Investors should be cautious about over-enthusiasm regarding the latest tech earnings, as a dovish Federal Reserve may not necessarily result in higher stocks prices. The correlation between the Nasdaq index and the US 2-year government bond yield, which indicates the Fed's policy outlook, has weakened since the beginning of the year. Despite some positive signs, such as the easing of the global supply chain shortage and falling commodity prices, inflation pressure is still a concern. US inflation has been slowing down since July 2021, and this trend may continue in the second half of the year due to base effects.

Meta's Revenue Growth Meagre Despite Stock Surge

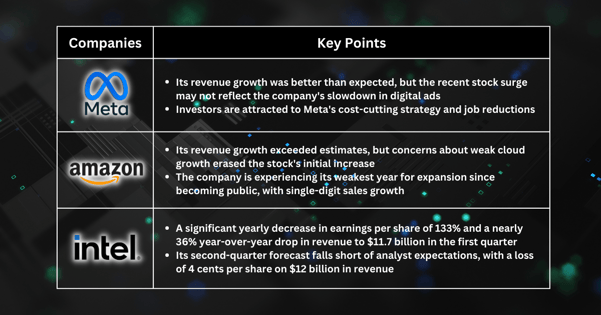

Meta's revenue growth of 3% from a year earlier was better than expected, but its recent stock surge does not necessarily reflect the company's slowdown in digital ads. Despite being approximately 37% below its record high from September 2021, Meta's shares have risen 170% since hitting rock bottom in November. The company's cost-cutting strategy and two rounds of job reductions have appealed to investors. Wall Street is optimistic that Meta will revive growth with easier comparisons after a weak 2022 and newer products gaining better traction.

Amazon's Cloud Growth Weakness Causes Concern

Although Amazon's revenue growth of 9% from a year earlier exceeded estimates, concerns about ongoing cloud growth weakness caused the stock's initial increase to be erased. The company is still experiencing single-digit sales growth, making it the weakest year for expansion since becoming a public company. Despite surging up to 10% initially, the stock's momentum may be affected by the company's cloud outlook.

Intel Underperforms Peers

Intel's first-quarter results showed a significant 133% yearly decrease in earnings per share and a nearly 36% year-over-year drop in revenue to $11.7 billion. Although the loss per share and sales were slightly better than expected, the stock's initial rise upon the release of the report was fluctuating during extended trading. For the second quarter, Intel forecasts a loss of 4 cents per share on revenue of $12 billion, falling short of analyst expectations for earnings of 1 cent per share on $11.75 billion in sales. Compared to its large tech peers, Intel is underperforming.

Fullerton Markets Research Team

Your Committed Trading Partner