Nvidia gained just 0.1% after its 3.2% rise the prior day. The graphics chip maker at the heart of the artificial intelligence boom reported record sales that doubled from a year ago. Nvidia looked set for a big bounce, reaching its highest level on record during trading, but those gains fizzled as investors took profits on their positions.

Market doubts that Nvidia’s results were inadequate to justify its valuation. The stock opened Thursday at more than $500 a share. That means the company would need to increase revenue by an average of 20% annually for the next 25 years. That is an extremely high bar, even with its AI prowess.

Meanwhile, precarious signs for the economy’s trajectory appeared just as the Fed kicked off its Jackson Hole Symposium. Officials raised their policy rate by a quarter point last month to a range between 5.25% and 5.5%. In June, many anticipated raising the rate to a range between 5.5% and 5.75% this year. Some have said that recent better-than-expected inflation numbers could make another increase unnecessary. Others worry that if the Fed holds rates steady, strong economic growth could cause inflation to decline more slowly than anticipated.

As with previous years, Powell is unlikely to use his speech to preview the Fed’s near-term policy deliberations. He is more likely to review what the central bank has done and provide a broader framing of where policy might be headed. Such remarks would likely underscore that the Fed’s inflation-fighting job isn’t done.

It may be too soon for Powell to publicly discuss how Fed officials might manage the proverbial last mile of the inflation fight—in which inflation gets much closer but not to their 2% target. But the issue is likely to be a topic for a lively debate on the sidelines of the conference.

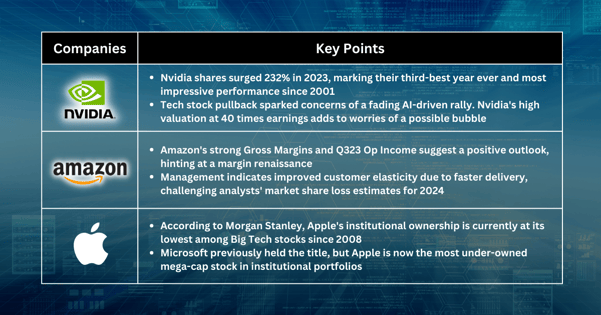

Nvidia: More corrections may happen in the near term

After a more than 232% jump in 2023, Nvidia shares are on pace for their third-best year on record and best yearly stretch since 2001.

In recent weeks, the pullback in technology stocks fuelled some fears that the AI-spurred rally was losing its steam. Rising stock prices this year raised worries about a possible bubble burst.

The rise in Nvidia shares brings its valuation to a steep price-to-earnings ratio of 40 times on a next-twelve-month basis. That is roughly double the S&P 500 average.

On a price-to-sales basis, Nvidia sits at about 37 times. That expensive relative valuation keeps Nancy Tengler from buying into the stock despite confidence in the long-term AI theme.

Despite some valuation concerns, Nvidia’s price-to-earnings-growth looks reasonable if the company continues to crush numbers and grow at around 40 to 45 times next year’s earnings.

Amazon: Overweight rating

We reiterate an overweight rating on Amazon. The evidence of this emerging in the Gross Margins & 3Q23 incremental Op Income guide was by far the strongest in company history. The company may be on the cusp of a margin renaissance.

Commentary from management around improved customer elasticity from faster delivery. Some analysts’ estimates pointing to market share losses in 2024 could be wrong, as the company’s investments create a better customer service experience. Meanwhile, he said competitors are dealing with shrink issues.

Apple: Unfavoured by institutional investors

Apple is now the Big Tech stock least owned by institutional investors and is the most under-owned it has been since 2008, according to Morgan Stanley.

Over the past four years, the most under-owned mega-cap stock in institutional portfolios was Microsoft. However, that position was ceded to the iPhone maker coming out of the second quarter.

Fullerton Markets Research Team

Your Committed Trading Partner