Amid recent positive indicators for the US economy, a sense of caution persists as concerns of an impending recession loom.

While the job market and services sector demonstrate resilience, and the housing industry experiences a revival, steady US growth prospects are accompanied by uncertainties. The Federal Reserve's ongoing interest rate increases have begun impacting the economy, and questions arise about the ability of consumers to withstand mounting pressures, thereby posing potential risks that could lead to at least a minor economic downturn.

Federal Reserve Chairman Jerome Powell emphasised the need for continued efforts to curb inflation, suggesting a prolonged tightening cycle that may extend into the fall. The central bank's determination to remain aggressive in tightening is bolstered by the prospect of other central banks, such as the Bank of England and the European Central Bank, pursuing multiple rate hikes.

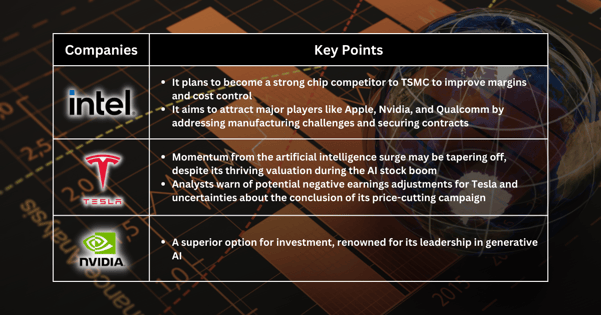

Intel: A Buying Opportunity Amid Transformative Plans

Intel's Chief Financial Officer David Zinsner outlined its strategic vision to position itself as a competitive chip manufacturer capable of rivalling Taiwan Semiconductor Manufacturing Company (TSMC).

As part of this plan, Intel will revamp its financial reporting structure and grant its foundry business, IFS, and its profit-and-loss statement, to enable transparent visibility into manufacturing margins and cost control.

To achieve this, Intel will utilise its chips to address manufacturing process challenges before opening its factories to third-party companies. A successful catch-up to TSMC could position Intel to secure contracts from major players like Apple, Nvidia, and Qualcomm, who currently rely on TSMC or Samsung for their manufacturing needs. Intel also anticipates announcing a significant customer for its foundry business later this year.

Tesla: A Momentary Pause

While Tesla has thrived amidst the AI stock boom, propelling its valuation higher, there are indications that its momentum from the artificial intelligence surge may be tapering off.

As the market remains enticed by the AI narrative, analysts advise preparing for a potential reality check, cautioning about forthcoming negative adjustments to Tesla's earnings forecasts despite its recent rally. Uncertainty looms regarding whether Tesla has concluded its price-cutting campaign on crucial vehicles, contributing to the need for clear guidance.

Nvidia: The Prime Contender

Nvidia continues to reign as the top contender for investing in generative AI. Promising prospects in data centres, with potential opportunities in software, cloud computing, and automotive sectors, instil optimism for Nvidia's future.

For those seeking investment exposure to generative AI, Nvidia remains the superior choice—a testament to playing with the best.

Fullerton Markets Research Team

Your Committed Trading Partner