The VIX index rose above 19 as stocks fell despite jobless claims remaining historically low. Fed’s rate outlook jitters stock traders now. The good news is that traders can profit from the market’s downturn by selling the stocks, especially in tech sectors, and look for those oversold stocks.

The violent moves in the bond market, especially the surge in the 10-year Treasury yield, have significant effects on the stock market. Stocks have sold off since US yields began rising in July, giving up much of the year’s gains, but the typical haven of US Treasuries has fared even worse. Higher Treasury yields mean that fixed-income investments become more attractive relative to stocks.

As yields rise, some investors may shift their capital from equities to bonds to capture higher yields. This can lead to a decrease in demand for stocks, causing equity prices to decline. Some traders would short-sell stocks, too.

Rising yields can lead to concerns about stock valuations. When bond yields rise, the discount rate used to calculate the present value of future earnings for stocks also increases. This can result in lower valuations for equities, which can trigger selling pressure.

High-growth and tech stocks, in particular, can be sensitive to changes in interest rates. These stocks often have higher valuations and may be more affected by rising yields. Investors may shift into safer or value-oriented stocks when rates rise.

Rising bond yields can create uncertainty and volatility in the stock market. Investors may become more cautious and risk-averse as they assess the potential impact of higher rates on corporate profits and economic growth. This can lead to increased market volatility.

Apple: Its boss sold a large amount of shares

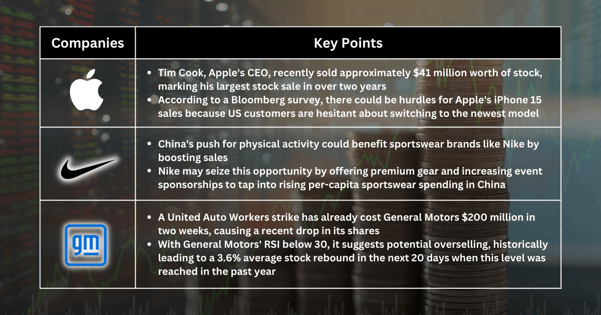

Apple Inc. Chief Executive Officer Tim Cook sold stock worth about $41 million after taxes in his biggest sale in more than two years as the shares of the iPhone maker slid off recent highs.

Apple’s iPhone 15 sales could remain stagnant as US customers refrain from upgrading to the newest model, as reported by Bloomberg’s survey.

Nike: Good news from China

China's efforts to encourage physical activity, aligned with the State Council's 2021-25 National Fitness Plan, may boost sales for sportswear brands like Nike. It could sell pricier gear and increase sponsorship of athletic events to capture a rise in per-capita spending on sportswear.

GM: Oversold may lead to some short-term rebound

General Motors Co. said a historic strike by the United Auto Workers has already cost $200 million in the first two weeks. Its shares slumped in the past few days. The RSI of General Motors fell below 30, indicating shares may be oversold. In the past 12 months, the stock has crossed below this level five times and rose an average of 3.6% in the next 20 days.

Fullerton Markets Research Team

Your Committed Trading Partner