With US & China close to a trade deal and a chance of RBA showing a tinge of optimism, Long AUDCAD?

This morning, RBA announced that they will be keeping their interest rates unchanged at 1.50%. The last time RBA moved its interest rates was in 2016 when they cut interest rates from 1.75% to 1.50%.

- During RBA previous meeting in February, RBA cut its forecast for GDP growth to 2.4% for the year to June 2019. What caused Aussie dollar to slide was when Governor Lowe said that the next move for interest rates is either up or down.

- Aussie dollar strengthened upon the release of the interest rates this morning as the market is pricing in a 10% chance of a price cut.

- Governor Lowe speech tomorrow could include a tinge of optimism as the market has already ruled out a 2019 rate hike which left RBA with a dovish stance.

- US-China trade negotiations were extending passed the 1st March deadline with no additional tariffs which boosted risk currencies such as Aussie dollar and New Zealand dollar.

- Even though the Australian economy has actually improved based on data released after the previous meeting, we believe that RBA will remain cautious. We saw that the labour market, NAB business confidence as well as China’s trade balance have improved.

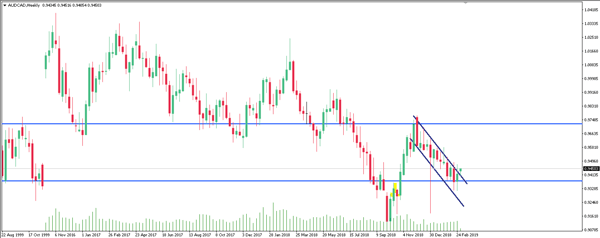

- AUD/CAD has recently broken up higher out of its downwards channel. We believe that it has the potential to continue to go up higher with oil prices unable to make significant advances.

Fullerton Markets Research Team

Your Committed Trading Partner