What do you usually think of when you hear the phrase Forex trading?

Something? None?

Don't worry. You're about to be introduced to the fascinating world of the foreign exchange market.

In this article, we'll provide you with the information and tools you need to get acquainted with Forex and the strategies you can use to take advantage of its revenue stream.

Trading in Forex is an investment.

And if you play your cards right (or choose your currency pairs right), you're going to make money. Trading currencies could be your source of additional income too.

Before anything else...glossary of terms

Since you're here to learn Forex trading for beginners, we'll introduce you to some of the terms commonly used on this side of the finance world. This way, going through the rest of the article will be an easy read.

Here goes:

Bid/ask spread

Also called the buy-sell spread; refers to the difference between the price a broker is willing to buy (bid) a currency versus the amount a seller is willing to sell (ask) a currency.

Broker

An agent or company that acts as an intermediary between banks and executes client orders to buy and sell currencies.

Central bank

It has power over monetary policy, making it a key player in the currency markets. Central banks directly influence the supply of money that impact currency price and demand.

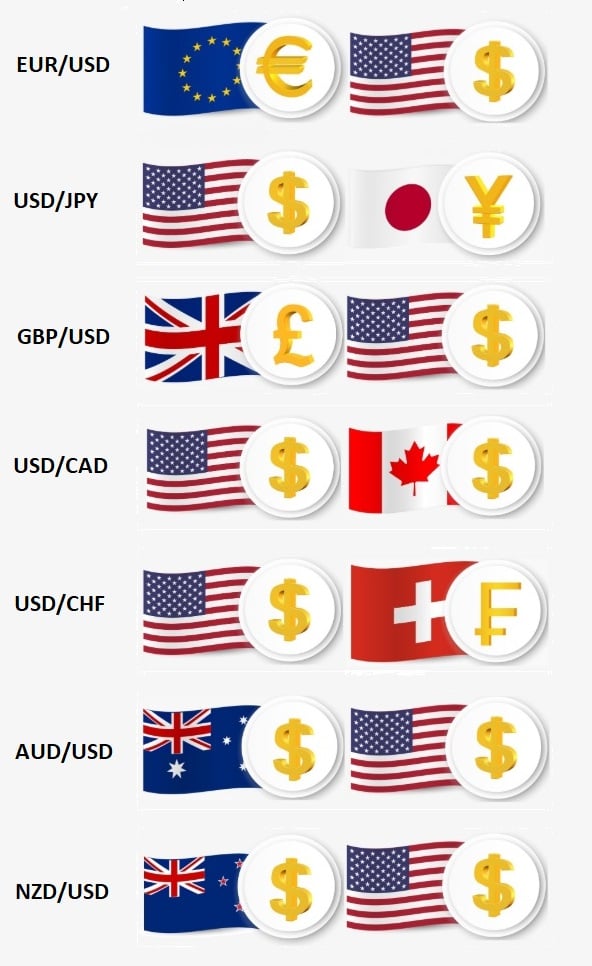

Currency pair

This constitutes two different currencies with one set as a Base currency while the other is a Quote or Counter currency. Pairs are shown as abbreviations of currency names, usually with a slash in between e.g. EUR/USD, USD/JPY, and GBP/USD.

Day trading

When a trader opens and closes a position the same day, trading only on short-term movements in the market.

Forex

The process of buying one currency and selling another simultaneously. Currencies are traded through a broker or dealer and then executed in currency pairs.

Fundamental analysis

In Forex, this is a way of analysing the strength of a currency based on the current or future economic outlook of a country.

Leverage

The use of borrowed capital from a broker to invest in something; allows traders to control a huge amount of money while using little of their own.

Long

This is when you buy first with an obligation to sell later because you expect the price of the currencies to go up.

Lot

This unit of measurement refers to the amount of transaction or the number of currency units to buy or sell.

Open position

When a trade is open and remains active until it is closed. During an open position, a trader can earn or lose a profit.

Pip

This is a unit of measurement that expresses the change in value between two currencies. If the value of EUR/USD increases from 1.3510 to 1.3511, for example, the change is 1 pip.

Position trading

A trading strategy where a trader holds a position for longer than any other traders dare. This is suitable for traders/investors who remain unfazed even in the face of unfavourable market conditions.

Risk management

Refers to how you deal with various types of risk in Forex trading investment, whether by limiting or eliminating them.

Scalping

Also known as short-term trading, this is when a trader makes dozens or hundreds of trades a day to take advantage of the bid-ask spread and scalp a small profit from each of the trades made.

Short

This is when you sell first with an obligation to buy later because you expect the price of the currencies to go down.

Stop-loss order

This order is executed by a broker upon the request of an investor because a certain price of a security has been reached. This is usually done automatically to reduce possible losses in a trade.

Swing trading

This is a strategy where a trader holds a position for a certain number of days and then swings to another based on the market's positive swing. Traders who can react quickly are sure to benefit from swing trading.

Technical Analysis

A process of developing trading strategies based on the price date of foreign exchange rates. This usually involves the use of charts to identify currency market patterns and trends.

What is Forex? How does it work?

As previously defined, Forex is the process of buying and selling currencies. This is something you've probably done when travelling to other countries and you need local currencies to shop or to pay for something.

As previously defined, Forex is the process of buying and selling currencies. This is something you've probably done when travelling to other countries and you need local currencies to shop or to pay for something.

How trading works, however, give the entire process a bit of a complex and risky twist. This is why Forex trading investment is not for everyone.

For beginners, the goal is to survive long enough for you to understand its unique and intricate inner workings. This involves understanding terminologies used (which you've already done, hopefully), studying the market, and learning how to trade Forex for beginners and beyond.

Before we delve into the HOW, let's talk about different features of the Forex market.

- Major players

- Major currencies

- Major currency pairings

Who or what are the major players involved?

As the largest financial market in the world, it might come as a surprise that there are only five major players:

- Central banks facilitate the monetary policies of the government in each country. The US, for example, has the Federal Reserve Bank. Japan has the Bank of Japan.

- Banks trade currencies with one another through electronic networks.

- Big companies participate in foreign exchange while doing business, buying and selling based on the prevailing exchange rates. Before a US-based company can buy parts in China, for instance, it must first exchange USD for Chinese Yuan (CNY).

- Money managers are individuals who trade in the Forex market and manage investment funds on behalf of their clients, which include central banks and the government.

- Individual traders are individuals who use their own capital to trade and speculate in the currency market. You will soon be one of them as soon as you learn more about trading Forex.

What else should you know about the major players within the Forex market? Learn more about them here.

What are the seven major currencies and pairings?

While there are many currencies around the world, the Forex market is dominated by seven major currencies that are most traded. Each one is then paired with another currency based on the overall liquidity.

Major currencies

Major currency pairing

The New Zealand dollar (NZD) usually makes the eighth spot.

Now that you have the basic information you need, let's start buying or selling a currency pair. At the simplest level, Forex investing requires a bit of fundamental analysis to help you make a profit.

Let's say you're rooting for the currency pair EUR/USD.

- EUR serves as the base currency

- USD serves as the quote currency

This means EUR will be the basis on whether to sell or buy the currency pair.

Based on the current situation of the US economy due to the impact of coronavirus, you believe that it will continue to weaken. So, you execute a BUY order, expecting the Euro to rise against the dollar.

If the situation is reversed, then you execute a SELL order because you expect the Euro to fall.

Are you getting the feel of Forex so far?

Once you learn the ropes and transition from beginner to another level, you will discover strategies that you can use to earn more, including when to go Long or Short.

What about Forex trading that makes it so popular/appealing?

There are plenty of reasons, from being the largest financial market to high liquidity.

For beginners, however, the most appealing aspect is accessibility.

Anyone can trade Forex and the cost of entry is low. You can start with a mini account or a standard one and pay the same minimum amount of deposit. In general, the minimum amount needed to open an account with a broker is $100.

Trading can be done over a wide range of platforms – desktop, smartphone, and other mobile devices. As long as you can connect online and sign up for a brokerage account, you can start trading right away.

Start with a demo account with the best Forex trading platform and get a feel of how the system works.

If you're still not confident enough about your trading knowledge and skills, you can copy trade.

Fascinating, yes?

Check out 10 Amazing Facts about the Forex Market.

Types of Forex traders

There are four main traders that play around the market. As a beginner, it might be too soon to tell what kind of trader you are, but you could be any one of the following:

The Day Trader

You open a position at the start of the day and then close it at the end of the day, never holding your trades overnight. Basically, you’re day trading. You usually act based on the biases of your pick and could end with a loss or profit.

The Position Trader

You don't mind holding trades for weeks, months, or even years. You make a trading decision based on your analysis of the market performance.

The Scalper

Your goal is to scalp what small profits you can make with every trade you hold for just a few seconds or minutes. You're busiest at the busiest times of the day, scalp trading.

The Swing Trader

Since you lack the time to monitor the charts all day, you hold trades for several days at a time and then decide on your next move after you analyse the market. An analysis is usually done for just a couple of hours every night.

Different traders have different personalities. So make sure to be the kind of trader that suits who you really are.

It's recommended that you choose a trading style and stick with it. Switching up frequently could result in losses. The only exception is when you've become stressed scalping. In this situation, a bit of flexibility will help.

Learn more about the 7 Habits of Great Forex Traders and practise them yourself.

Benefits, challenges and risks of trading Forex

Just like any investment vehicle, Forex has its share of risks and rewards. But with the right strategy and attitude, you can be making profit consistently.

Just like any investment vehicle, Forex has its share of risks and rewards. But with the right strategy and attitude, you can be making profit consistently.

What you gain trading Forex

There are many benefits when you trade Forex. Some of these are:

- Achieve financial freedom

- Earn additional passive income

- Get to spend more time with loved ones because working hard to earn is no longer a top priority

- Make a profit whether it's a bear or bull market

- No need to pay a commission or transaction cost

Most importantly, you have access to the same market information as everyone else. Take advantage of this to gain a better understanding of the Forex market and global finance.

Challenges and risks of trading Forex

- Paying a higher price

- Difficulty in opening and funding an account

- Fears over fund safety

- Fear that a broker is trading against you

- Less-responsive customer support

- Trading is limited to Forex only

- Low leverage

- Scalping and/or hedging is not allowed

- Multiple accounts are required to trade lots in standard, mini, or micro sizes

- Wide fixed and variable spreads

The list may give the impression that the Forex market is less beneficial and profitable, but you haven't seen the bigger picture yet.

You see, challenges don't equate to a loss, depending on how you look at a situation.

For instance, you may think you're paying a higher price because of slippage. But it only happens on a platform that tolerates it, when volatility is particularly high, or when a currency pair is traded outside the peak hours of the market.

If you have trouble opening or funding your account, then find a platform or broker that eliminates the barrier to trading Forex.

How do you get started investing in Forex?

There are three investment options when trading Forex – spot, forwards, and futures.

The spot market is now synonymous with the Forex market because it has become the preferred market for speculators and individual investors. Here, currencies are bought and sold based on their current price.

The forwards and futures markets, on the other hand, trade contracts rather than actual currencies. A contract that represents claims to a particular currency, for example, are bought and sold over the counter.

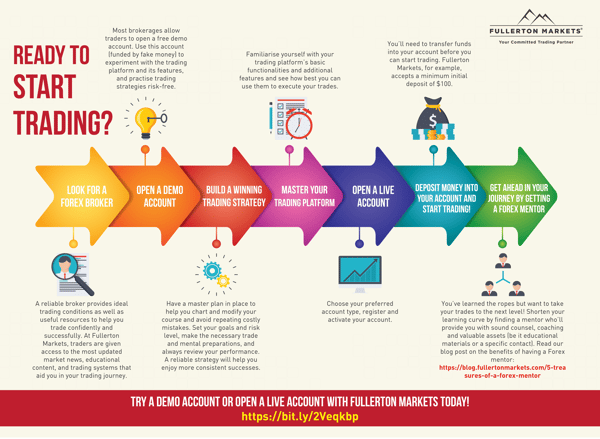

When it comes to Forex trading for beginners, your activities will be mostly on the spot market. The way for you to go ahead and start investing is broken down to three.

Live vs Demo account

With a demo account, you experience a live simulation of the actual trading platform, complete with instruments and charting, but using fake money.

Use it to train, practise, and test trading strategies you want to employ without any real loss.

Once you gain enough knowledge, you can then switch from demo to live account.

Manual trading

As the name suggests, this is where you trade Forex yourself instead of relying on a robot to automate trading on your behalf. This may involve buy and hold, swing trading, and day trading.

Copy trading

Also known as mirror trading, this is where a trader shares real-time trades that you and others can copy. If a trader makes a trade, your account will do the same in real time and with the same allocation.

CopyPip is Fullerton Markets' own trading system where you can copy the trading strategies of 300+ signal providers.

Have you decided to open a demo account or to copy trade? Below is a step-by-step guide on how to start trading.

Choosing a broker

As an individual trader, and someone starting out at that, you need a broker that you can trade with in the Forex market. But with the number of brokers available, choosing a reliable one is challenging.

You need someone who can help you overcome the many challenges in Forex trading and make more profit than losses.

Here's a list of what you need to investigate.

How low is the spread?

Spread is the transaction cost a broker may quote you. The lower it is, the higher profit you can make.

Is the safety of your funds guaranteed?

Only trade with a broker that offers an additional layer of security on top of segregating between client and corporate accounts. Learn how Fullerton Markets protects its clients’ wealth with a triple-level protection plan, Fullerton Shield.

Does the broker offer mini account?

This is highly recommended for new traders because both the profit potential and risk involved are lower. Of course, you can always choose to start out strong and face the consequences head-on.

Is there a demo account available?

The best trading platform and software for beginners should offer a demo account where you can train over a live simulation of an actual trading platform without losing money. This way, you can build your confidence and develop your trading style before you open a live account.

In addition, choose a broker with excellent customer support and reasonable deposit/withdrawal fees. Make sure the fees you incur would not make you a less profitable Forex trader.

Fullerton Markets satisfy these features and more. As your committed trading partner, we'll ensure you’re well-guided in your first foray into the world of Forex so you can succeed in your investing and trading endeavours.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Where to Invest Your $100 and Grow Your Wealth