Even though the market may already be pricing a weaker NFP data, the actual data, if worse than forecast, could still spark selling pressure but in a smaller magnitude. GBP/JPY may move lower.

- Yesterday, jobless claims rose from 3.307 million to 6.648 million, hitting another historical high.

- The fall in USD/JPY was tepid at best as the market is already pricing weaker data in the coming months due to the Covid-19 pandemic.

- Tonight’s NFP will be the first labour data that could reflect some or even most of the impact by the pandemic.

- The market is forecasting non-farm employment to fall to -100k, unemployment rate to rise to 3.8% and average hourly earnings to drop to 0.2%.

- As we mentioned above, NFP may reflect some but not all of the impact of the current pandemic, as the data is measured only from 12th March 2020 while the actual lockdown of the US states only started on 20th March 2020.

- In any case, if the data are slightly better than forecast, USD/JPY may rally. However, the rally might not sustain and could provide a good short opportunity.

- If the data appear to be worse than forecast, USD/JPY may spike lower. However, the magnitude of the move will largely depend on market sentiments – as the market have already been pricing in weaker data.

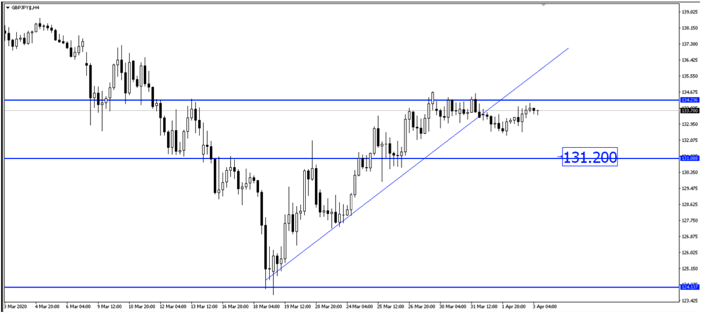

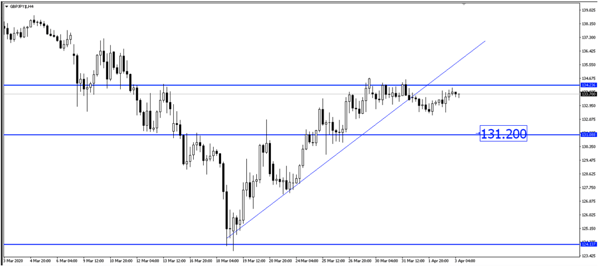

- In our opinion, GBP/JPY may provide a good short opportunity after the price broke an uptrend support line and could head lower. If NFP falls short, the strengthening yen could push this pair lower towards 131.20.

Fullerton Markets Research Team

Your Committed Trading Partner