As the Federal Reserve recently raised interest rates as anticipated, investors eagerly await the June data on the personal consumption expenditures price index (PCE), a key inflation indicator closely monitored by the central bank. Economists project a 0.2% increase in the core PCE from the previous month, with a year-on-year climb of 4.2%. The PCE figures hold particular significance, as they could impact market sentiment and potentially challenge expectations regarding future rate hikes.

Equity Markets on Steady Path with Tech Sector Leading Slightly

During the week, the Dow and Nasdaq were on track to record modest gains. The 30-stock average saw a rise of 0.16%, while the tech-heavy Nasdaq achieved a 0.12% gain as of Thursday's market close. Meanwhile, the broader S&P 500 remained relatively flat, reflecting a marginal 0.02% increase. These market movements come amid recent Fed decisions and economic data reports, indicating cautious investor sentiment.

Strong Q2 GDP Growth Signals Resilient US Economy

The US Commerce Department's report revealed that the second-quarter gross domestic product (GDP) growth surpassed expectations, offering reassurance about the economy's resilience. During the April-to-June period, GDP increased at an annualised rate of 2.4%, outpacing the consensus estimate of 2%. This acceleration was mainly fuelled by robust consumer spending, supported by gains in non-residential fixed investments, government expenditures, and inventory growth.

Meta (formerly Facebook) Posts Impressive Q2 Earnings Results

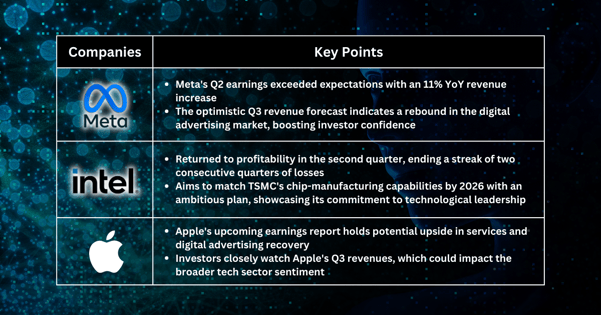

Meta impressed investors with its second-quarter earnings report, surpassing analysts' expectations and providing a promising outlook for the current period. The company experienced an 11% revenue increase year-on-year, achieving double-digit growth for the first time since 2021's end. Meta's optimistic third-quarter revenue forecast of $32 billion to $34.5 billion signals a rebound in the digital advertising market, bolstering investor confidence in the company's growth potential.

Intel Bounces Back to Profitability and Sets Ambitious Goals

Intel's second-quarter earnings announcement revealed a return to profitability after two consecutive quarters of losses. The company also presented a robust forecast, exceeding market projections. Intel aims to match TSMC's chip-manufacturing capabilities by 2026, a strategic move to bid for producing cutting-edge mobile processors for other firms. This ambitious plan, "five nodes in four years," demonstrates Intel's commitment to re-establishing its technological leadership.

Apple Earnings Present Potential Upside

As Apple gears up for its upcoming earnings report, market analysts anticipate some areas of potential upside. Apple's fiscal Q3 revenues are projected to be aligned with the company's guidance, but optimism stems from potential outperformance in services amid a conservative forecast and an anticipated cyclical recovery in digital advertising. Investors keenly observe Apple's performance, which could influence the broader tech sector's sentiment.

Fullerton Markets Research Team

Your Committed Trading Partner