Despite being around for quite a while now, the MetaTrader 5 (MT5) trading platform is somehow still not as popular as its predecessor, MT4. However, MT5 does have a number of benefits that make it a criminally underrated platform in the trading world.

Previously, we compared the features of MT4 vs MT5, providing a brief overview of the similarities and differences of both trading platforms. This time, we want to focus on MT5 and dig deeper into its many features and tools.

Read on and find out the ways MT5 has added onto some MT4 features, as well as the new features it brings to the table.

Improved Features

Metaquotes Software Corp, the company behind MT4 and MT5, strongly believes in “If it ain’t broke don’t fix it.” They do, however, believe in improving the things that already exist.

Here are some of the improved features of MT5:

Not Just Forex Trading

MT4 was specifically built for Forex traders. But as brokers continue to add more markets to their list of financial instruments to meet clients' growing needs, the trading platform also had to be expanded. MT5 is now a more universal trading platform for traders and investors looking to diversify.

With MT5, you can trade stocks, futures, options, and bonds. The platform is also able to connect you to over 80 exchanges all over the world. These include the Chicago Mercantile Exchange (CME), Dubai Gold and Commodities Exchange (DGCX), and Moscow Exchange (MOEX).

Pending Order Types

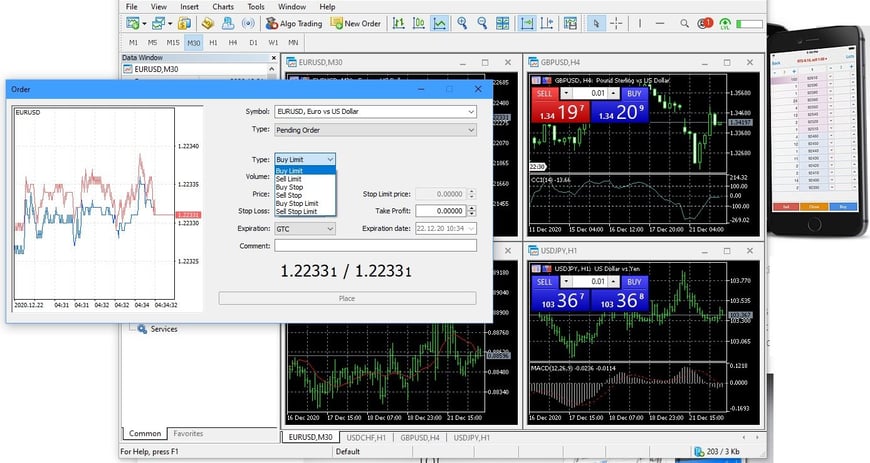

A Pending Order is basically an instruction you provide your broker regarding which position to enter or exit. MT4 offers four types of pending orders – Buy Limit, Buy Stop, Sell Limit, and Sell Stop. MT5 adds on to these with two new pending order types – Buy Stop Limit and Sell Stop Limit.

The Buy Stop Limit acts as a stop order for placing the Buy Limit. What happens is that as soon as the future Ask price reaches the indicated stop level, a Buy Limit order will be placed at the level, specified in the Stop Limit price field.

A stop level is set above the current Ask price, while Stop Limit price is set below the stop level. The same principle applies to the Sell Stop Limit, but with Bid prices as the limit instead of Ask prices.

Technical Indicators

MT5 provides traders with access to an extensive suite of tools.

Compared to MT4’s 30 indicators, MT5 has 38. MT5 splits these indicators into five different groups – Trend, Oscillators, Volumes, Bill Williams and a custom one where you can store your self-developed or imported indicators. This new indicator group system allows you to access the larger number of indicators more easily and quickly.

The new indicators include:

Trend Indicators

- Double Exponential Moving Average

- Triple Exponential Moving Average

Oscillators

- Triple Exponential Average

Bill Williams

- Market Facilitation Index

These additions give traders a much wider array of tools they can use to analyse trends and make more informed decisions that can lead to better trades.

MT5 also has an expanded list of analytical objects that help identify financial instrument price trends. While MT4 offers 31 analytical objects, MT5 has 44 which include Lines, Plotting Channels, Gann Tools, Shapes, Arrows, Fibonacci and Elliot.

Timeframes

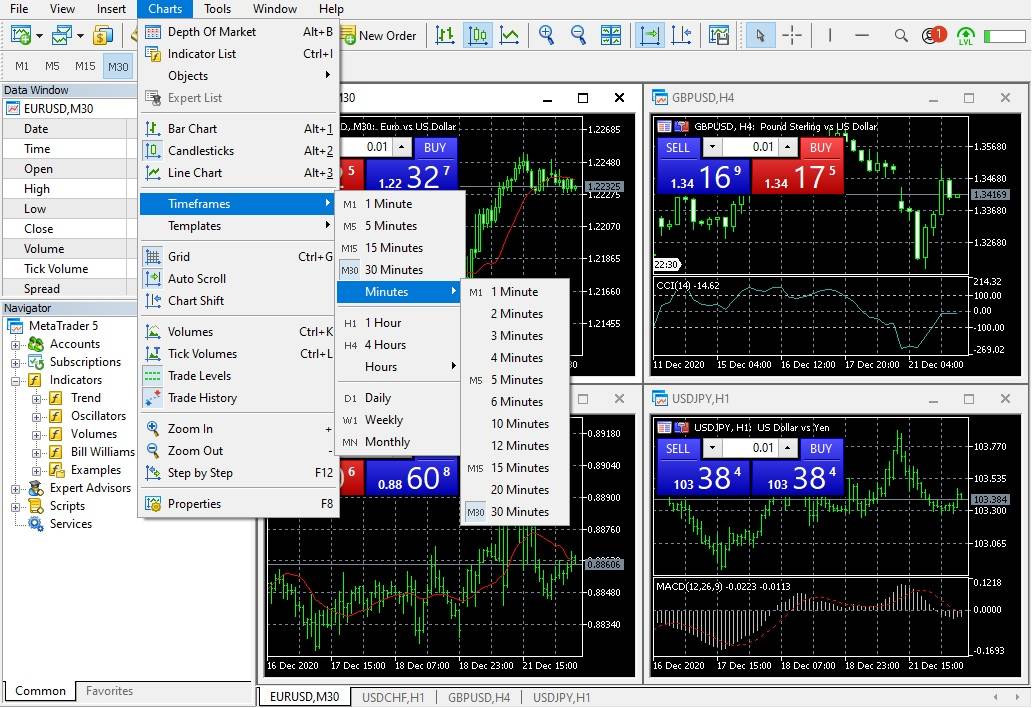

MT5 offers a much wider assortment of timeframes (21 in total!). In addition to the nine timeframes available on MT4 (M1, M5, M15, M30, H1, H4, D1, W1, MN), MT5 also boasts the following ones: M2, M3, M4, M6, M10, M12, M20, H2, H3, H6, H8, H12.

With MT5, you have more flexible options for setting your timeframe intervals, allowing you to see the market from different angles.

Strategy Tester

One of the drawbacks of MT4 is that it only allows you to test an Expert Advisor (EA) on one currency at a time. With MT5, you can test your EA on multiple currencies and analyse several currencies and their correlations simultaneously.

The EA testing and optimisation are also done using real ticks that give traders a simulation as close to real-market conditions as possible.

With this improved feature, you can better prepare and understand your strategies and plan better for your future trades.

Email with Attachments

MT5 provides users with access to an email service, with the ability to send and receive attachments as well. The attachment feature is not available on MT4.

New Features

Of course, what would an upgraded trading platform be without features that are totally new to the system?

Here are some of the new features of MT5:

Economic Calendar

A new feature on MT5 that isn’t on MT4 is a built-in economic calendar. In a similar way that a normal calendar or news resource provides information about the things around us and when they are happening, an economic calendar provides users with information about macroeconomic events.

With the MT5 economic calendar, you can check the time of the report, the instrument that is likely to be impacted, the event’s importance, forecasted numbers, previous numbers, and actual numbers. These features allow you to keep up with the latest events and react accordingly and almost instantaneously.

For day traders, the economic calendar is a great tool to help reduce trading risks as certain events will tell you whether to sit out or cancel your order as the market swings.

Built-in MQL5.community Chat

MT5 allows you to communicate with fellow traders from the community while monitoring the market and doing your trading operations. With this new feature, both novices and professionals can benefit from sharing their experience.

Order Fill Policy

Where on MT4’s Fill or Kill policy, an order would be cancelled without the required volume, on MT5 you can fill out your order with several other currently available offers.

Also, there are additional order execution conditions that can be set on MT5.

- Immediate or Cancel: When an order can't be filled completely, whatever volume of the order is available will be filled, while the remaining one is cancelled.

- Return: Applicable to limit and stop-limit orders and market orders, this policy allows the remaining volume of a partially filled order to be processed further rather than cancelled.

Netting

A big new feature on MT5 is the netting system. This means you can have an account that allows you only one common position for a symbol at any given time.

Unlike hedging, which is available on both MT4 and MT5, netting doesn’t allow users to buy and sell a symbol simultaneously. This means that when you execute a deal in the same direction of a symbol, the volume of the position increases. Conversely, a deal in the opposite direction of a symbol will cause a decrease in the volume of the position.

For example, if you place a Buy order for 1 lot on EUR/USD, and then a second BUY for another lot on the same pair, the initial order will automatically become a BUY trade for 2 lots of EUR/USD, rather than 2 separate trades.

Depth of Market

One final new tool traders can leverage on MT5 is Depth of Market (DoM). DoM helps traders see the depth of liquidity available in a certain financial market.

By referring to the DoM window, you can see how many orders (liquidity) are available in the market, and at which price. This helps you figure out the level of liquidation of different currencies at different times, and is especially helpful for those employing the “scalping” trading strategy.

MT5 is a significant improvement over the beloved MT4, and this is why we encourage traders of all levels to start making the jump. After all, MT5 is a sustainable trading platform that will serve you far into the future.

Ready to build and grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: A Comprehensive Guide on Short-Term vs Long-Term Forex Trading