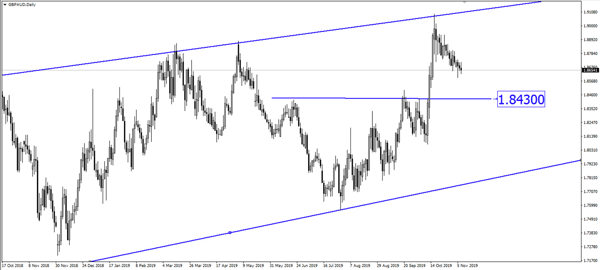

With the backdrop of political chaos, slowdown in global economic growth and the delay in Brexit, some of the policymakers may vote for an immediate rate cut. GBP/AUD may continue its downtrend.

Bank of England (BoE) is widely expected to keep rates unchanged tonight at 0.75% while it cuts its growth and inflation forecasts as Brexit continues to hurt the economy.

- In its last meeting in September, BoE moderated its stance slightly and said that any future rate hike requires an improvement in global growth and clarity on Brexit’s planned exit from the European Union.

- Since the last meeting, the economy has been showing signs of a slowdown.

- Retail sales have stagnated, unemployment rate has increased, and earnings growth has slowed.

- On the other hand, we saw a modest improvement in CPI while service and manufacturing activity grew.

- Economists think the BoE will cut rates at some point in 2020, and financial markets price in a roughly 55% chance of a 0.25 percentage point cut next year according to BOEWATCH.

- If one to two policymakers vote in favour of an immediate rate cut, we could see a sell-off in GBP.

- The Quarterly Inflation Report will be released after the rate decision and we are likely to see a small cut to the BoE’s already modest forecast of 1.3% growth in 2019 and 2020, and less of a rebound in 2021.

- GBP/AUD could move lower towards the 1.8430 level, resuming its current downtrend.

Fullerton Markets Research Team

Your Committed Trading Partner