The Dow tends to beat the Nasdaq index recently, outperforming it by as much as 2.5 percentage points on Thursday, creating the widest gap between the two indexes since February 2022.

Strong quarterly results from Johnson & Johnson, in which the healthcare giant beat on earnings, helped propel the blue-chip average. Indeed, shares popped 6%. Goldman Sachs and Boeing are also up more than 2%. Each of those three stocks is good for at least 30 points on the Dow. Meanwhile, Tesla’s 9% decline is dragging on the Nasdaq index.

Even as the Dow is on its way to a ninth day of gains – its longest winning streak since September 2017 – it’s still only up 6.4% in 2023, compared to the Nasdaq 100′s jump of 41%. Having that said, the downside in tech stocks should not be ignored.

Of the S&P 500 companies that have reported earnings thus far, 74% have exceeded expectations, data shows. The strength in corporate earnings has created optimism for a soft landing for the US economy.

All these good factors, together with Fed’s tightening cycle, may move into the end, retail investor enthusiasm for stocks climbed to 51.4% in the latest weekly survey by the American Association of Individual Investors, up from 41.0% bullishness last week, and the seventh straight week bullish sentiment landed above its long-term historical average of 37.5%.

The latest week’s optimism was the highest since April 2021, at 52.7%. Conversely, a bearish opinion that stocks will fall in price over the next six months dropped to 21.5%, the lowest since June 2021, from 25.9% last week.

However, too many retail investors, who are bullish on stocks, might not end with good things. When too many investors become overly optimistic and invest heavily in stocks, it can lead to an overheated market. This will result in inflated stock prices that might not be supported by underlying fundamentals.

Excessive bullish sentiment can also lead to herd mentality, where investors follow the crowd without conducting thorough research. This can result in speculative behaviour, with investors buying stocks solely based on the belief that others are doing the same rather than considering the intrinsic value of the investments.

If many investors are overly optimistic and have already priced in positive expectations, any deviation from those expectations could trigger a market correction. A sudden shift in sentiment or a negative surprise in economic data can cause stock prices to decline rapidly.

Tesla: More profit-taking activities should be expected

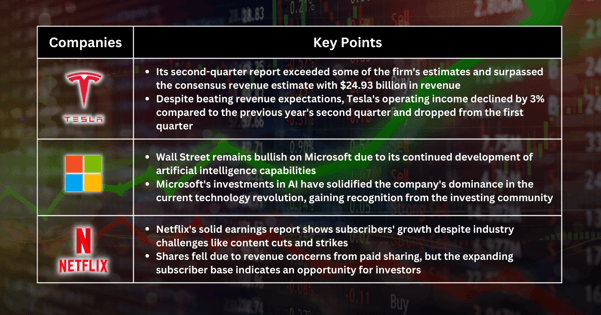

Tesla’s second-quarter report beat some of the firm’s estimates but was wary of the effect lower prices would have on margins.

Tesla beat expectations on the top and bottom lines in its second-quarter report. The electric-vehicle maker reported revenue of $24.93 billion, beating the consensus estimate of $24.47 billion.

However, operating income fell 3% from the year-earlier period to $2.40 billion. That’s also down from $2.66 billion in the first quarter.

The stock was also under pressure after CEO Elon Musk and company leaders gave vague responses to questions on the timing for deliveries on the Cybertruck.

Microsoft: Riding with the AI’s uptrend

Wall Street’s bullishness on Microsoft continues as its artificial intelligence capabilities after the software giant revealed pricing for its AI subscription service.

Microsoft revealed a $30 fee for its monthly Copilot offering, which adds AI capabilities to Microsoft 365. The company also shared a significant update to its Bing AI chatbot and said it would offer Meta Platform’s new large language model to Azure customers.

The announcements led to some Wall Street price target adjustments as the company solidified its dominance in the latest technology revolution consuming the investing community. Microsoft has been at the forefront with its multibillion-dollar investment in ChatGPT-maker OpenAI.

Netflix: Pullback is an opportunity

Netflix posted a solid earnings report even as the broader media industry cuts down on content for its streaming services and contends with actors and writers being on strike. The company added 5.9 million subscribers in the quarter in a sign that it is a password-sharing crackdown and advertising tiers are generating new subscribers.

However, shares fell following concerns that paid sharing has not added more to revenue yet. The earnings results were a signal that investors should buy the pullback in shares as the company grows its subscriber base.

Fullerton Markets Research Team

Your Committed Trading Partner