What is one of the main reasons that many traders and investors fail at the early stages of their financial journey and lose money?

Lack of a risk management plan.

This is true for most financial assets, not just gold and Forex.

Why?

Because the primary goal for any trader is to make a profit, not to protect their capital. Do you remember why you ventured into trading or investing in the first place?

Yes. To make money. To earn a profit. That's the main goal.

Unfortunately, risks are as much part of trading and investing as profit. In fact, you risk a certain percentage of your capital in exchange for returns.

It's therefore important that you know how to manage if not avoid risks and preserve your capital at the same time.

How to manage risks and protect your account when trading gold

1. Understand the various factors that affect gold price

We've said it before:

- Gold prices are inversely related to economic downturns, recessions, inflation and the US dollar.

- It's affected by supply and demand and the Central Bank's monetary policy.

- Gold is positively correlated with the Japanese Yen.

- The metal-currency pair XAUUSD tends to move in a trend.

- There are certain months of the year when gold prices are high.

With this knowledge, you'll know how to ride the rallies and slumps of gold. You can capitalise when prices are high and tread carefully when prices are low.

2. Maintain the right trading attitude and discipline

In some cases, the real enemy is yourself. Failure to control your emotions and reactions to the gold market or trade outcomes can be your undoing.

When was the last time you lost? What was the first thing that came to your mind?

- You wanted to risk a bigger amount on your next trade to recoup your losses.

- You wanted to open more positions in the hope that when all of them close profitably, the total profit will cover what you lost.

- You took a break and only traded after you've regained your composure.

- You took a long hard look at what happened and formulate a better strategy.

If you're prone to experiencing the first and second scenarios, you're risking more than just your capital. You risk losing your self-confidence as well.

If you go with choices three and four, then you have better control of your emotions and mindset.

Negative emotions are not only triggered by a losing trade, however. Winning can also lead to ego trading that could have a disastrous outcome.

So the goal is to master the right trading mindset and to have a strong discipline to stick to your trading plan and money management rules.

Learn more about maintaining a pre-trading checklist as part of your trading discipline.

3. Always place a stop-loss

You should set a stop-loss immediately after you place an order. This will protect your capital when the market moves against you as well as keep your loss at a minimum. Basically, it protects you from the risk of the unknown.

While it's unfortunate that your stop-loss might be triggered by short-term price fluctuations, resulting in an unnecessary sale, not setting one could be more disastrous.

In determining the right stop-loss, consider your risk-reward ratio. If you go with 1:3, for example, your stop-loss is placed where you'll likely earn three times what you've traded.

You can also use a trailing stop, which is based on a certain percentage below the market price.

4. Control the positions you open

Ideally, you should open trades that are within the recommended amount based on your available capital. In the event that a trend reverses, your entire capital won't be decimated.

Remember that there's no way to correctly predict the market 100% of the time. There's always a risk of incorrect analysis or a market reversal.

What if you want to open multiple positions?

Consider the risk you make per trade and the impact on your account if all positions close at a loss. Say you risk 2% per trade. If you open four positions and all of them lose, your account will decrease by 8% at the end of the day.

5. Use the high risk-reward ratio method

When you trade gold with a higher winning percentage, you have a greater chance of being profitable.

A good strategy used when trading XAUUSD is to trade at a 1:3 ratio. That is, you only trade when the setup has the potential to make you three times more than what you're risking. How much profit you earn will vary depending on the number of trades you win.

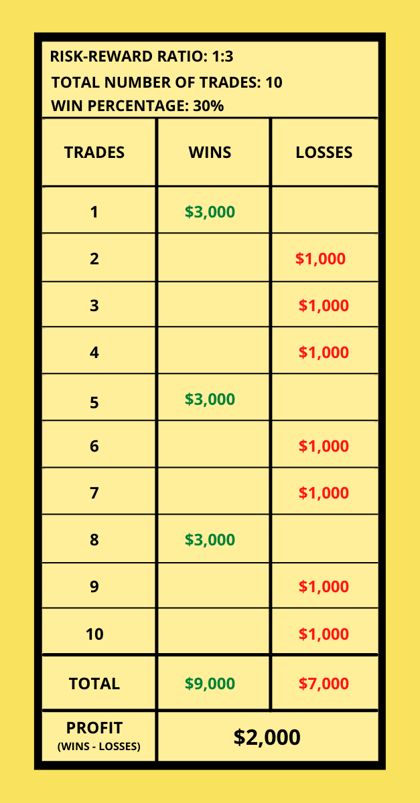

For illustration purposes, here’s a simple example. Let’s assume you have a total of 10 trades at $1,000 each. At a 1:3 risk-reward ratio, you should earn $3,000 returns from every trade.

- If you win 30% of your trades, you earn a total of $9,000 (3 x $3,000) and lose $7,000 (7 x $1,000) for a total profit of $2,000.

- If you win 50% of your trades, you earn a total of $15,000 (5 x $3,000) and lose $5,000 (5 x $1,000) for a total profit of $10,000.

Here’s how your 30% winning percentage will look like.

An alternative is to use the percentage risk method.

This is a strategy where you risk the same percentage with every trade of XAUUSD. It's recommended that you risk no more than 2% per trade. This is $1,000 if you have a capital of $50,000.

6. Learn the basics of money management

Whether you're trading gold, Forex or other financial instruments, knowing basic account management will go a long way. It is especially crucial with leveraged trades.

The rules are simple, your average profit must be higher than your average loss. It's vital that you strictly calculate the difference between the two to determine whether you'll get negative or positive outcomes.

Take profit when you're winning. If you feed on your greed and wait to make even more money, you could end up with a loss.

When you combine money management rules with the risk management strategies listed above, you'll be able to preserve your capital when trading gold and other financial vehicles.

Ready to grow your wealth from the world's largest financial market? No better place to start than right here with us! Start trading with Fullerton Markets today by opening an account:

You might be interested in: 4 Attributes That Make Gold a Safe Investment