The progress of the economy reopening continues to weigh on risk assets, short USD/JPY this week?

Risk assets could be caught in a tug-of-war in the week ahead, as investors weigh the potential positives of a reopening economy against the worry that coronavirus may continue to spread.

Many investors remain sceptical that the stock market’s powerful ascent can continue and are maintaining their cautious stances – a sign of lingering unease that could challenge the rally in the weeks ahead. The first part of the recovery would be rapid—a significant bounce after a deep plunge as people can safely engage with reopen business activities. We are not too surprised to see what looks like a considerable pickup from the deeply depressed April numbers, but we also think the pace of recovery is going to slow way down after the businesses that can easily reopen do so.

Some of these doubters have been bruised by the S&P 500’s 18% climb this quarter and are perplexed by what they deem a seismic disconnect between the battered economy and roaring financial markets. Hopes for a swift economic recovery following coronavirus lockdowns and historic stimulus measures by the world’s central banks have lifted stocks, pushing the technology-laden Nasdaq Composite to a record last week.

Yet, cynics say there are plenty of reasons to remain cautious. These include projections for a bumpy economic recovery, setbacks to developing a coronavirus vaccine and uncertainties surrounding November’s presidential and congressional elections. Those concerns dragged down markets last week, a rare slide in what has been a weeks-long surge.

In the past week, the S&P 500’s sharp gains briefly drove the index into positive territory for the year, before a bruising sell-off at the end of the week. The Fed also dampened sentiment when it released economic forecasts on Wednesday that showed a slow recovery and interest rates at zero through the end of 2022. Traders will hear more of the news when Fed Chairman Jerome Powell speaks before Congress this Tuesday and Wednesday in his semi-annual economic testimony. He may provide more clarity on the Fed’s bond-buying and other policy moves.

Retail sales for May are released on Tuesday, and that will be an important outlook at consumer spending activity. It is the most important data in the coming week, other than the weekly jobless claims report on Thursday. The strongest evidence comes from consumer spending. In April, retail sales collapsed by 16%, the biggest one-month drop on record.

Whether the recovery can continue at this pace remains clouded by uncertainty over future fiscal stimulus, resurgent infections and the drag of unprecedented job loss on consumer finances. Nonetheless, an L-shaped recovery, in which activity stays depressed, now looks remote. And while the overall recovery may not end up V-shaped, it may also be less feeble than many had feared.

Our Picks

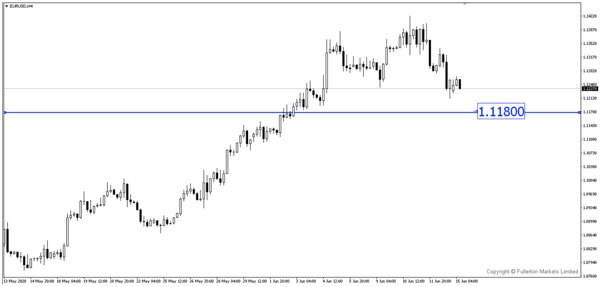

EUR/USD – Slightly bearish

This pair may drop towards 1.1180 this week.

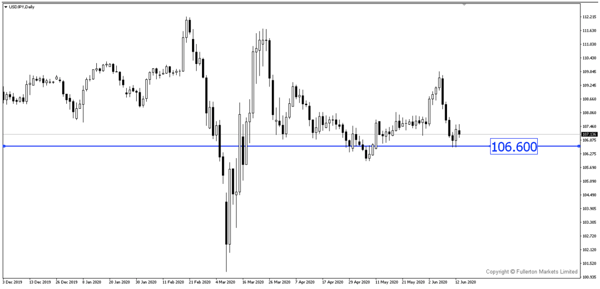

USD/JPY – Slightly bearish

This pair may drop towards 106.60.

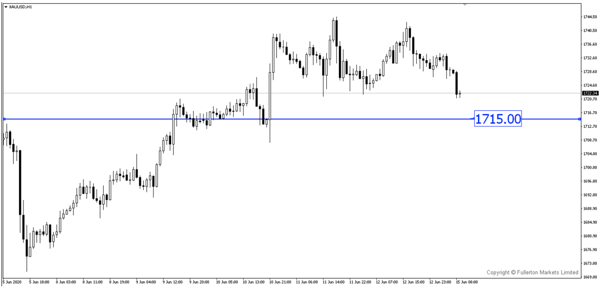

XAU/USD (Gold) – Slightly bearish

We expect price to drop towards 1715 this week.

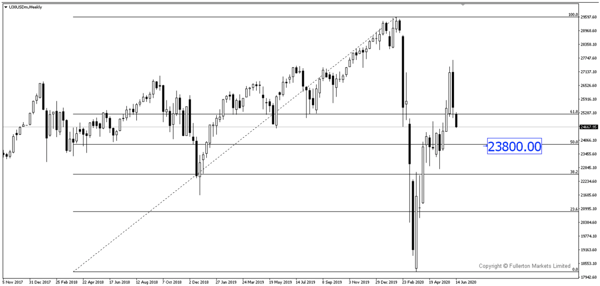

U30USD (Dow) – Slightly bearish

Index may drop towards 23800 this week

Fullerton Markets Research Team

Your Committed Trading Partner