Major US stock indices are poised for their third consecutive week of gains, with the S&P 500 and Nasdaq registering over 2% increases by Thursday's close, and the Dow expected to climb by 1.9%.

The positive momentum is attributed to softer readings in October's consumer price index (CPI) and producer price index (PPI). The CPI remained unchanged from the previous month, and wholesale prices witnessed their most significant monthly drop since April 2020.

Investor confidence has surged, prompting speculation that the worst of inflation and the Federal Reserve's stringent rate policy may be subsiding. Analysts noted a notable shift on Tuesday, suggesting the Fed, having concluded its aggressive tightening, is adopting a wait-and-see stance for the coming months, with market expectations leaning towards a potential rate cut.

Despite the optimistic surge in November, questions linger about the sustainability of this outlook for the rest of the year. In the current month alone, the S&P 500 has surged by 7.5%, the Dow by 5.7%, and the Nasdaq by an impressive 9.8%. However, there is a possibility that expectations for rate cuts could wane in the coming weeks as it might be premature for such anticipations to materialise.

Cleveland Federal Reserve President Loretta Mester cautioned that lower inflation levels this week aren't sufficient to declare victory over higher prices. She acknowledges progress but emphasises the need for more substantial evidence.

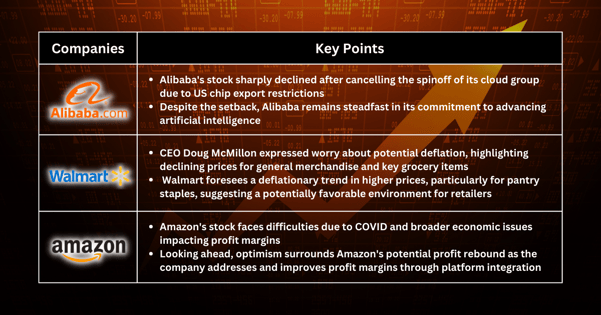

Alibaba Faces Setback but Holds AI Promise

Alibaba witnessed a sharp decline after announcing the cancellation of the complete spinoff of its cloud group due to US chip export restrictions. Despite this setback, Alibaba's commitment to fostering artificial intelligence remains robust.

Aligned with tech giants like Tencent, Alibaba is strategically positioned to capitalise on the rising demand for AI computing, particularly in the cloud market. This advantage is amplified by their substantial inventory of Graphics Processing Units (GPUs), distinguishing them from state-owned telecommunications companies.

Walmart Reacts to CEI’s Deflation Warning

Walmart CEO Doug McMillon raised concerns about potential deflation, citing decreasing prices for general merchandise and key grocery items like eggs, chicken, and seafood. The retailer anticipates a deflationary trend in stickier higher prices, including pantry staples, in the coming weeks and months.

McMillon's warning suggests the US may be entering a period of deflation, potentially favourable for retailers.

Amazon Seeks Profit Margins Amid Business Evolution

Amazon's stock performance has faced challenges in recent years due to the impact of COVID and broader economic difficulties affecting profit margins. The habits of Prime users, crucial for regular shopping, have gained significance. Integration across platforms, including advertising and media consumption, is growing.

Looking forward, there's optimism that Amazon's profits could rebound in the next few years as the company addresses and improves its profit margins.

Fullerton Markets Research Team

Your Committed Trading Partner