Concerned about recent market downturns or the possibility of a recession? Here's some good news: The Federal Reserve's recent signal that interest rates won't drop as steeply as expected might have rattled traditional stock traders, but it could open up opportunities for others.

The recent market turbulence is, in part, due to the surprising announcement by Fed officials that interest rates won't decline as much as previously anticipated. This adjustment is more significant than it might seem at first glance. Some officials, in both their projections and comments, have hinted that interest rates may not only stay elevated for an extended period but could potentially remain permanently higher. In technical terms, this pertains to the "neutral rate" – a rate that maintains stability in inflation and unemployment over the long term, which has increased.

This development has implications for investors, businesses, and households whose plans are tied to interest rates over a decade or more. It could explain the recent sharp rise in long-term Treasury yields and the challenges faced by the stock market.

The S&P 500 and the tech-heavy Nasdaq Composite have experienced declines of 2.7% and 3.5%, respectively, this week; on track for their worst week since March and marking their third consecutive negative week. Meanwhile, the Dow Jones Industrial Average has dipped by 1.6% during the same period.

The silver lining is that traders can capitalise on market volatility and asset price fluctuations during a recession. Typically, stock prices fall during a recession, often triggering panic selling among investors. However, traders with the ability to identify undervalued stocks or assets poised for a future rebound can purchase them at a lower cost and hold them until the market recovers.

Additionally, short-selling presents an opportunity for traders. This strategy involves betting against a stock or asset expected to decline in value and can be highly profitable when executed correctly.

Analysing Short-Selling Opportunities in Key Stocks

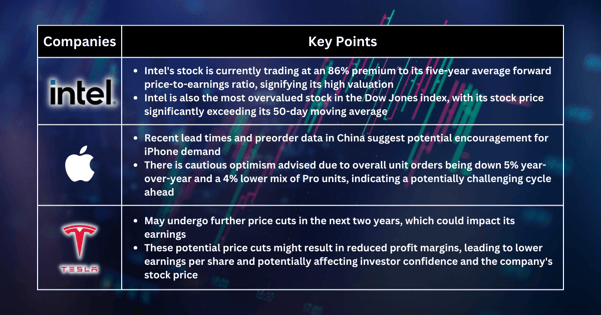

Intel: Intel currently trades at an 86% premium compared to its five-year average forward price-to-earnings ratio. It stands out as not only one of the most fundamentally expensive stocks in the broader market but also the most overvalued stock in the Dow Jones index, with its stock price trading significantly above its 50-day moving average.

Apple: While recent lead times and preorder data in China might appear encouraging for iPhone demand, cautious optimism is advised. Latest checks in China indicate a potentially challenging cycle ahead, with overall unit orders down 5% year-over-year and a 4% lower mix of Pro units.

Tesla: The electric vehicle giant may face more price cuts in the next two years, potentially impacting its earnings. This could lead to reduced profit margins and, consequently, lower earnings per share. Such developments could also affect investor confidence and the company's stock price.

In these uncertain times, strategic trading, including short-selling and identifying overvalued stocks, can provide opportunities for investors to navigate the evolving market landscape.

Fullerton Markets Research Team

Your Committed Trading Partner