The success of a trader is very much dependent on one’s trading discipline. 70% of forex traders lose and 15% of them breakeven. The remaining 15% of forex traders win as they have consistent discipline which leads to profitable trading.

Trading is a matter of getting the law of averages to work in your favor.

There is no shortcut in profitable trading. You must trade a proven forex trading strategy over and over so that across a series of trades, the strategies work well enough to produce an overall profit.

The formula is very simple: Trade with discipline and you will succeed; trade without discipline and you will fail. Many naive investors want to double their profit in days or even weeks. However, they fail to realise that forex trading is just like any ordinary investments and not a get quick scheme

Here are 10 golden rules that have helped me carve my trading journey which I hope will guide you in your forex journey too:

1. Have a reasonably funded account

I believe most of us will start out trading in demo accounts over a period of time to test out our strategies. Once we feel confident in our profitable strategy we will then move on to a real account. Some may try out trading in real accounts using small sums of money to further test their strategy and emotions, which is perfectly fine.

However, here is my explanation to why a well-funded account matters. If you compare a $100 funded account versus a $5000 funded account.

Let’s say we manage to yield 5% return for one month:

$100 account gives you $5

$5000 account gives you $250

If you compare the two, the $100 account holder will tend to trade more aggressively as the returns are not satisfying in relative terms. As a result, the small account holders are likely to have the psychological pressure to take more trades. This act leads to more risk taking and ultimately higher chances of getting stop out. Therefore, the $100 account holder has a greater tendency to burn their account.

However, the one earning $250 can feel the impact of how trading can start to improve his/her life style, without the need to over-trade or taking excessive risk.

2. Do not risk more than 5% of your capital per trade

Having proper risk management means to trade within your account size. A general rule of thumb is to risk not more than 5% of your capital. We cannot win 100% of all our trades as we do not have 100% control of the market. What we should instead aim for is to have net profits in our account at the end of the month. If you do not limit your risk or keep your trading size consistent, you can lose all your winnings for the past month in a single trade or worse, get margin call for a single trade that you have over leveraged. Though many trading strategies require different risk management, a swing trader may trade smaller lots as compared to a scalper for example. So, it all depends on your trading style.

3. Do not try to call every market turn

Do not try to catch the tops and bottoms! You might want to set up for counter-trend trades near some major market tops and bottoms. You may be tempted to go in at every trade that you see in order not to miss out on any possible profits. Trying to catch the tops and bottoms of the market is like trying to stop a charging bull or bear and hoping it will turn around. Sound risky? Yes, it is!

4. The job of a trader is to react, not to predict

Don't Predict, but React

We should never try to predict where the market is heading but instead we as traders should wait out for signals or hints from the market that suggest the next possible move. Our job is to capitalise on these moments and ride along with it.

5. Do not analyse until you paralyze

Many traders procrastinate and missed out profitable trades because they over-analyse. Some wait for the perfect price to enter (which never got filled) while others wait for all the indicators to go their way before entering a trade. I’m not saying that we should not follow our trading plan. What I want to relay is that you’ll never be right until you place that trade and you just have to learn to manage it. If you are wrong, get out and cut losses.

6. Always stick to your trading plan

If you want to sell or buy a specific pair due to trade calls you see on websites or your friends telling you that a specific pair is overbought/oversold, you are bias. You should always look for confluence that goes along with our trade. Once most or all of your criteria is met and there are technical evidences available, that is when you should take the trade based on your own analysis.

7. Always use top-down analysis approach & go with the trend

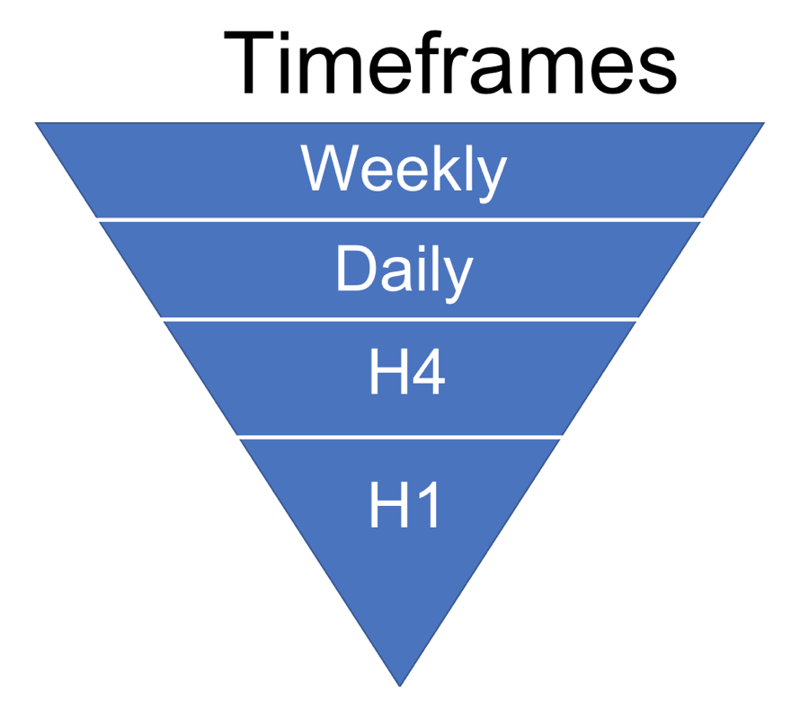

The Timeframes

The Timeframes

This approach is to always look at the highest timeframe (usually weekly chart) down to daily and so on. The trend, support and resistance in the higher timeframe are always stronger and more reliable. This helps us to gather more confluence for our trading probability. If you see a downtrend in weekly and daily timeframe and we are looking to short in a h1 timeframe, your risk is relatively reduced as the overall trend even in the larger timeframe is not against you.

There’s a saying which goes “The trend is your friend”, which I find is very true. By following the trend, you are limiting your risk but riding along with the momentum.

8. Don’t give up when you encounter a losing streak

Always remember that trading is just like any other investments are we are looking at profits in the long run. It is normal to have losing streaks but as long as your trading method is proven, the odds will fall into your favour in time to come. One can lose 60-70% of their trades but still profit in the long run, which brings me to my next point.

9. Keep the profitability in your favour

Keeping the profitability in your favour is to always ensure your trade has a RRR (Risk-to-Reward Ratio) that is favourable to you. If you have a stop loss of 40 pips but your target is 120 pips, that is a 1:3 risk to reward ratio which gives you the leeway to lose 2 extra trades before you can breakeven. I’ve known a trader who only wins 35% of his trades but has consistent profits monthly. This is because his RRR is always many times more than the risk he takes.

10. Trade like a bricklayer!

The job of a bricklayer is to show up every day and lay the bricks with the same method over and over again. The same goes for trading. If you are constantly looking at your trades every 3 minutes and you can feel your heart pounding very quickly every time you make a trade, you have either risk too much of your capital or you still have not master your emotions to trade reasonably. The same consistency you have in your trading methodology and execution strategy will lead you to become profitable.

Louis Teo

Market Strategist