With Brexit still not reaching an agreement, which poses a downside risk, short GBP/JPY?

BoE is widely expected to keep its interest unchanged tomorrow as Governor Mark Carney made it clear during the last meeting that they had no plans to tighten.

- During BoE’s last meeting, Governor Carney spoke of the possible scenarios that would require a rate cut if Brexit negotiations were to go south.

- At the current juncture, Brexit progress seems bleak as there are a lot of uncertainties regarding the kind of trading relationship that will eventually evolve from the Brexit negotiations.

- However, the UK budget that was announced on Monday strengthens the case for a near-term interest rate as the stimulus package could lift economic growth by 0.3% in 2019.

- It is unlikely that BoE has factored in the budget numbers, therefore BoE could use Brexit uncertainty as the justification for keeping rates unchanged.

- In terms of economic data, UK’s economy has been doing well with unemployment rate at a 40-year low, pay growth at a 10-year high and inflation well above the central bank’s target of 2%.

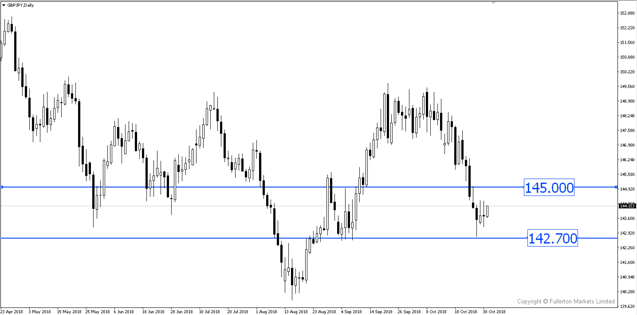

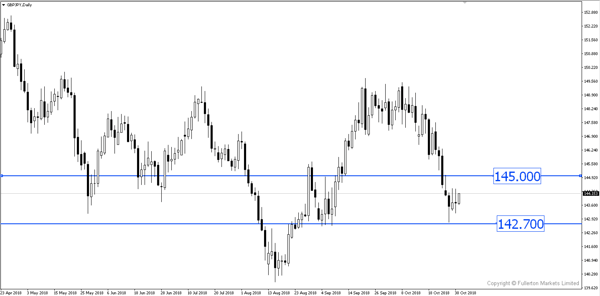

- If BoE talks about the possibility of easing and cuts their economic projections, we could see GBP/JPY fall to 142.70 price level. However, if BoE looks past the recent slowdown in data and focuses on the upside risk of inflation, GBP/JPY could spike up to 145.00 price level.

Fullerton Markets Research Team

Your Committed Trading Partner