In today's financial marketplace, a well-maintained portfolio is vital to any investor's success. As an individual investor, you need to know how to determine an asset allocation that best conforms to your personal investment goals and risk tolerance. In this article, I will be looking at Strategies Provider portfolios on Fullerton Markets CopyPip* Platform.

Fullerton Market CopyPip

*To know about CopyPip, visit www.fullertonmarkets.com/copypip

There are a lot of factors to be considered when choosing a profitable portfolio but we have narrowed down to the top 5 which we believe is the most important.

1. Recommended Minimum

Most people would talk about risk tolerance of a trader before they should invest in a particular portfolio -- that is, how much volatility are you willing to deal with in the pursuit of investment gains? In terms of forex, this could mean the amount of money you wish to put in with your Strategy Provider. Investors should always try to meet the recommended minimum set by CopyPip under each Strategy Provider. The reason is as a Strategy Follower mimics how a Strategy Provider trades, if you meet the recommended minimum, the chances of a discrepancy in results could be lowered.

For example, if the Strategy Provider trades using a $1000 account while you use a $200 account. If you were to mimic his/her trade 100% , there is a chance that you might get stopped out if he had a drawn down of 20% considering that both of them uses the same lot size. If the amount of available funds on your brokerage account is less than the “recommended minimum”, there is a risk to get a Stop Out in your account (forced closure of positions due to lack of funds), while the strategy provider will continue trading.

Though there are settings in place that allow you to change your lot allocation method, we would definitely suggest having the necessary funds to meet money management rules of a trading strategy and follow it with a minimum possible lot of 0.01

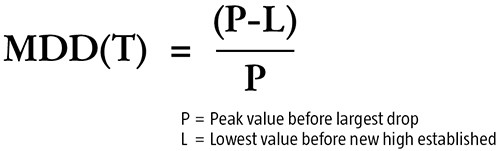

2. Maximum Drawdown Risk

A drawdown is the peak-to-trough decline during a specific recorded period of an portfolio and is usually quoted as the percentage between the peak and the subsequent trough. Hence, a max drawdown risk simply means how many percent . The Maximum drawdown reflects the maximum equity loss you have experienced in your portfolio. This measure can be very important to you when you are analysing your own portfolio or evaluating other traders to determine if you want to place your funds with them and in this case the Strategy Providers.

Assume a Strategy Provider’s portfolio has an initial value of $5000. The portfolio increases to $7500 over a period of time, before plunging to $4000 in a ferocious bear market. It then rebounds to $6000, before dropping again to $3500. Subsequently, it more than doubles to $8000. What is the maximum drawdown?

The maximum drawdown in this case is = ($3500 – 7500) / $7500 = –53.33%

Note the following points:

- The initial peak of $7500 is used in the Maximum Drawdown calculation. The interim peak of $6000 is not used, since it does not represent a new high. The new peak of $8000 is also not used since the original drawdown began from the $7500 peak.

- The Maximum Drawdown calculation takes into consideration the lowest portfolio value ($3500 in this case) before a new peak is made, and not just the first drop to $4000.

Formula to Calculate Maximum Drawdown

3. Fees/Costs

Under CopyPip, Strategy Providers can earn by charging either by setting a performance fee or a management fee. To investors , keeping your costs / fees low is critical to long term success. Portfolio returns after fees are the reason you invest; paying lower fees is common sense. As the saying goes, “It ain’t what you make, it’s what you keep.”

For performance fee, there is a high-water mark impose to ensure that investors do not have to pay performance fees for poor performance, but more importantly, guarantee that investors do not pay performance-based fees twice for the same amount of performance.

Assume the investor places $5000 into the fund, and during its first month, the fund earns a 15% return. Thus, the investor's original investment is worth $5750. The investor owes a 20% fee on this $750 gain, which equates to $150. At this point, the high-water mark for this particular investor is $5750, and the investor is obligated to pay $150 to the portfolio manager.

Next, assume the fund loses 20% in the next month. The investor's account drops to a value of $4600. This is where the importance of the high-water mark is noted. A performance fee does not have to be paid on any gains from $4600 to $5750, only after the high-water mark amount. Assume in the third month, the fund unexpectedly earns a profit of 50%.

4. Average returns per month

Investment returns either monthly or yearly must beat inflation. Prices tend to rise over time. Maybe you have a cable bill that keeps going up, or you remember when milk cost less than $2 per gallon. There are many economic reasons why prices rise gradually over time. This is normal economics. Inflation means that, over time, a dollar is worth a little bit less. Inflation has traditionally been about 2% or 3% a year—much less so since the 2008 financial crisis, but it's a good rule of thumb. With this in mind, the yearly returns for a portfolio must be at least 4% and above in order to beat inflation and builds your wealth.

Last but not least, we must account for the fees when calculating average returns as the fees may erode returns.

5. Age

As many investors would have come across the off-repeated phrase, "Past performance is no guarantee of future results." However, past performance can be helpful when analyzing an investment, but it's important to look at a long-time horizon. Nothing is guaranteed, but long-term past performance can certainly offer insight into the potential for a portfolio’s performance.

When analysing past returns, it's best to include the period where black swan events happened. This helps to evaluate the portfolio resistance to black swan events and also to see if it is “Black-Swan-Proof”. Those longer returns are more indicative of the stability and strength of the portfolio you are investing in.

Louis Teo

Market Strategist