You were so sure that your trading setup will bring you huge profits, but...

It hits a stop loss. It totally went against you.

Does this sound familiar?

No trader would want to lose, but it can happen. Unfortunately, this happens more frequently for traders who lack or have yet to develop the right trading mindset. The same is true for those who have seriously bad trading habits that they transform into a destructive trader.

Are you one of them? Let's find out.

“When I get hurt in the market, I get the hell out. It doesn’t matter at all where the market is trading. I just get out, because I believe that once you’re hurt in the market, your decisions are going to be far less objective than they are when you’re doing well…If you stick around when the market is severely against you, sooner or later they are going to carry you out.”

- Randy McKay

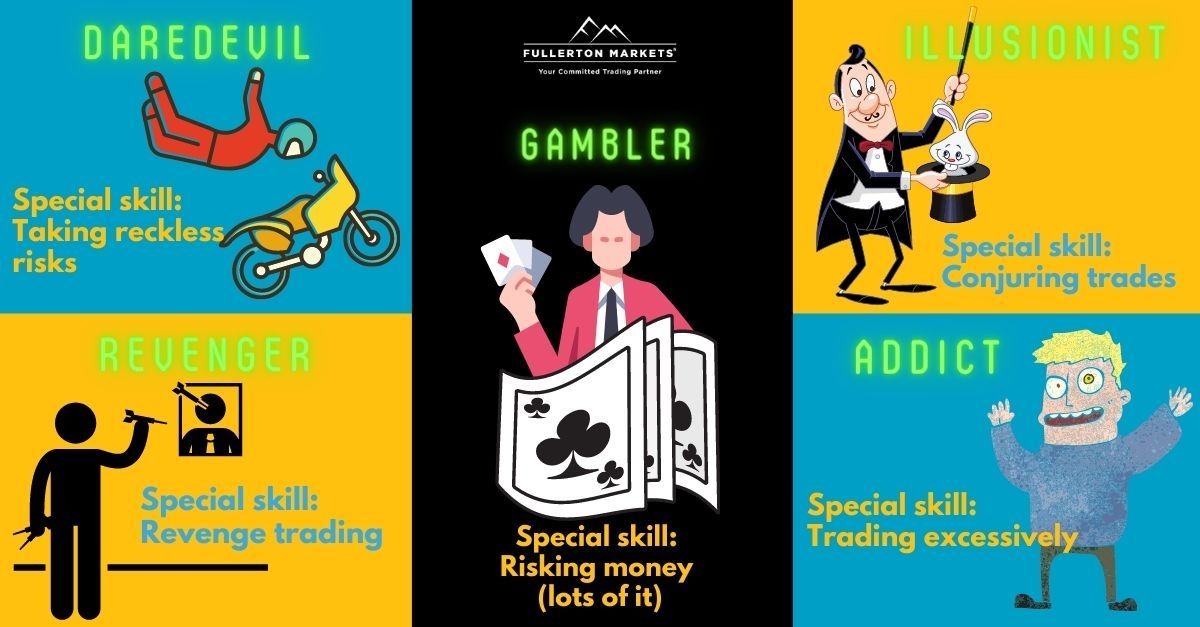

Do you do as Randy McKay does under similar situations or the opposite? If you do the latter, you could be any of these characters:

- Daniel the Daredevil

- Reggie the Revenger

- Gary the Gambler

- Eisenheim the Illusionist

- Archie the Addict

They make up a team of what we like to call Killers of a Trader. Because, really, any one of them can take on the Forex market and lose. Fantastically!

Types of Destructive Traders and How You Can Avoid Becoming One of Them

Daniel the Daredevil

Daniel finds satisfaction jumping off a plane or riding big waves. He's also inclined to take similar risks with his investments and trades. Unfortunately, risky moves in the market don’t always result in the same adrenaline rush he enjoys as when he’s doing extreme sports.

Daniel’s daredevil attitude means he’s inclined to not set a stop loss when he trades. Without a stop loss in place, there's a high risk of money going down the drain. One unprofitable trade doesn't make Daniel a happy trader.

Don't be like Daniel.

There's a huge difference between a necessary risk and a bad risk when trading. The former is done with care and prudence, the latter is just plain wrong decisions. Where trading and investing are concerned, it’s important to protect your account at all times. Always put a stop loss. Never trade outside of your trading plan.

Reggie the Revenger

Reggie is an emotional trader with little control over his reaction to the outcomes of his trades. Every time he makes a bad trade, he takes revenge on the market by taking a "double or nothing" stance. By doubling the lot size, he might regain his losses. Or so, he thinks.

In some cases, he jumps right back in after a loss and foregoes any and all of his trading plans. Why bother when they didn't work, right? Unfortunately, trading without logic and strategy rarely ends in victory.

How do you keep your inner Reggie in control?

Avoid taking revenge on the market following a loss. Since you've been hurt, follow Randy McKay's advice--"get the hell out." Step away from your trading rig and leave the room. Do something else to calm down and get your mind off the situation. Then, on your next trade, focus on the data rather than what you felt when you lost your previous trade.

Learn How to Deal with a Losing Streak in Forex Trading without blowing up your account.

Gary the Gambler

Gary doesn’t trade for the profit but for the thrill and excitement of risking money. Yes, he couldn't care less about how much of his capital he's likely to lose as long as he's trading. This results in him taking on excessive risks, using the martingale system, and other activities that are categorised as gambling rather than trading or investing.

Remy often ends up losing more than winning. He brags about his wins every time but will not talk about his losses. He's also prone to chasing his losses and is not afraid to steadily increase the risks he takes just to win.

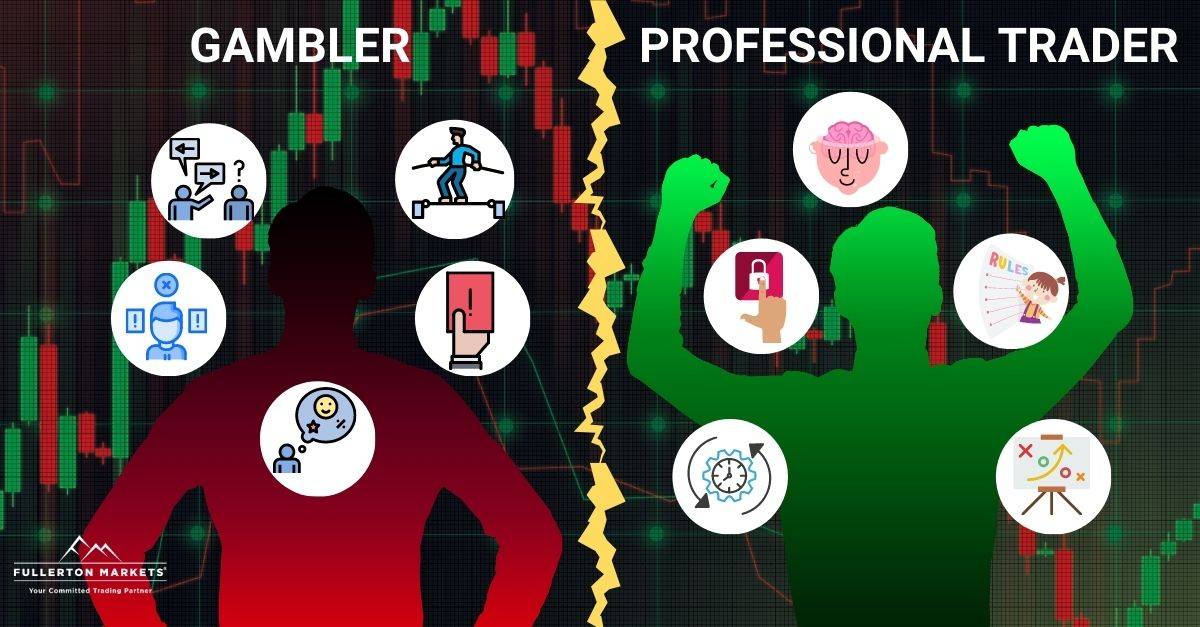

Trading is not gambling, but a lot of people conflate them. So let's set things straight.

A gambler

- Takes an inconsistent trading approach

- Takes risks without fear but gets frustrated with every loss

- Doesn't follow rules or a clear trading system

- Doesn't keep a trading program or map out their trades

- Has unreasonable expectations with every trade

- Doesn't accept losses and is likely to overtrade

A professional trader

- Works to constantly and continuously improve their trading system

- Doesn’t gamble or take unnecessary risks

- Sets clear trading rules and follows them

- Maps out every move and record and review their performance

- Understands that trading is not a ticket to get rich quickly

- Deals with losses with a level head and learns from them

If you want to be the exact opposite of Gary the Gambler, then do what professional traders do.

Eisenheim the Illusionist

Eisenheim likes to create something out of nothing like magic, which is why he doesn't let rules dictate his every trading move. Fuelled by ego, he likes to think that he's always right and the loss he experiences is nothing more than a glitch.

Most of his trades are influenced by his biases. Rather than look for actual data from the charts or economic news, he looks for information that supports his biases.

Simply put, Eisenheim listens to his ego rather than the market.

If you don't want your account to pull a vanishing act on you, stick to a trading plan that is real and has given you concrete results. Don't open trades that aren't there. Most importantly, keep your ego in check.

Archie the Addict

Archie is addicted to trading. He might even suffer from pathological trading since he can't seem to stop doing it. He gets a kick out of it, both mentally and physically. What's bad about his addiction is that trading has now become gambling and it's not only costing him money but also his relationships with others.

There are several signs of investing addiction, and the constant and nagging need to trade is just one of them. If you find yourself trading in secret and shunning others who might bother you with your excessive trading activities, you're following in Archie's footsteps.

Whether you have the symptoms or are already addicted to trading, seek out support from family and friends. You might want to turn to professional counselling as well. Otherwise, you could end up in a downward spiral.

So, which type of destructive trader are you? We’re hoping you’re none of the above. If you are, don’t fret. There are ways to break your bad habits and form new ones that will help you become a great trader.

On that note, we'll leave you with Five Things Great Traders Don't Do according to global financial expert and Asia’s top Forex coach, Mario Singh, in his book Secret Conversations with Trading Tycoons.

- Great traders don't risk it all

- Great traders don't listen to opinions; they pay attention to facts

- Great traders never stop learning

- Great traders don't worry

- Great traders don't select just any broker

If you want to know more, get a copy of the book and gain valuable insights from trading tycoons themselves.

Ready to grow your wealth from the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Types of Traders: How to Choose Your Trading Style