US NFP tonight may be well below the estimates, short USD/JPY & long silver (XAG/USD).

The US economy is losing momentum in the back half of the year to a degree enough to meaningfully depress the pace of hiring.

- Job creation has already decelerated markedly, and diminished business confidence in recent months will exacerbate the defensive posturing among hiring managers.

- Earlier this week, data showed the lowest manufacturing jobs gauge since 2016 and slower private hiring; a sharp drop in small business hiring plans; and the worst US services-employment index in five years.

- Factors such as trade war and manufacturing recession are starting to permeate the economy at a time when companies are already struggling with a shrinking pool of qualified workers.

- US manufacturing has been hit the hardest so far. The market will be keenly watching the September report to show whether the pain has spread more broadly in the labour market, whose relative strength has helped keep the record-long US expansion from turning into a recession.

- The NFP tonight could be below 100k, well below the 140k estimate, and such a result will pressure USD/JPY lower and silver higher.

- The latest ISM manufacturing survey already delivered the economic evidence the Fed needs to continue cutting interest rates, which Friday’s numbers will likely confirm.

- The next leg of the big bond rally is under way, the economy will be pushing the Fed funds rate back to, or maybe even through, the zero bound before this cycle is over.

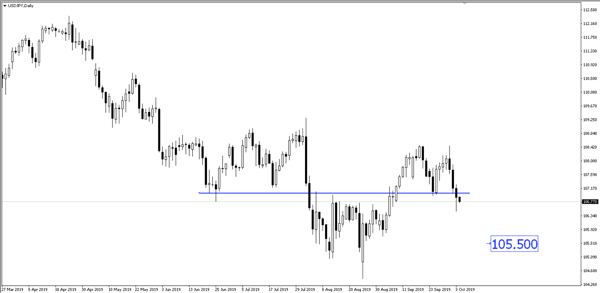

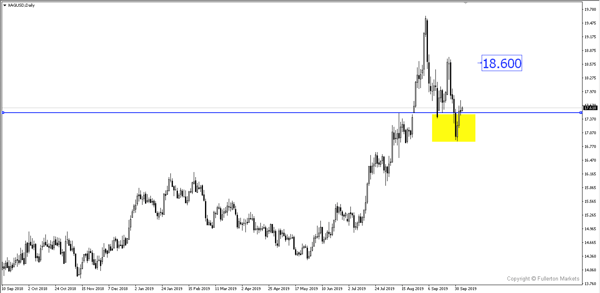

- USD/JPY after breaking a critical support could be heading lower towards the 105.50 price level while silver (XAG/USD) could head higher towards the 18.60 price level.

Fullerton Markets Research Team

Your Committed Trading Partner