Should you use MT4 or MT5? Should you make the switch or stick to what is familiar and comfortable to use?

The answer is not exactly a straightforward YES or NO.

Why? For the simple reason that technology is constantly evolving and what works now may not necessarily work in the future.

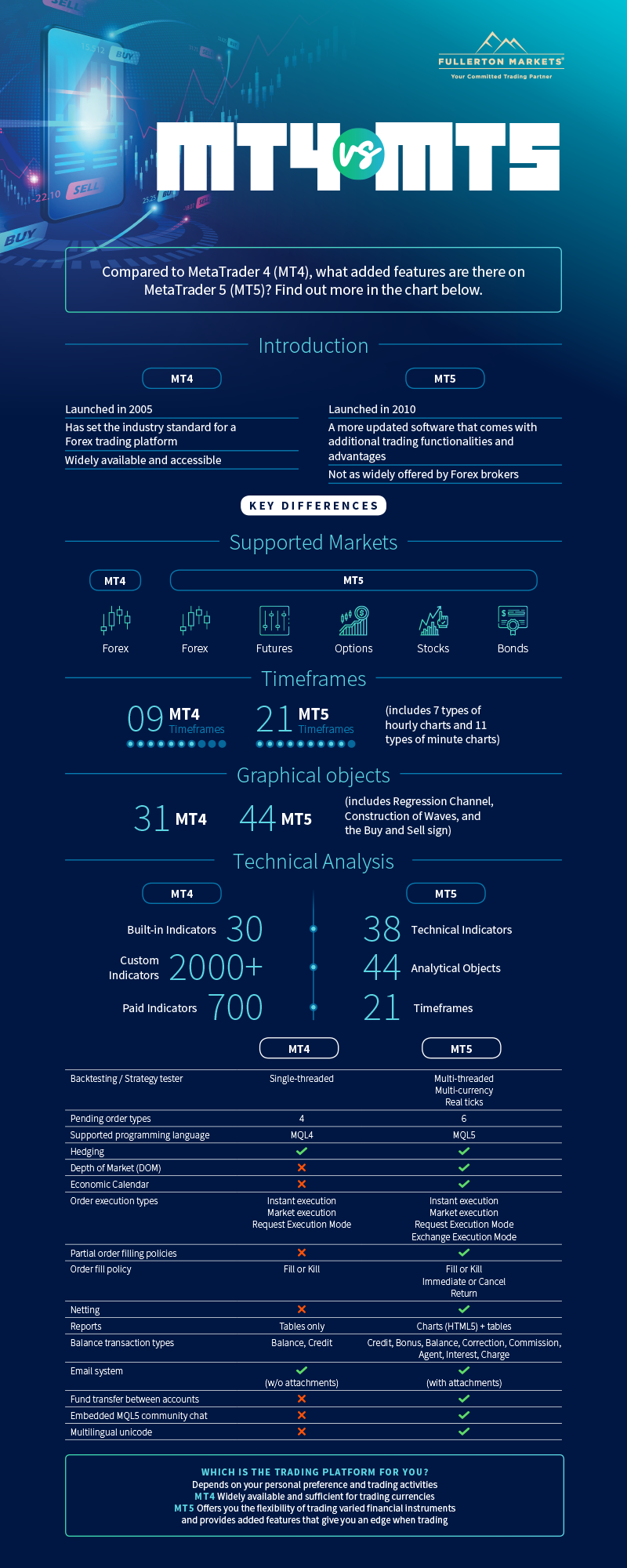

A brief history lesson

Comparing two of the trading industry’s leading platforms has been going on for a while now. It's only recently that the conversation has intensified. And there are reasons for this.

MT4 has been around for a long time. It was launched in 2005, which makes it 15 years old. It sets the industry standard for a Forex trading platform, which is why it's offered by many Forex brokers.

To say that it's popular is an underestimate. Every Forex trader has been acquainted with the trading platform in one way or another.

In comparison, MT5 came out five years after MT4 did. Because not many Forex brokers offer it, it's not as popular. This doesn't mean it's not worth exploring. This is especially true if you trade stocks, bonds, options, or futures on top of currencies.

A major difference between these trading platforms is that the newer platform supports these markets and not just Forex. It’s a more versatile choice for the more versatile investor.

MT5 also comes with features not found on MT4, and whatever similarities exist are improved.

Is this reason enough to switch to MT5 from MT4?

Maybe.

If you can recall, MetaQuotes announced in 2018 that it will no longer sell the MT4 platform because it's outdated and can't be developed further. The developer had been pushing for the use of MT5 since then.

So, as early as now, you should explore MT5 to make the imminent transition easier.

MT4 vs MT5: A quick overview

MT4 vs MT5: What are the basic features both platforms share?

Speaking of transitions, switching to MT5 may not be that jarring since it shares similar features with the MT4 platform. In fact, some of these functions are better or come with additional options. So you’ll see familiar functions and some newer additions.

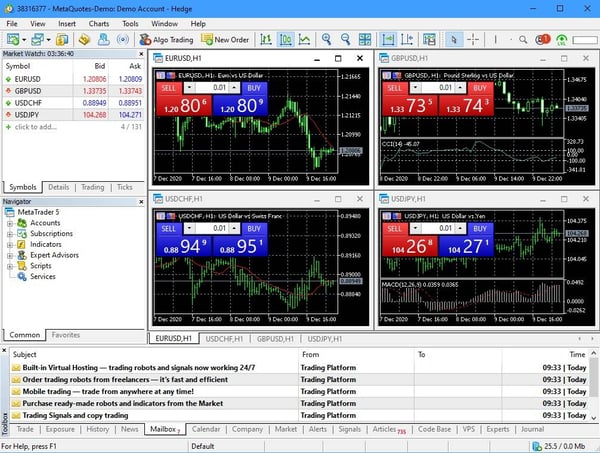

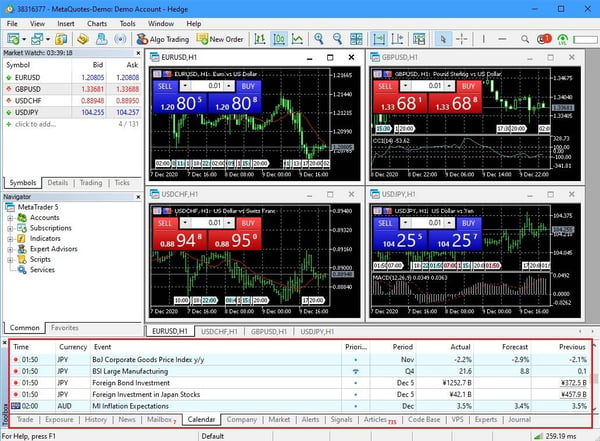

Interface

Both MT4 and MT5 have a similar interface, except for the additional services and timeframes on the latter. This should be expected since the MT5 allows other forms of trading. Moreover, different programming languages were used to develop the platforms--MQL5 for MT5 and MQL4 for MT4.

Supported Markets

As previously mentioned, both platforms cater to Forex trading but, as a multi-asset platform, MT5 can do more than just connect traders to the Forex market.

It also serves as a gateway to global exchange markets, connecting investors to different exchanges around the world, including the Chicago Mercantile Exchange (CME), Dubai Gold and Commodities Exchange (DGCX), and Moscow Exchange (MOEX).

The three main categories of securities that MT5 supports are bonds, derivatives and shares.

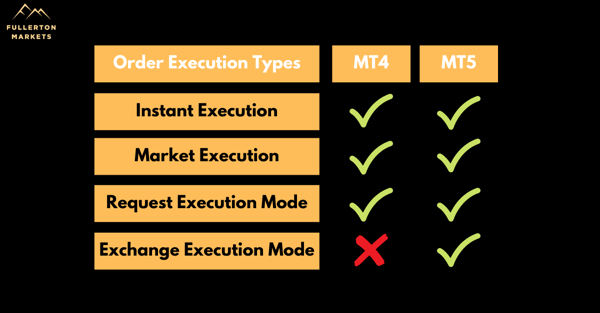

Order Execution Types

While MT4 supports three types of order execution, MT5 supports four. The additional Exchange execution mode sends trade operations to an external trading system and executes them at the current market price.

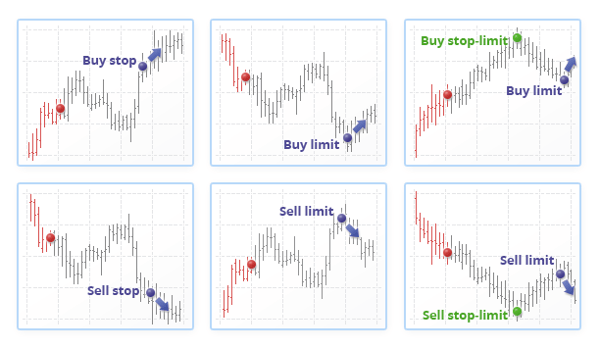

Pending orders

In addition to the standard pending order types in MT4, MT5 has two more additional types--Buy Stop Limit and Sell Stop Limit. The four standard types of pending orders are executed when a single condition is met, but the additional two has to satisfy two conditions before the pending order is executed.

Buy Stop Limit combines the Buy Limit and Buy Stop orders. A simple example is when the current price rises to X, a Buy Stop order is placed at the stop level specified.

An example of a Sell Stop Limit is when the current price drops to X, a Sell Limit order is set to where a pullback on the upside occurs.

Hedging

Both MT4 and MT5 support the hedge accounting system, but the function was just added as a second accounting system to the latter. Originally, MT5 was designed for trading within the netting accounting system. The addition of hedging expanded the platform's capabilities, allowing traders to:

- Have multiple positions of a financial instrument or per symbol, including those in the opposite directions

- Open one position per financial instrument and then close, change the volume, or reverse the existing position, depending on the trading strategy

Timeframes

MT5 has 12 more time frames than the standard nine timeframes that MT4 has. These include seven types of hourly charts and 11 types of minute charts. Day traders can set their charts in timeframes of 2 hours, 8 hours and 12 hours.

Graphical objects

Both MT4 and MT5 come with several analysis tools that are used to detect cycles and levels of support and resistance, to build channels, and to identify financial instrument price trends, among others. With MT5, however, you get 18 more on top of MT4’s 33 graphical objects, bringing the total to 44. These include Regression Channel, Construction of Waves, and the Buy and Sell signs.

Symbols

When it comes to the number of tradable financial instruments, MT4 can only support a maximum of 1024 symbols. MT5, however, removes this restriction and supports an unlimited number. This allows traders to follow more markets, effectively taking advantage of the hedging strategies on the platform.

Technical indicators

Both trading platforms are equipped with important charting tools that support traders who are heavily dependent on technical analysis. While MT4 comes with 30 built-in technical indicators, MT5 provides eight more.

Combined with the 44 graphical objects that can be applied to 21 timeframes, charting takes on another level on the MT5 platform.

Strategy tester

When it comes to EA (expert advisor) tester and optimisation modes, MT4's built-in strategy tester only supports testing a single pair, while MT5 supports testing multiple threads that are executed over a network of remote servers. This contributes to a shorter execution time.

Multi-currency - EAs can be tested on multiple currencies, including more sophisticated EAs that not only analyse several currencies at one time but also identify the correlations between currencies.

Real ticks - EA testing and optimisation are done using real ticks, which simulate close to real conditions possible. Unlike generated ticks, where data is based on cached one-minute records, real ticks are gathered from liquidity providers and exchanges.

Email System

MT4 and MT5 both have a built-in email service that sends notifications straight from the trading platforms. The only difference between the two is that the latter supports email attachments, while the former doesn't.

Which features of MT5 does MT4 lack?

Partial Order Filling Policies

This option allows a trader to edit their order to be partially filled. If a trade becomes available with maximum volume, based on the limit order specified, it will be executed. The rest of the unfilled volume is then cancelled.

Order Fill Policy

With MT4's instant execution of Fill or Kill, this platform takes no prisoners, so to speak. If an order's specified volume is unmet, it will not be executed.

It's a different story on MT5. If the specified volume is currently unavailable in the market, it can be filled by several other offers that are currently available. There are also additional order execution conditions that can be set.

Immediate or Cancel - When an order can't be filled completely, whatever volume of the order is available will be filled, while the remaining one is cancelled.

Return - Applicable to limit and stop-limit orders and market orders, this policy allows the remaining volume of a partially filled order to be processed further rather than cancelled.

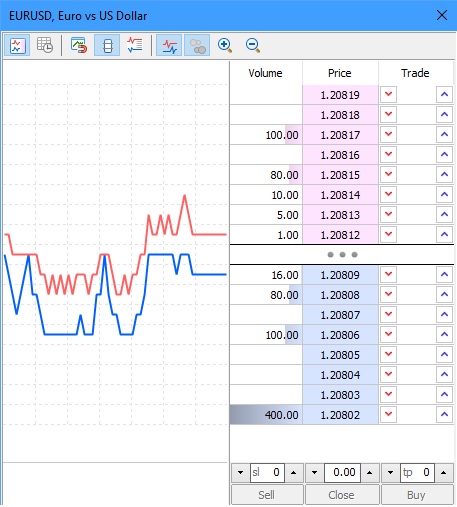

Depth of Market

This functionality on the MT5 displays bids and asks for a specific financial instrument at prices closest to what the market offers based on a specific volume.

This functionality on the MT5 displays bids and asks for a specific financial instrument at prices closest to what the market offers based on a specific volume.

DOM on over-the-counter (OTC) markets is different from that on the exchange market because the former is based on quotes from a broker, while the latter features real prices and order volumes.

Time & Sales

MT5 has the ability to receive data from time and sales that occur over the Exchange market.

The feature allows you to view in detail the real-time list of all exchange transactions, providing you with a clearer picture of the various trading activities on different price levels. This is where you can anticipate upcoming rise or fall in security prices, depending on the increased buyer or seller activity.

The Time & Sales list covers in-depth data revolving around each transaction, including time, price, direction and volume.

Economic Calendar

If you trade using fundamental analysis, this feature on the MT5 will be an indispensable tool for you. This is where you can find publications and resources based on economic news from a country's financial market or various macroeconomic indicators. Considering how such indicators can affect prices of financial instruments, being able to access these curated resources in one place will prove highly beneficial.

Transfer funds between accounts

MT5 offers several account management functions, including the ability to transfer funds between accounts within the same trade server. Depending on the broker, you can also transfer funds between platforms. That is, if you have both MT4 and MT5 accounts, you can transfer your funds from one platform to another and vice versa.

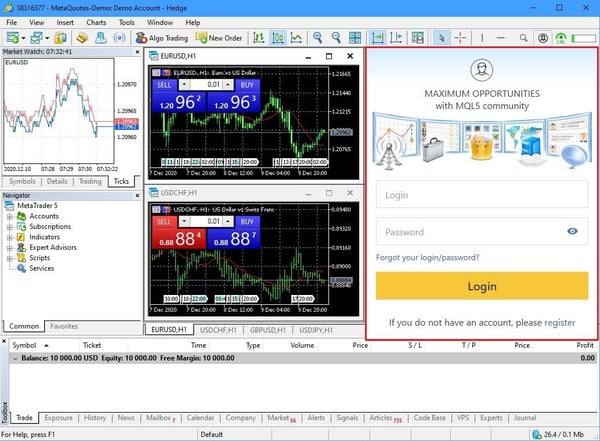

Embedded MQL5.community chat

This function will enable you to chat with other traders directly from the MT5 platform.

Netting

As previously mentioned, the MT5 trading platform was primarily designed with a netting accounting system, allowing a trader to have one open position of a financial instrument only.

Exchange Trading

MT5 supports trading for the Exchange Markets, allowing you to trade bonds, futures, options, and stocks.

What are the biggest innovations on MT5?

In summary, the MT5 platform comes with several innovations:

- Allows hedging orders and netting positions

- Allows trading in different financial markets

- Shows Depth of Market data in real time

- Integrates an economic calendar

- Comes with additional unique indicators and updated charts and timeframes

A major innovation, however, is the NO FIFO rule that brokers, especially those operating in the US, must comply with. This requires the system to deal on a first-in, first-out (FIFO) basis.

For example, if a trader goes long 1 lot of EUR/USD and then makes an additional trade with the same parameters, the first trade must be closed first before the second one.

What Fullerton Markets offers traders moving forward

Fullerton Markets is gearing up to launch its MT5 platform to provide traders with more flexibility in their trading activities while ensuring a smooth transition. It's inevitable that MT4 will be phased out and, as early as now, existing and new traders must learn to adapt to when MT5 becomes the trading platform of choice.

In line with this, Fullerton Markets:

- Is integrating MT5 within the same Fullerton Suite linked to the current MT4 platform. This way, traders can conveniently open, fund, and switch from one platform to another in one place.

- Allows traders to transfer funds between platforms.

- Enables traders to take advantage of MT5's new features:

- Updated timeframes

- Additional pending order types

- More indicators and analytical objects

- Economic calendar

- Order modification screen

Check out some interesting FAQs about Fullerton Market's MT5.

Are you excited to test MT5's features and capabilities? We are too. MT5 may be the new platform on the block, but it does offer innovations that MT4 lacks. Switching to the new platform could open more opportunities to profit and earn more.

Ready to build and grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: 5 Portfolio Protection Strategies every Investor Should Know