The past weeks showed that hopes on vaccine offer great opportunities to sell USD/JPY and buy gold.

Risk assets traded higher early Tuesday morning to begin a holiday-shortened week, as optimism about a potential coronavirus vaccine built. However, our experience in the past weeks shows that such scenario only offers great opportunities to sell risk assets at good price.

Futures on the Dow Jones Industrial Average jumped over 500 points, pointing to an implied opening jump of around 526 points. S&P 500 and Nasdaq 100 futures also pointed to a positive open for the indexes on Tuesday. Trading volumes remained thin in overnight action. The US markets were closed Monday in observance of Memorial Day.

American biotech company Novavax said on Monday it has started the first human study of its experimental coronavirus vaccine. The company expects initial results on safety and immune responses in July. Last week, another biotech company Moderna reported positive development on its vaccine trial in which all 45 participants had developed coronavirus antibodies.

The number of coronavirus cases in the US topped more than 1.6 million as deaths rose to more than 97,000, according to a tally by Johns Hopkins University on Monday. Many states have taken steps in recent weeks to lift lockdown measures that curbed the spread of the disease.

Meanwhile, investors kept an eye on the US-China tensions, which showed signs of escalation over the weekend. White House National Security Advisor Robert O’Brien said Sunday the US will likely impose sanctions on China if Beijing implements national security law that would give it a greater control over autonomous Hong Kong.

There is no guarantee that an early reopening can ensure a successful economic recovery. Even if businesses open, consumers may not feel confident to venture out. A recent study revealed that more than two-thirds of Americans surveyed will actively avoid public places until lockdowns end. Experts also fear the possibility of a second wave of infections that can shut down the economy once again.

If the US is hit by a second wave of infections, the country’s economy will be coming out of a bad GDP shutdown, with a high unemployment rate and a debt-to-GDP ratio greater than 100% while the projected deficits for this year are already USD5,000 per American household. A second wave of infections would be an even more serious economic disaster than the current one.

Financial markets have been on a roller-coaster ride since the coronavirus crisis first took place. In the US, stock markets saw their worst first quarter on record as the new coronavirus became a worldwide pandemic, but shares rallied in April and have been volatile in May as the lifting of lockdowns, economic stimulus and hopes for a Covid-19 treatment remain in focus.

In the future, a lot will depend on the “tug of war” between government stimulus and fundamentals. The fundamentals are going to stink and there is no question that the earnings are going to be extremely challenging. And the bridge is the fiscal stimulus. The US economy, similar to the global economy, is expected to take a significant hit from the pandemic, with the IMF predicting US GDP will contract by 5.9% this year.

Our Picks

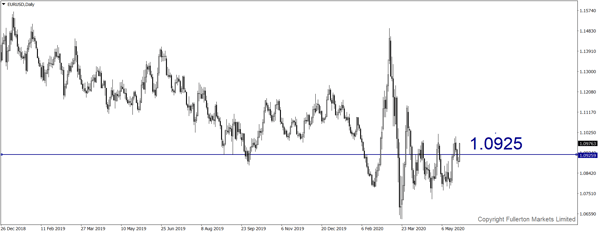

EUR/USD – Slightly bearish.

This pair may fall towards 1.0925 this week

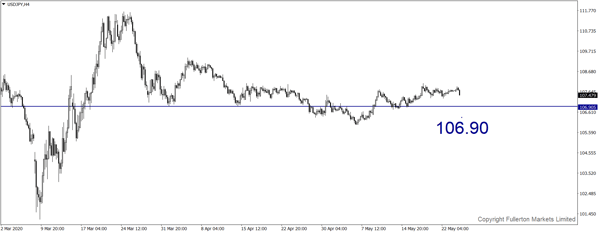

USD/JPY – Slightly bearish

This pair may drop towards 106.90

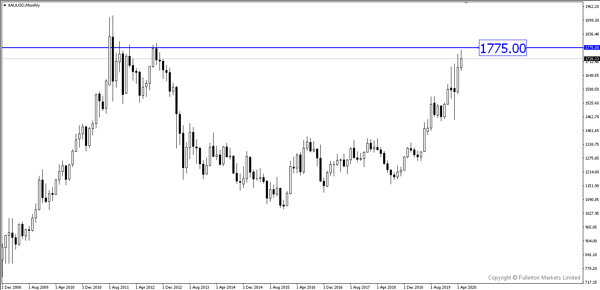

XAU/USD (Gold) – Slightly bullish

We expect price to rise towards 1775 this week

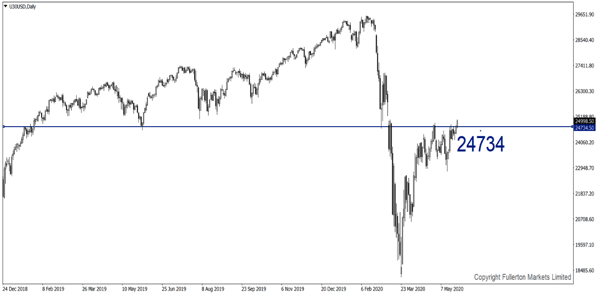

U30USD (Dow) – Slightly bearish

Index may drop towards 24734 this week

Fullerton Markets Research Team

Your Committed Trading Partner