There are 9.6 million online traders in the Forex market, the majority of whom are from Asia (3.2 million), followed by Europe (1.5 million) and North America (1.5 million).

This shouldn't come as a surprise considering the many benefits that come from currency trading. One of these is higher leverage, which allows you to trade more even with lower capital.

For example, a 1:50 leverage lets you trade up to USD5,000 with a USD100 base capital. If your trade works in your favour, you'll profit more than what you initially invested.

Conversely, if your trade works against you, your loss is also multiplied. With the appropriate risk management measures in place, however, you can protect and preserve your capital.

It’s all about understanding how leverage works, including its correlation with margin.

What's the best leverage for Forex trading?

Many agree that the best leverage ratio in currency trading is between 1:100 to 1:200. A USD500 account, for example, can trade up to USD50,000 using the leverage of 1:100.

Most professional traders also use the leverage of 1:100 for a couple of reasons:

- It provides a good balance between buying power and trading risk.

- It allows them to open just enough trades and prevent them from overtrading.

The best leverage for you, however, depends on the capital at your disposal and whether you're a beginner or not.

Your account must meet the minimum margin required to open and maintain a trade. More on this later.

If you're just starting out, it's best to start low and then work from there. A leverage of 1:50 is recommended. Once you've gained enough experience and confidence in your trading knowledge and skills, you can then increase your leverage.

Check out this Definitive Guide to Forex Trading for Beginners and the Uninitiated

However, once you become a pro yourself, you might want to mimic professional traders in their choice of leverage. More often than not, traders who require 1:500 are overleveraging, which can be risky.

How to choose the best Forex broker that offers high leverage

Ideally, you should choose a broker that offers the leverage you want to use when trading currencies. So, if you prefer high leverage because it gives you more trading power, then choose a broker accordingly.

Not all traders may be able to enjoy this privilege, however, since certain countries set limits on how much leverage traders can use. In the US, for example, the maximum allowed leverage is only 1:50.

If this doesn't apply to you, then the next step is to choose the right high leverage Forex broker.

Look for the following criteria:

Margin requirements

Since leverage in the US is limited only to 1:50, the margin requirement is 2%. If you can leverage your trade by 1:500, the margin requirement is 0.2%.

To calculate, use the formula:

Margin = 1/Leverage

Different brokers impose different margin requirements. It will also depend on the country you're in.

Account and trade minimum requirements

Do you remember the minimum margin required mentioned above? Most brokers require that your account meets the minimum margin to open a trade. So make sure to check if you have the requisite capital to open an account and trade with the leverage you want to use.

To calculate, use the formula:

Margin Required = Current Currency Price × Units Traded × Margin

Here's an example.

- Margin requirement = 2%

- Current Currency Price = USD1.35

- Units Traded = 100,000

Margin Required = USD1.35 x 100,000 x 0.02 = USD2,700.00

Your account must have at least this amount to trade.

Commission and fees

Before you open an account, make sure that you understand all the charges that your broker sets, especially on commission and spreads.

Support

The broker you choose must provide support for the trading platform that you use. This way, you're guaranteed a prompt and reliable response should you encounter any problems.

You don't always need to use high leverage when you trade, but it can come in handy in certain situations. If you plan to take advantage of this, choose a broker that meets the criteria listed above.

Why trade with Fullerton Markets?

Fullerton Markets not only offers high leverage, but also different leverage options to accommodate different account balances.

For example, if your account has USD1,000, you can use leverage from 1:10 to 1:500.

Check out the complete list of leverage options we offer, including a link to Fullerton Markets’ Full Risk Disclosure.

Given these options, you can trade and maximise profits no matter the size of your trading capital. Most importantly, you have the freedom to choose leverage that suits your trading preferences.

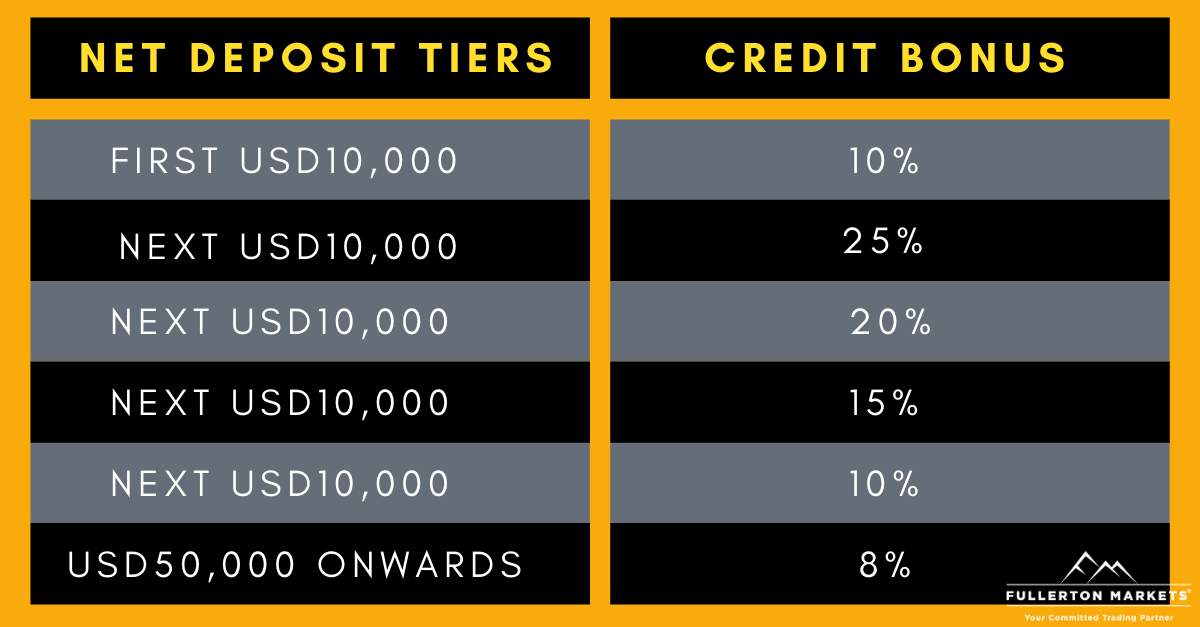

We've also increased the maximum leverage of our Infinity Credit Bonus from 1:200 to 1:500, thus offering clients more flexibility with their trades. Clients enjoy the following bonus percentages with the amount they deposit:

For the first USD10,000, you’ll get a USD1,000 losable bonus. What’s even better is there are also no trading volume requirements in order to keep your bonuses.

What if you deposit more than USD10,000? The bonus will accumulate through tiers.

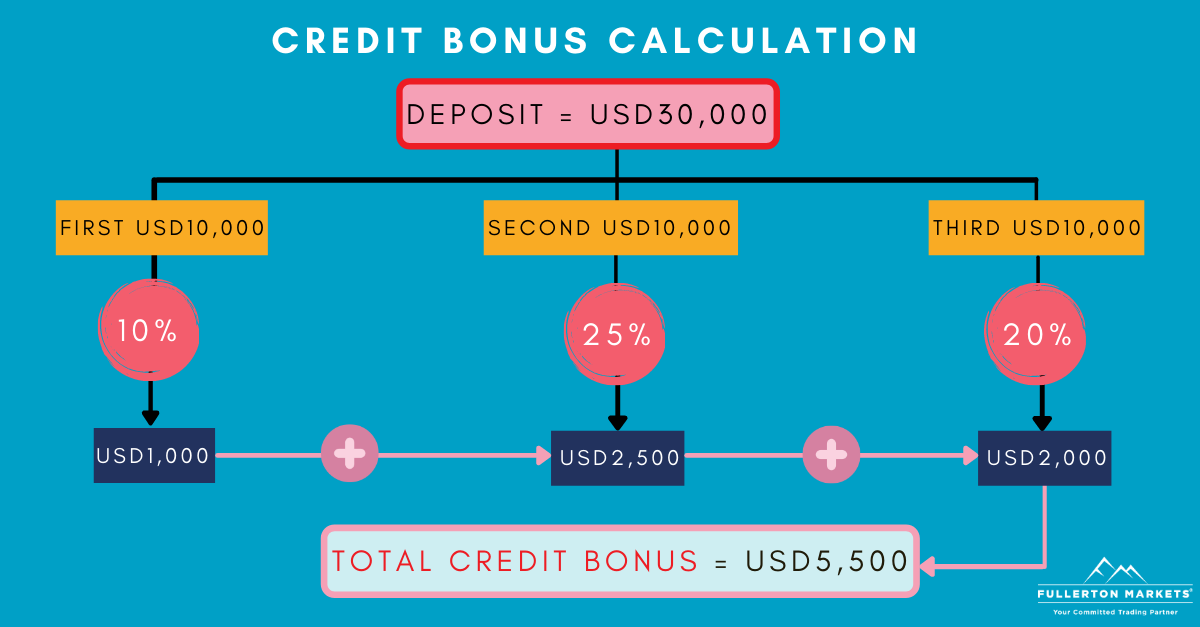

For example, if you’ve funded your account with USD30,000, the first USD10,000 gets 10% (USD1,000), the second 25% (USD2,500), and the last 20% (USD2,000). This yields a total of USD 5,500. Check out the calculation below for clarity.

You can then trade this amount without the additional risk to your account, such as interest, economic, or liquidity risks. This also gives you more leverage when you want to capitalise on big movements in a volatile market.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: Social Trading: What You Need to Know and How to Benefit from It