US stock futures rallied more than 1%, and the dollar slid versus major peers Monday as traders digested the steps taken by regulators to shore up the American financial sector in the wake of Silicon Valley Bank’s failure.

Treasury Secretary Janet Yellen said her office would protect “all depositors” at the bank, whose demise Friday marked it as the most significant event since 2008. The government actions will also include a new lending program that Federal Reserve officials said would be big enough to protect uninsured deposits in the US banking system.

Two-year Treasury yields added to their sharp decline last week, falling as much as 15 basis points before trimming the move amid bets for slower rate hikes from the Fed. Its yields on the 10-year maturity rose slightly.

Monday’s market moves come after risk assets fell last week, with the US stock benchmark suffering its worst week since September. Wall Street’s so-called “fear gauge” spiked, with the Cboe Volatility Index hitting the highest this year.

JP Morgan: healthy profile after the sell-off in the financial sector

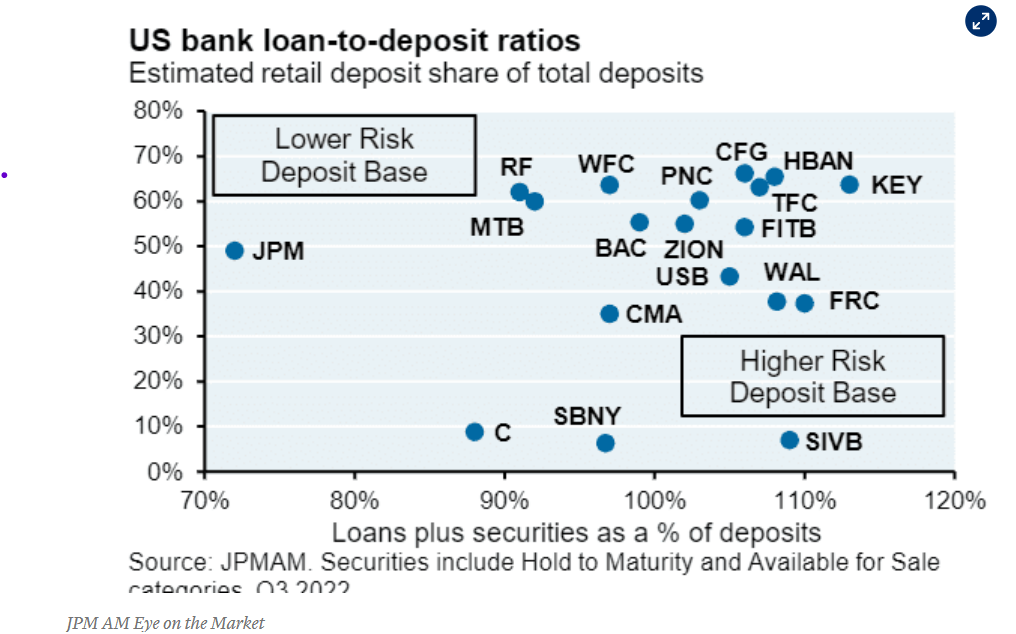

Some sell-off in financial sectors are “overdone,” as investors have overblown the sector’s liquidity risks. Some price drops may serve as a buying opportunity.

Overall, we see JP Morgan's liquidity profile as solid against expected, with a healthy loan-to-deposit ratio.

Microsoft: Revenue upside from ChatGPT has not yet been priced in

Microsoft is poised to benefit from the artificial intelligence boom. An estimated $40 billion revenue upside for Microsoft from ChatGPT has not yet been priced into forecasts.

MSFT is a direct beneficiary due to its ownership position of OpenAI (effectively 75% today). The associated exclusivity agreement providing Azure infrastructure services to all OpenAI models' needs makes MSFT relevant to the proliferation of AI-driven application productivity.

Microsoft shares have climbed more than 5% in 2023, helping the tech stock rally. The stock is coming off a losing year, which declined almost 29% in 2022.

Tesla: Price may face some near-term downward pressure

Tesla Inc. is under investigation by US regulators over complaints that the steering wheel can fall off certain new Model Y vehicles while they are in use.

The company's share price has outperformed Nasdaq since the beginning of the year and some traders may use this event to square off some of the positions.

Fullerton Markets Research Team

Your Committed Trading Partner