quickly to market changes and any new information that comes through within the day, this style would suit you best. You must identify the current technical condition of the Forex market, which is broken down into trends, ranges and breakouts, and then trade according to the most suitable price action.

Pros and Cons of Scalping

Pros

- Offers plenty of trading opportunities every day

- Provides a healthy income when more winning trades are made

Cons

- Requires long hours of the day to monitor the charts

- Can lead to stress and pressure

- Transaction costs can eat up your profits

How will you know which Forex trading style suits you best?

To help you decide on the most suitable trading style for you, consider the following top three criteria:

1. Your personality

2. Length of time you can spend trading, and

3. Your level of Forex knowledge

Remember self-knowledge? This is where knowing your own mental states, dispositions and processes will come handy.

If you're patient, have thorough knowledge of the Forex market's fundamental factors and don't want to spend a lot of time studying the charts, you'll make a good position trader.

If you prefer to make quick money based on the market’s current technical conditions and don't mind being glued to your computer all day, you can be a scalper.

To eliminate any doubts, take this personality test. This is taken from the chapter dedicated to understanding a trader's profile in the book 17 Proven Currency Trading Strategies: How to Profit in the Forex Market by best-selling author and thought leader in global finance Mario Singh.

It also outlines the differences of each trading style to help you further identify your personal preferences.

It's important to study the pros and cons and the risk-reward ratio for each trading style. Your profitability as a trader, however, heavily depends on your personality, time frame of trade, and your knowledge on Forex trading.

Can you change your Forex trading style?

There's every possibility that you'll want to change your trading style, especially when you further develop your skills and gain more knowledge about the currency market. You may also want to learn about other trading strategies as you go along. From a technical trader, you may want to know about the events-based trading approach.

However, it's highly recommended that you learn one approach first and then master it before you move to something else or combine trading styles. This is especially important for new traders.

Discover the 7 habits you must develop to become a great Forex trader.

Become the Forex trader you should be

Now that we've given you the details, start your journey to discovery. Use what you now know to identify if you have the personality suited for position trading, swing trading, day trading, or scalping, and your next trade will be a good one.

Ready to build and grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin copy trading with Fullerton Markets today by opening an account:

You might be interested in: A Definitive Guide to Forex Trading for Beginners and the Uninitiated