Anyone can trade in the foreign exchange market. Even those who have little knowledge of currency trading.

How?

By copying trades.

What's awesome about this trading strategy is that you earn on autopilot.

So even when you know nothing or just a little about Forex, you can dabble in it through more skilled traders with proven strategies that you can copy. This is why copy trading is ideal for new traders.

Are you ready to know more?

How copy trading works

Copy trading is so popular these days that it’s given birth to the phrase “people-based” portfolio, which refers to traders who invest in other traders or investors rather than perform trades themselves.

The basic principle is to copy all the trades that a certain trader executes. You win when they win. You lose when they lose.

The mechanism behind copying trades, however, is not as straightforward. Trades are made in a percentage-based manner because you only connect a part of your portfolio to a single trader, not all of it.

In a way, this allows you to diversify and not put all your money into one signal provider.

It's highly recommended that you invest no more than 20% of your portfolio in a single trader.

Find out: How copy trading differs from manual, mirror, and social trading.

Criteria in Choosing a Trader to Copy

One of the biggest challenges of copy trading is choosing who to copy. There are so many signal/strategy providers on one platform and so many factors that must be considered.

One of the biggest challenges of copy trading is choosing who to copy. There are so many signal/strategy providers on one platform and so many factors that must be considered.

So we narrowed the criteria down to just six. Still a lot, but enough to give you a good foundation.

The first thing you need to do is to check out a trader's profile description. This is where you'll find all the pertinent data you can use to identify the best trader to copy.

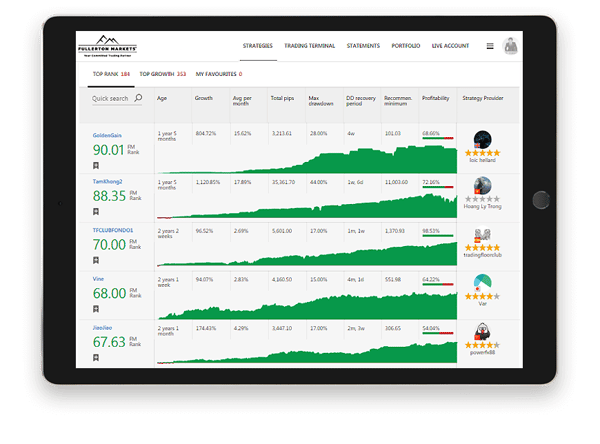

On our own copy trading platform, CopyPip, you'll find the following details:

- Equity growth

- Level of risk

- Maximum drawdown

- Performance charts and more

Proven track record

Check out a trader's performance over the last 12 months or more. It's better if they have been trading for longer so you can see their performance when the market is bullish or bearish.

Returns

The best trader to follow must show consistent rather than sporadic results.

A quick way to identify this is to look at the historical performance graph. If it's gradually increasing, then you could be looking at your future signal provider. If there are irregular spikes, check out someone else.

Basically, you'd want to copy a trader who delivers 3% gains each month for an entire year than someone who wins for the first six months and loses in the next six.

Confidence

Follow a signal provider who trades with a real account and risks their own money. They're likely to be less reckless with their trades if this is the case. This also indicates that they’re confident enough to take the risks with the benefits of Forex trading.

You should also check if the negative month in their performance chart is strategic and not a mistake.

Number of followers

Similar to social media, a trader with a lot of followers could indicate they're suitable to copy. You can even liken them to an influencer. Why would people copy their trades if they’re not winning, right? You could get a portion of those winnings too.

But you must check if the followers, or at least a majority of them, trade with “real money.” You're risking funds from your own pocket, after all.

This also gives you an advantage from a social trading perspective. You can tap those followers for trading advice or for their thoughts and trading strategies.

Risk level

Copy trading is not without its risks, but you don't need to take on the high risk of losing your money if you can't afford to. This is where you need to look at a signal provider's risk level. Is it high or low?

More than anything, check out if stop levels are set on each trade opened and at which distance to determine risk levels. Don't copy a trader with no stop levels as this equates to potential risk at unlimited levels.

Historical drawdown

In Forex, drawdown is the difference between the account and equity balance, where the equity balance is below the account balance. It measures the biggest loss of an account, which is why you must check how much of a trader's account has been in the negative over a period of time. It's likely that the same drawdown can happen in the future, especially if the same strategy is used.

In CopyPip, the maximum drawdown is shown in a trader’s portfolio description. This will help you differentiate one trader from another.

How to minimise risk when copy trading

- Copy more than one trader to spread your risk.

- Make sure the traders you follow use different trading strategies.

- Follow day traders if you prefer to close your trades the same day or no more than 12 hours.

- Observe how a trader behaves during and after a bad trade. If they stick to their tried-and-tested system, stay on.

Most importantly, when a trader changes their trading behaviour or has been underperforming, cut your losses. You're better off freeing up your capital to invest in other traders who are potentially more successful.

Introducing Fullerton Markets' CopyPip System

As a copy trader, or what we prefer to call strategy follower, you will have access to our global network of top-performing traders who have the potential to help you trade in Forex with a winning strategy, earn, and grow your own passive income. Plus, through regular tips on our blog, you’ll learn about recommended strategy providers on CopyPip, and why they’re winning in the markets.

Although you will copy trade, you still have control over what you consider acceptable maximum loss. There are also many trade and risk allocation methods that you can choose from. Learn about all the other unique advantages that CopyPip offers investors and start earning on autopilot today!

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: 5 Considerations When Choosing A Profitable Portfolio to be a Great Trader