Have you heard about the Instagrammer who was accused of a Forex ‘scam’ amounting to £4,000,000?

Gurvin Singh, a 22-year old influencer who frequently flaunts his lavish lifestyle on social media, managed to fool 170,000 of his followers by providing them what he marketed as a ‘copy-trading’ service on the global trading platform called Infinox.

More than 1,000 investors, mostly aged between 18 and 25, lost all their family’s money, student loans and part-time wages during a major dip in 2019. These traders were unable to withdraw funds nor contact him.

Forex scams are nothing new. In fact, currency trading has been associated with fraud for a long time, resulting in people's reluctance to engage in it, and for legitimate brokers to be associated with scams. This is an unfortunate truth, even for us.

But Forex is not all illegal and fraudulent. There are brokers like Fullerton Markets that you can trust. It all comes down to being smart in choosing a Forex broker or trading platform.

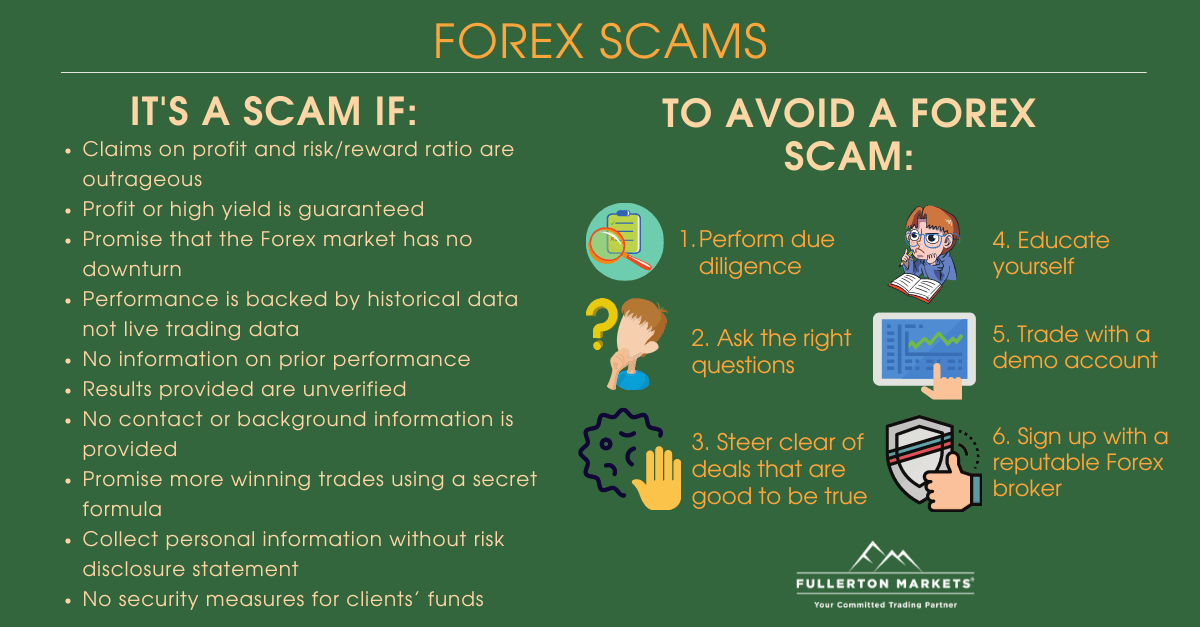

How to spot a Forex trading scam

The Commodity Futures Trading Commission (CFTC) issued a fraud advisory to help traders against potential fraud. It outlines how to identify a possible fraudulent sales pitch and the questions you should ask to identify a trusted broker.

Combined with our own recommendations, here’s a list of red flags you should be aware of.

1. Outrageous claims on profit and risk/reward ratio

The profit you make from a single trade depends on a variety of factors such as the leverage you use, the number of units you buy and sell, and where you placed your stop loss, among others. Add to this the probability of your trade moving against you, making a huge profit every single time isn't guaranteed.

2. Guaranteed profit or high yield

Considering that the currency market has its share of risks, you're unlikely to profit from every trade. You could win today and lose tomorrow. Your winning or losing streak could move in an opposite direction as well.

3. Promise that the Forex market has no downturn

In reality, the Forex markets can be bullish or bearish, depending on economic movements. The advantage of Forex trading, however, is that you can still profit from a slow or low volatile market.

Check out tips on How to Trade in a Slow Forex Market (Low Volatility)

4. Proof of performance is not backed by live trading data but only historical data

A reliable trader or signal provider would not have problems showing you their portfolio based on current trades, data, and strategy. You want to profit from the current market, after all, not on past ones. Besides, the trading system that worked in the past may not necessarily work in the present.

5. No evidence on prior performance

What's worse than history-based data is no data at all. You can't trust anyone who claims their trades were successful when there's no information to back them up. With your money on the line, you should ask for solid proof.

The same is true if you plan to subscribe to a trading system or software. Look beyond the attractive marketing pitch and ask for actual and current data on a system's performance before you sign up for it.

6. Results provided are unverified

Say you're provided proof that a trader performed well with both past and current trades. But are the results checked and verified? Discuss with other traders or read online reviews to verify the information.

7. No contact or background information is provided

Never trust a trader or broker who doesn't provide an email address or phone number that you can contact in case of queries or problems. If the direct contact information doesn't seem to exist, they probably don't.

8. Promise more winning trades using a secret formula

There's seriously something scary about secrets where your money is concerned. It's best that you deal with someone or a brokerage that values transparency.

9. Collect personal information without the risk disclosure statement

A legitimate broker will not persistently bother you to obtain personal information such as your name, phone number, home address, and email address. Not before providing you with a written risk disclosure statement. If they become pushy in this regard, you should flag this as unsolicited marketing and most likely a scam.

10. No security measures for clients’ funds

Most trusted brokers offer security and safety measures to protect traders’ funds. Check out their websites to know if there is a policy to deal with deposits and withdrawals should there be any disputes.

How to avoid Forex trading scams

1. Perform due diligence

Nothing beats careful and thorough research to identify a scam from the not. This should be easier using the information provided above. If a trading system or broker doesn't show any red flags, for example, then it may be reliable.2. Ask the right questions

Once you narrow down your options to two or three brokers or trading systems, investigate further. Seek the answers to the following questions:

- Does this product meet my financial needs?

- Is the finance professional or broker qualified to provide me with their products and services?

- How do they make money from their offers?

- Can I contact the broker by email, phone, or other means?

- Does the broker have responsive and reliable customer support?

- Am I dealing with real people with contact information or physical address?

- Can they provide me with current and historical performance data, verified results, and other pertinent details?

- Can they provide a written risk disclosure statement?

- Can they put all the information discussed in writing?

If any individual or entity is hesitant to provide you with the data you need, ask why or stay away from them.

3. Steer clear of deals that are good to be true

Forex trading is not a get-rich-quick scheme. While there are shortcuts you can take, you still need to put in time and effort. If an offer says otherwise, be wary of it.

Even when the broker offering sounds legitimate, always read the fine print. You'll never know what's hidden there that can hurt your trading account.

4. Educate yourself

Before you start trading currencies, you should know what you're getting into. Go further than knowing how to avoid a Forex scam. As you trade, learn, and acquire skills that you can use to trade independently and identify legitimate brokers and financial services.

5. Trade with a demo account

We highly recommend that you first test out a broker or trading system using virtual funds. In case it's a scam, you won't lose actual money that you can't recover. Most importantly, never trade money you can't afford to lose.

6. Sign up with a reputable Forex broker

In choosing an online Forex trading brokerage, consider the following important factors:

- Has been in the industry for at least two years

- Offers quick deposits and withdrawals

- Known and recognised internationally in multiple countries

- Has customer support and team members who speak your local language

- Operates with transparency

- Implements measures that ensure clients can lodge complaints and receive the appropriate solutions

Choose Fullerton Markets as your trusted broker

Fullerton Markets is not a scam. We have all the attributes of a reputable Forex broker, which clearly shows that we're not a scam.

You can rely on the integrity and legitimacy of all our products and services, and in our ability to provide you with the appropriate support and solutions for any issues you might encounter.

We highly recommend that you perform due diligence on us and we'd be more than happy to answer all your questions with honesty and transparency.

To sum it up

Don't fall victim to Forex trading scams. Be in the know and you can avoid such fraudulent schemes with ease.

Ready to grow your wealth without the worries in the world's largest financial market? No better place to start than right here with us! Begin trading safely with Fullerton Markets today by opening an account:

You might be interested in: 5 Most Popular Forex Indicators: Definition, Pros and Cons