The Nasdaq Composite is off nearly 6% in September and down 4.3% for the quarter. This month will be the worst in 2023 for it. The Dow is on track for a 3% decline this month and a 2.2% fall for the quarter.

Investors are now turning their attention to the latest personal consumption expenditures price index reading due Friday. The PCE reading is the Federal Reserve’s preferred inflation metric. The market expects the core PCE to advance 3.9% year over year in August and gain 0.2% monthly.

Stocks are lower mainly because Investors expect further slowing in the final quarter of 2023. Businesses would do well to prepare for a period when the consumer will retrench and become more cautious about spending.

Also, Inflationary pressures will likely be higher in the future than in the past 20 years, meaning that higher real interest rates are necessary in such an environment to keep inflation at target.

Meta: Solid performance despite broad sell-off in the tech sector

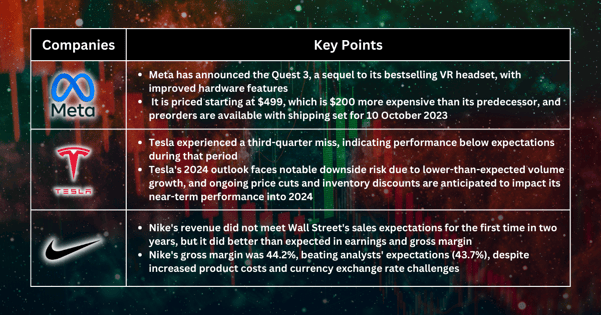

Meta announced Quest 3, a sequel to the bestselling VR headset of all time, on Wednesday. Starting at $499, the device is more expensive than its predecessor by $200. However, it includes a more powerful chip from Qualcomm, better screens and an ability called “passthrough”, which is expected to be one of the key features on Apple’s competing Vision Pro headset. Preorders are open on Wednesday and ship on 10 October 2023.

Tesla: Near-term outlook does not look bright

In addition to a third-quarter miss, we see meaningful downside risk to Tesla’s 2024 consensus expectations due to limited volume growth next year. The near-term risk from weaker fundamentals into 2024 is likely due to a much lower volume outlook than the market believes.

Price cuts to Model Y cars in China, Model S/X and targeted inventory discounts should continue in 2024.

Nike: Share performance will link to China's economic outlook

Nike reported revenue this week that fell short of Wall Street’s sales expectations for the first time in two years, but it beat earnings and gross margin estimates.

During the quarter, Nike’s gross margin fell about 0.1 percentage points to 44.2%, higher than the 43.7% analysts had expected. The company attributed the gross margin drop to higher product costs and currency exchange rates.

Investors have been laser-focused on Nike’s recovery in China. Sales in China grew by 5% compared to the year-ago period to $1.7 billion, which fell short of the $1.8 billion analysts had expected.

Fullerton Markets Research Team

Your Committed Trading Partner