Where markets go next may well depend on how Nvidia does after going forward. The S&P 500 rallied to a fresh record Thursday after Nvidia, which has helped lift the broader markets for the better part of the past year, surged more than 14% on a monster fiscal fourth-quarter earnings report.

The stock market outlook experiences a sudden surge in optimism propelled by a significant surge in Nvidia shares following the release of its quarterly earnings report, which showcased unprecedented growth and provided a bullish outlook.

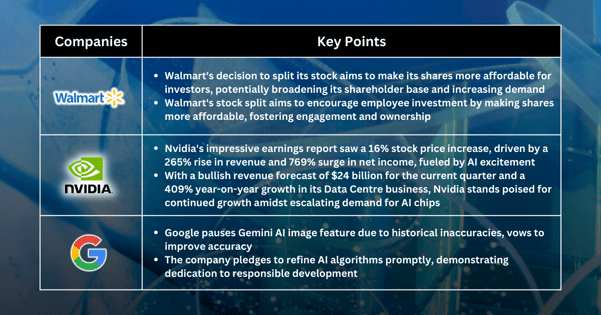

Nvidia, the renowned chip giant, reported a remarkable 265% increase in total revenue compared to the previous year, primarily fuelled by the thriving artificial intelligence sector. This surge has catapulted Nvidia to the status of the fifth-largest company in the U.S. based on market capitalisation.

Additionally, the company's forward-looking guidance indicates the anticipation of another exceptional revenue increase for the ongoing quarter, surpassing already high expectations for substantial growth.

The soaring enthusiasm surrounding artificial intelligence has been a driving force behind the astounding rally in Nvidia's stock, along with other major players in the technology sector, over the past year. The extraordinary performance demonstrated by Nvidia in this quarter is expected to further instil confidence in the tech industry, thereby benefiting the broader market sentiment.

Previously, pessimistic sentiments attempted to dampen the momentum of Nvidia's stock, with bears aiming to capitalise on the news and sell off shares. However, the earnings report presented little room for criticism or disappointment. Instead, it highlights the vast potential for future growth within the company, especially considering its substantial investments in artificial intelligence technology.

This positive sentiment suggests a potential rebound for the Nasdaq Composite index in the near term, as confidence in the tech sector is reinforced by Nvidia's impressive performance and promising outlook.

Walmart: lower share price post-split may attract new investors

The decision by Walmart to split its stock, in this case, a 3-for-1 split, has significant implications for both the company and its investors. Psychologically, a lower share price post-split may attract new investors who perceive the stock as more affordable. This could broaden Walmart's shareholder base and increase overall demand for its shares.

One of the primary motivations behind Walmart's stock split is to make it more accessible for its employees to invest in the company. By reducing the price per share, Walmart aims to encourage its employees to purchase more full shares rather than fractional shares. This move is intended to foster a sense of ownership and engagement among its workforce.

From an investor's perspective, however, the stock split does not alter the fundamental value of the company. Despite the increase in the number of shares outstanding, the overall value of Walmart remains the same. This means that while investors will hold more shares post-split, their proportional ownership stake in the company remains unchanged. Additionally, the financial performance and fundamentals of Walmart's business remain unaffected by the split.

However, stock splits can potentially enhance market liquidity by increasing the number of shares available for trading. With more shares in circulation, it may be easier for investors to buy and sell Walmart stock, potentially leading to increased market participation and activity.

Nvidia: More important than Fed

Nvidia shares closed up 16% on Thursday, a day after the chip giant posted bumper earnings that beat Wall Street estimates. It reported revenue of $22.10 billion for its fiscal fourth quarter, a rise of 265% year on year, while net income surged by 769%, as the company continues to see a boost from excitement over artificial intelligence.

The positive outlook from Nvidia prompted a round of broker upgrades from JPMorgan to Bank of America. Nvidia sees no signs of slowing. The company forecast its revenue in the current quarter will hit $24 billion, way ahead of estimates. Fundamentally, the conditions are excellent for continued growth in 2025 and beyond, Nvidia CEO Jensen Huang told analysts on Wednesday, adding to the bullish sentiment around the stock.

Nvidia’s Data Centre business, which includes the company’s H100 graphics cards that are used for AI training, posted sales of $18.4 billion in the fourth quarter, representing 409% year-on-year growth.

AI’s surge began at the end of 2022, after OpenAI made its ChatGPT tool widely available. Public fascination with ChatGPT’s ability to generate humanlike language led to a flood of investment in OpenAI and spurred on its competitors. Improving sophisticated AI systems like ChatGPT requires increasingly large numbers of the chips Nvidia and its competitors make.

That trend might bode well for Nvidia’s sales trajectory. While many industry observers expect a slowdown in AI chips to come at some stage, the current rush by tech-company competitors to best one another in the AI race might overshadow the industry’s typical ups and downs for some time.

Google: Lost the game to OpenAI?

Google's decision to pause its Gemini artificial intelligence image generation feature comes in response to mounting complaints about its historical inaccuracies. Users, particularly on social media platforms, have voiced concerns about the AI tool's tendency to depict historical figures, such as the U.S. Founding Fathers, as people of colour, which they perceive as inaccurate.

The initial response from Google, posted on X on Wednesday, acknowledged the AI's capability to generate a diverse range of people, which is generally considered a positive feature. However, the company admitted that the software was "missing the mark" in this instance and pledged to rectify these inaccuracies promptly.

In an updated statement released on Thursday, Google announced its decision to temporarily halt Gemini's feature for generating images of people. This pause will allow the tech giant to work on refining the AI's algorithms to produce more accurate depictions. The company aims to reintroduce an "improved" version of the feature in the near future.

Google's response reflects its commitment to addressing user feedback and continuously improving its AI technologies. By taking proactive steps to address concerns regarding historical accuracy, Google demonstrates a commitment to responsible AI development and ethical considerations in image generation.

Fullerton Markets Research Team

Your Committed Trading Partner