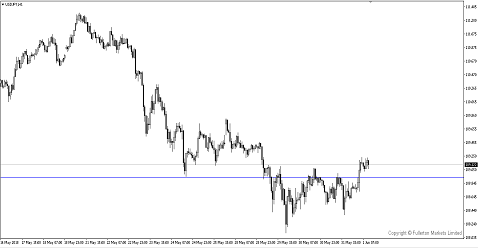

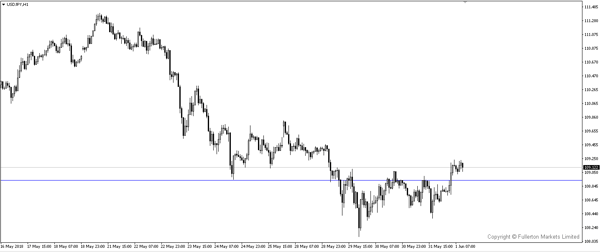

Wage growth may not accelerate in tonight’s report, short USD/JPY?

The correlation between US average hourly earnings and the Fed’s preferred inflation gauge, the core PCE deflator, is over 82% as reported.

- We expect a 0.3% increase in average hourly earnings and such a gain will nudge the year-on-year rate of change up to 2.7%. Given the Fed’s sanguine assessment of the inflation outlook, policy makers will need to see average hourly earnings above 3% before they begin to express more hawkish concerns.

- We also expect unemployment rate to remain unchanged at 3.9%. The rate is due to decline further later this year, but considering it took seven months to register the latest drop, the next move may take some time to manifest. That is if labour-force participation begins to drift higher.

- USD/JPY may fall towards 108.70 if US jobs report to disappoint in general

Fullerton Markets Research Team

Your Committed Trading Partner