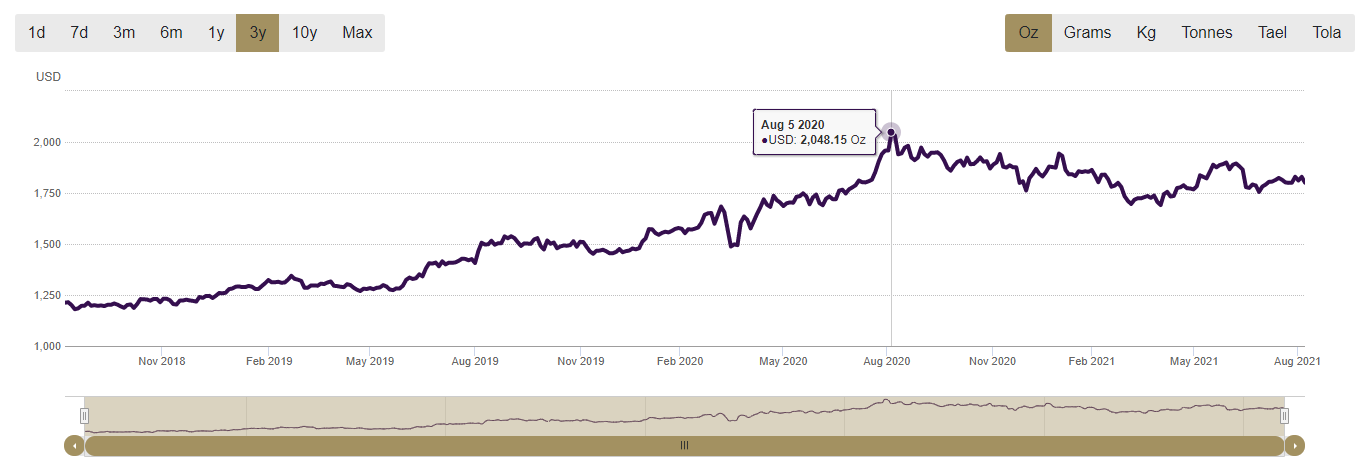

As one of the most traded commodities in the world, it's not a surprise that you'd want to trade gold as well. It doesn't hurt that its price exceeded $2,000 per troy ounce in August of last year. Imagine how much profit you'd have made if you were trading, then.

Source: Gold.org

Source: Gold.org

Well, it's not too late to start.

In this article, we'll share strategies to help you trade, earn profits, and avoid common pitfalls.

What are the benefits of trading gold?

Right off the bat, gold remains stable in periods of instability. Most of the time, world chaos causes more people to turn to safe-haven assets, including gold.

Well, we're in a crisis now. History shows that market crashes happen every 10 to 13 years and gold prices increase each time.

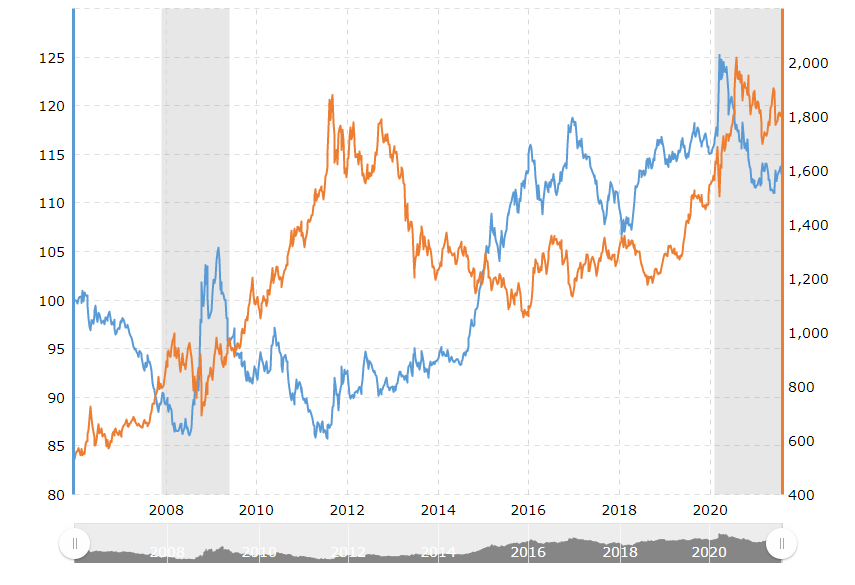

Source: TradetheDay

Source: TradetheDay

In addition, gold:

- Hedge against inflation

- Can be traded in a range of financial instruments

- No need to hold and store physical gold when traded online

- Recommended for portfolio diversification

- Potential for high profit

Of course, it's not without risks. The gold market is highly volatile, which increases the probability of losing money. Gold trading also comes with fees and a higher liquidation spread.

What is the difference between trading and investing in gold?

When you trade gold, you:

- Don't own any underlying assets

- Speculate on the price, whether it rises or falls

- Hedge your portfolio

- Leverage on your exposure

- Take positions in the shorter-term

When you invest in gold, you:

- Own or hold physical gold and other underlying assets

- Buy and sell gold ETFs and stocks

- Diversify your portfolio

- Focus on growth over the long-term

- May earn dividends and voting rights

What are your options for trading and investing in gold?

- Gold bullion or physical gold in the form of gold bars or coins.

- Gold certificates work similarly to cash banknotes

- Gold futures are contracts that you can use to exchange gold for a fixed price set at a future date.

- Gold stocks let you invest in various elements of the gold industry, from production to mining.

- Gold ETFs (exchange-traded funds) are traded like stocks but are backed by gold.

You also have the option to trade gold on foreign exchange. Instead of a currency pair, you'll be trading gold and its spot price. The most common metal-currency pair for gold is XAU/USD.

How do you start trading gold?

Now we get to the heart of the matter. Like most financial instruments, trading gold requires a mix of technical and fundamental analysis.

As a beginner, you're more likely to want to focus on trading gold right away. If you're to earn a decent profit, however, there are other aspects you need to look into.

1. Understand what influences the price of gold

The price of gold is often affected by four factors--supply and demand, geopolitical events, natural disasters, and Central Bank's monetary policy.

Market outlook, on the other hand, has an inverse effect on the price of gold. If the outlook is positive, the price is likely to drop. It's likely to rise when the market view is bleak.

If you take all these into consideration, you'll have a good idea when to open or close a trade.

2. Identify trading strategies you can use

Gold can be traded using short-term or long-term strategies. The former is applicable if you're scalping or day trading, while the latter involves holding underlying gold assets for longer.

Whichever is the case, the knowledge you acquired in step one will come in handy, especially on the aspect of how gold prices skyrocket during economic instabilities.

It will also help to remember that:

- Gold is usually inversely related to USD, which means gold will thrive when USD is underperforming and vice versa. Stay on top of US news to help you discover gold trading opportunities. Below is a chart that shows this inverse correlation. USD is represented by the blue line and gold the orange line.

Source: Gold.org

Source: Gold.org

- Gold and the Japanese Yen are typically correlated. Both are considered safe-haven assets and have shown a strong correlation for the past century. You can use this correlation to predict how the price of gold will move.

- The metal-currency pair XAUUSD typically moves in a trend. As you trade, you're going to discover trend-trading strategies that will help you get the best possible outcome and moving with the trend when trading XAUUSD often yields great results.

- Certain technical analysis indicators work best with trading gold such as Fibonacci retracement, moving average crossovers, support and resistance, and price action. You'll learn more about them as you move along.

As a beginner, you have the option to trade gold manually or profit from it on autopilot. You can copy trade from strategy/signal providers (SP) who focus primarily on trading XAUUSD. Choose the best SP to follow to boost your chances of earning profit.

Here’s What You Need to Know about Copy Trading

3. Develop a trading plan

As early as now, it's best that you create and follow a trading plan. This will help you develop great habits as a trader and teach you the value of discipline where trading is considered.

Your plan should cover every aspect that will groom you into becoming a consistently profitable trader. This includes risk management, trading goals, mental and emotional preparation, entry and exit rules, performance analysis, and Forex trading rules to follow.

4. Choose the right gold broker

The broker you choose will depend on the type of gold you want to trade or invest in. There are online brokerages that let you trade gold stocks, futures, ETFs, and via Forex.

Regardless of the financial instrument, it's important that the broker you choose offers lightning-speed execution and prioritises fund protection. To help you make a better decision, test out a broker's platform and services using a demo account.

5. Start with a demo account

Once you've selected a broker, open a trade. You can start with a demo account to test your strategy and get a feel of how trading gold works. More often than not, you'll understand the process more if you gain hands-on experience. Once you have enough trading confidence and learned basic skills, you can then switch to a live account.

6. Educate yourself

Golden opportunities to profit from gold come in different forms and at different times. Relying on the fundamentals alone can only go so far. This is why you should invest in educating yourself about trading gold and acquiring strategies that will help you advance from a beginner to a professional trader.

Ready to grow your wealth from the world's largest financial market? No better place to start than right here with us! Start trading with Fullerton Markets today by opening an account:

You might be interested in: Top 11 Female Traders [and Then Some] Who Broke Through the Boys Club