With strong US economic data and optimism from Fed speak, USD/JPY could move higher despite a 100% priced in rate cut.

Federal Reserve is widely expected to cut rates later by 25 basis points which is the second cut this year. However, dollar has been trading higher despite a rate cut happening. Usually a rate cut is seen as a dovish move to the markets which results in related currencies moving lower.

The market however is pricing in a less dovish Fed and believes that Fed Chairman Powell may not be looking for further cuts beyond that.

There are two reasons why the market is bullish on the dollar even though a rate cut is 100% priced in tomorrow.

1) US economic data has improved in general since the August FOMC meeting. Even though retail sales, manufacturing activity and consumer sentiment came in lower, inflation and wage growth have been moving higher.

Inflation and wage growth were the Fed’s main concerns as seen from Powell’s speech during its last meeting. With these improvements, Powell could be waiting for further data before committing for another rate cut in the near future.

2) Fed officials’ comments from the last few weeks were mostly optimistic with most of them reluctant to ease further. FOMC voter Rosengren said that “no immediate action is needed if data stays on track.” This can be inferred that Fed officials are satisfied with current market conditions and future rate cuts will be still data-dependent with no confirmation of a cut.

We believe that the market may be mispricing the dovishness of Fed similarly to what they did with the ECB. With the improvement of market sentiments due to US-China trade tensions easing and improvement in data, Fed may not need to open doors for further cuts for now.

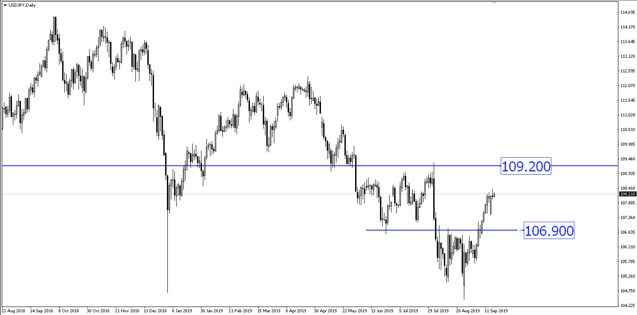

If Powell were to show any signs of optimism during their press conference after the rate cut, USD/JPY could move higher towards the 109.20 price level. However, if Powell were to continue his dovish sentiment and say that Fed is open to further cuts this year, USD/JPY would fall towards the 106.90 price level. We are leaning towards the former.

Fullerton Markets Research Team

Your Committed Trading Partner