XAUUSD reached its highest price at $2070 on 6 August 2020. In the second week of September 2021, the price had an estimated average of $1,700.

Considering how gold is viewed as a store of wealth during crisis and volatility, you might want to explore the earning potentials of trading XAUUSD. This could be your opportunity to turn the current pandemic into something financially beneficial to you.

Important facts about XAUUSD you must know

XAU represents gold as a form of currency in the Forex market. Under the ISO 4217 currency standard, the symbol denotes one troy ounce of gold.

When paired with the US Dollar, XAUUSD tells you how much you have to pay in USD when you buy one gold ounce.

To increase the profitability of your trade, it's important to note that certain assets, indices, organisations, and economic data have the most influence on the price of XAUUSD. These include:

Assets

- Silver

- Currencies

- USD

- EUR

- Bonds

- Bund

- T-Note

- Indices

- GDM (NYSE Arca Gold Miners Index)

- HUI Gold Index

- XAU (Philadelphia Gold and Silver Sector Index)

- Stock exchanges

- New York Mercantile Exchange (COMEX)

- Chicago Board of Trade

- London Bullion Market

- Euronext/LIFFE

- Tokyo Commodity Exchange

- Korea Futures Exchange

- Bolsa der Mercadorias e Futuros

Organisations

- World Gold Council (WGC) - responsible for the market development of the gold industry.

- London Bullion Market Association (LBMA) - members trade gold and silver wholesale over the counter.

- Commodity Exchange Inc (COMEX) - the primary market where metals are traded.

- Chinese Gold & Silver Exchange Society (CGSE) - consists of gold trading firms in Hong Kong that participate in the Chinese Gold and Silver Exchange.

- Zurich Gold Pool - Established by the Union Bank of Switzerland (UBS), Swiss Bank Corporation, and Credit Suisse in 1968.

Economic data

- Supply and demand of gold and other commodities

- Struggling markets

- Instances of currency devaluation

- Use of gold in jewellery, technology, and other products

Why should you care about all these? Because the data you gain will help you understand and determine where gold stands in the market and how you should approach trading XAUUSD.

Why should you trade XAUUSD?

1. Safer and more reliable

This is in comparison with other financial instruments such as stocks and options. The main reasons are due to the fact that gold's value:

- Is often unaffected by economic situations

- Tends to increase especially during market turmoil, as evident in the history of gold prices

- Quickly rises and drops in large quantities

If you manage to ride the wave when the price swings upwards, you're likely to make a lot of profit.

2. High potential for profit

As an extremely liquid asset, you have unlimited opportunities to buy and sell gold in a market that runs nearly 24/7. This means plenty of chances to earn high returns.

Moreover, most XAUUSD trading platforms keep the bid/offer spreads tight and allow traders to use leverage as high as 200:1 or more. So, even when your initial deposit is small, you'll earn double or triple from a positive trading outcome.

Don’t be complacent, however. Make sure you fully understand how leverage works before you use it because of the risks involved. Most importantly, set up risk management strategies in place.

3. Receive constant quotes

Wherever you may be and at any time the market is open, you can receive live data and prices right from the trading platform you're using. This makes it easier to analyse and plan your next move.

4. No need for storage

Unlike investing in physical gold, you won't have to deal with the inconvenience of paying for storage when you trade XAUUSD.

You may need to pay for the rollover rate or the cost of holding the currency pair overnight, however. So consider the cost when calculating your net profit.

5. Diversify your portfolio

Diversification is the best way to protect your portfolio and ensure more profits, and many financial advisors recommend that you add 1% to 2% gold. Some even advise increasing the number up to 15% given gold's current prices.

6. A good and profitable copy trading option

If you're new to Forex trading or you prefer not to do all the weightlifting, you can mimic professional traders of XAUUSD and profit on autopilot. Simply follow, copy and earn.

With this trading option, you can trade like a pro regardless of your knowledge about the foreign exchange market. By choosing the right trader to follow and the best copy trading platform, you’ll profit from XAUUSD without trading yourself.

How to choose XAUUSD strategy providers on CopyPip

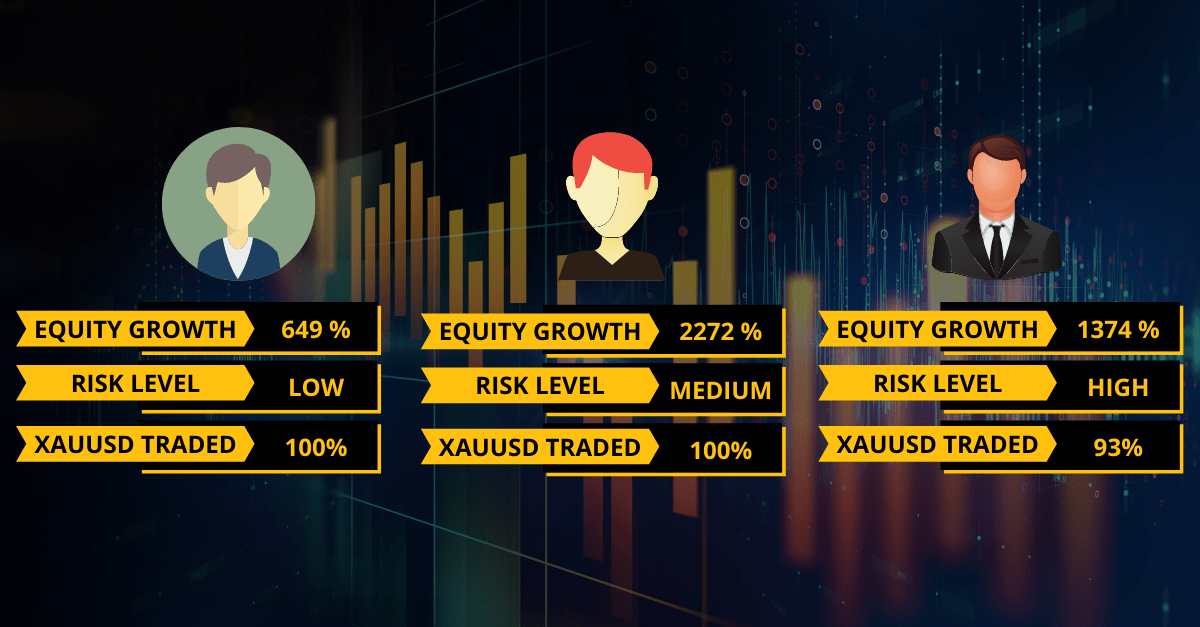

CopyPip is Fullerton Markets' copy trading platform. If you're interested in trading XAUUSD, you'll find strategy providers (SP) who trade the currency pair. For example:

- Goldmuch is a prime example of slow and steady, taking minimal trading risks to ensure positive growth of 648.96% over a five-year period.

- Teen Ant trades a variety of currencies, including 11% of XAUUSD, and achieved growth of 944.17% in less than a year.

- ProsperityFX achieved equity growth of 2222.16% in less than 3 years.

One of your most important considerations is whether to copy someone who trades mainly XAUUSD or with a good mix of other currencies. The difference of which is your access to more diversification opportunities. When you copy trade other currency pairs, you can make money at times when gold prices are low.

Once you've decided, you can then narrow your choices based on various parameters:

- Equity growth

- Risk level

- Performance

- Historical drawdown and more

To minimise or spread your risks, copy two or more SPs, preferably those that use different trading strategies.

Here's a complete guide on how to choose the best trader to copy.

Whether you trade XAUUSD manually or copy trade, grab every opportunity to profit from gold.

Ready to grow your wealth from the world's largest financial market? No better place to start than right here with us! Start trading with Fullerton Markets today by opening an account:

You might be interested in: 7 Tips to Make More Money with Gold's Seasonal Pattern