FOMC may prepare investors for a September rate amid stronger data, Long USD/JPY?

Fed is widely expected to keep rates unchanged with a 97% probability chance according to FedWatch tool. Instead, investors will be focusing on the FOMC statement for Fed’s path of interest rates as well as their outlook for the US economy.

Tonight’s FOMC does not come with a press conference or updated projections. This means there will be a heavy emphasis on FOMC statement and Fed will want to use this chance to prepare the market for September’s rate hike. This is due to a few reasons:

- Q2 GDP data came out at 4.1%, stronger than expected. This was double the January-March periods of 2.2% and the strongest performance in nearly 4 years

- Inflation rate firming steadily at 2.2%. the PCE index, Fed’s favourite inflation gauge, rose steadily at 0.1%.

- Wages and salaries rose by 0.5% in Q2. Even though it was a slowdown from a 0.9% in the first 3 months of the year, we expect significant acceleration in wage growth for the rest of the year, boosted by a tightening labour market.

The Fed has raised interest rates several times since December 2015 to a range of 1.75% to 2%. That may seem low historically but comes in the context of an employment recovery that has taken so many years to make up the ground lost during the Great Recession.

Market will also be looking at whether President Trump’s remarks would lead to any changes to Fed’s policy plans. President Trump previously tweeted that he was “not thrilled” about the rising interest rates, expressing concern that Fed could upset the economic recovery with a stronger dollar.

In our opinion, as much as Federal Reserve has a unique relationship with the government, it is ultimately still an independent government entity in tradition and is not politically influenced. Chairman Powell further emphasize previously “We have a long tradition here of conducting policy in a particular way, and that way is independent of all political concerns. We do our work in a strictly nonpolitical way, based on detailed analysis. … We don’t take political considerations into account.”

In summary, the bulk of the changes we expect are likely to be backward-looking, mainly describing current economic conditions to reflect recent data. As long as Fed emphasize on further tightening in the actions of rate hike, we could see a strengthening of dollar.

The US 10-year treasury note rose to 2.99% on Monday, before falling to 2.750% at the time of writing ahead of FOMC.

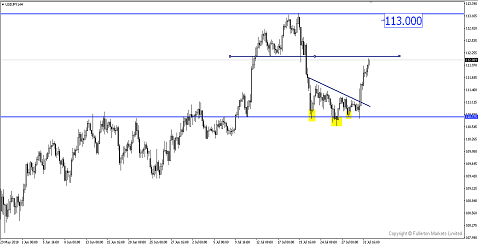

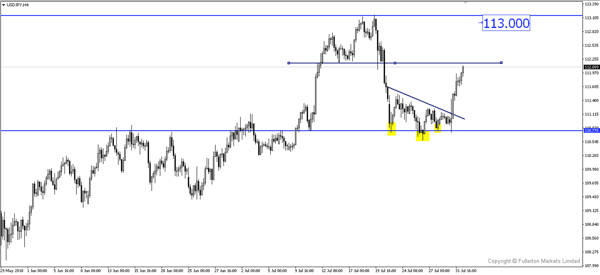

Market has already been pricing in a hawkish FOMC as USD/JPY attempts to break the 112.00 psychological price barrier. We could see 113.00 price level this week if Fed is indeed hawkish.

Fullerton Markets Research Team

Your Committed Trading Partner