With RBNZ likely to cut rates tomorrow to 0.75% alongside RBZ’s current interest rates, NZD could remain dovish.

RBNZ is widely expected to cut rates by 25 basis points to 0.75%, on par with Australia’s historical low interest at 0.75%. According to Reuters, 80% of economists polled expect RBNZ to cut rates by 25 basis points tomorrow. On the other hand, the implied probability for a cut is now 65%, rising from roughly 50% a few days ago.

- New Zealand inflation expectations which were released today fell from the previous 1.86% to 1.80%, which could trigger further easing by RBNZ.

- The slowing global economy, the protracted US-China trade war and warnings of a recession could also pressure RBNZ to ease further.

- New Zealand Q2 GDP fell to 2.1%, the lowest since 2013.

- RBNZ has always been focused on employment data and even though last week’s data showed unemployment ticking higher from a decade low, it is still lower than the bank’s forecast in August.

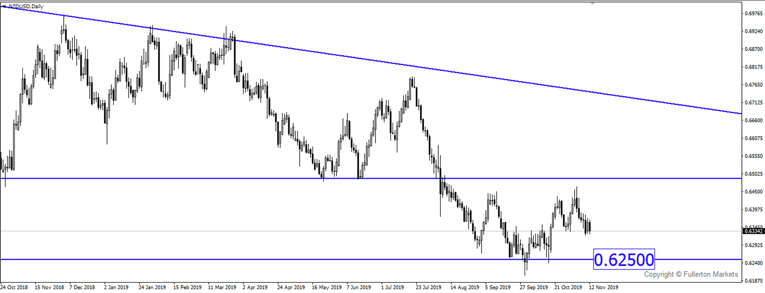

- NZD/USD could head lower towards 0.6250 as the chances of RBNZ keeping its dovish bias is still higher.

Fullerton Markets Research Team

Your Committed Trading Partner