Market sold riskier assets like US stocks after solid NFP, sell USD/JPY?

US job growth surged in January and wages increased further, recording their largest annual gain in almost 9 years. This bolstered expectations that inflation would push higher this year as the labour market hits full employment. US stocks and bonds slid after the data was announced while the dollar steadied on.

Nonfarm payrolls jumped by 200,000 jobs last month after rising 160,000 in December, according to the data showed last Friday. Unemployment rate was unchanged at a 17-year low of 4.1%. Average hourly earnings rose 0.3% in January to $26.74 which boosted the year-on-year increase in average hourly earnings to 2.9%. This was the largest rise since June 2009 which was higher than 2.7% in December. However, weather effect must be considered as workers put in fewer hours last month likely due to the bitterly cold weather. The average working hour fell to 34.3 hours, the shortest in four months.

In general, the robust employment report underscored the strong momentum in the economy, raising the possibility that the Federal Reserve could be a bit more aggressive in raising interest rates this year, especially the likelihood that more hawks could join the FOMC Committee as voters. The Fed had forecasted three rate increases this year after raising it three times in 2017.

Fed officials on Wednesday expressed optimism that inflation would rise towards the central bank’s target this year. Policymakers described the labour market as “having continued to strengthen” and economic activity as rising at a “solid rate.” So far future markets have priced in a rate hike in March. The prices for US Treasuries fell, with the yield on the benchmark 10-year note hitting a four-year high as investors are worried about a high inflation. The dollar traded steadier versus most of the G-10 currencies after the jobs data and US stocks plunged amid higher longer tenors’ Treasurers’ yield.

There were worries that the Trump administration’s $1.5 Trillion tax cut package passed by the Republican-controlled US Congress in December, the biggest overhaul of the tax code in 30 years, could cause the economy which already operating near full capacity into an overheating scenario. As the labour market is strong and the tax cuts have yet to kick in, the current market could underestimate the pace of Fed’s normalization. Many say that Powell’s policy will be an extension of Yellen’s, but it seemed difficult as they took the chairs at different economic cycle. When Yellen took the chair, global economy was still pretty weak. Thus, Yellen’s policy strategy is gradually removing the crisis management to a more neutral policy. But given the current US economy and its capital market could be close to “overheating”, Powell may need to stay vigilant ahead of the curves to analyse the upcoming inflation and growth trend, especially on the impact of upcoming $1.5 Trillion tax reform package. From the current backdrop, we think that a drastic move is unlikely given the flattening US curves. Without a solid inflation growth, more aggressive hiking will further flatten the US curves, and this is not a good sign for the economy. However, the situation could change next year if the tax reform has more visible impact to inflation and growth.

The market also is also worried that any improper unwinding of Fed mega-sized bond purchases, with QE being one of the key contributors to the low volatilities in financial market, may spur some unwelcomed shock to financial market.

Our Picks

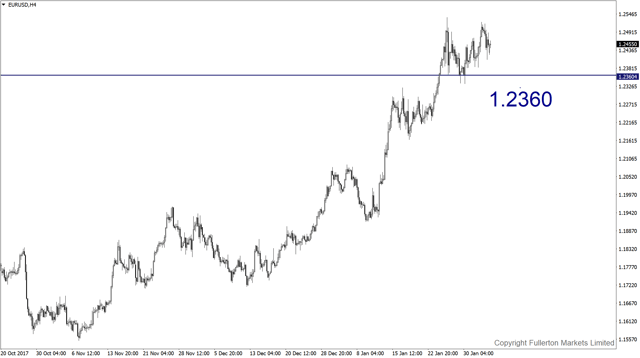

EUR/USD – Slightly bearish.

Strong NFP data could push price drop towards 1.2360 this week.

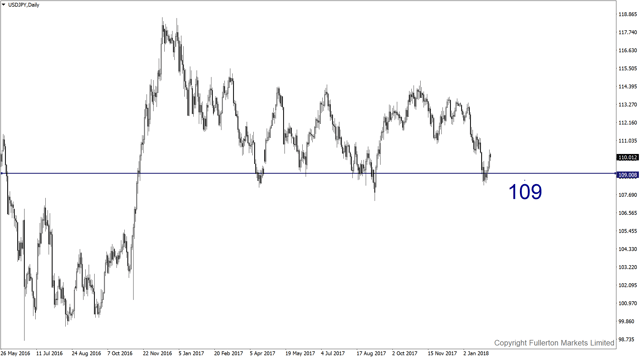

USD/JPY – Slightly bearish.

Sell off in global stocks could spur demand on yen, USD/JPY could fall towards 109 this week.

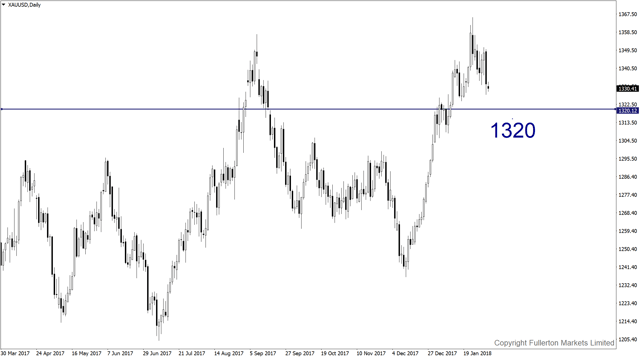

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1320 this week.

The dynamic sell down in gold is partially due to a strong NFP data.

The higher interest rate environment will increase further risk-taking which is not good for safe haven like gold.

Fullerton Markets Research Team

Your Committed Trading Partner