Trump’s “tax reform play” may see profit taking, buy EUR/USD?

Applying range-trading strategy next year might be appropriate as no central bank is willing to lose the game of tightening

Afraid of the global tightening? This might not necessary. Central banks around the world are gingerly trying to take away policy stimulus accumulated in past years without adding much volatility. Led by interest-rate increases by the Fed and PBOC, central banks around the world are shifting towards a tighter monetary stance last week. Yet, the moves were considered as tiny, and the language about future policy outlook seemed fairly balanced.

Another year of synchronized global growth in 2018 is very likely as both the Fed and ECB revised their growth forecast even though they signalled that they would be slowly scaling back the stimulus. Here we looked at what other central banks did after the Fed raised the rate:

- PBOC surprised the market by raising the rate by five basis points. This indicates the tightening bias of the policy makers and this stance will continue in 2018. PBOC’s financial research institute also said that emerging market economies should start monetary policy normalization and exit the easing measures.

- Mexico’s central bank raised its benchmark interest rate last week for the first time since June, lifting borrowing costs by 25 basis points to 7.25%. One board member even favoured a 50 basis-point hike.

- Turkey’s central bank raised one of its main interest rates by less than expected and vowed to keep policy tight until the inflation outlook improves

In the Euro dollar futures market, which is hyper-sensitive to Fed policy, showed that market does not believe Fed is looking to accelerate tightening paces. Most traders doubt that Fed is going to raise rates three time in 2018 given the prospect of tame inflation. This can be seen in the flatness of the spread between Euro dollar contracts that settle in December 2018 and December 2019. The gap remains close to its 2017 low, signalling traders see limited risk of a hawkish Fed in coming years.

Major central banks have moved slowly to reduce stimulus while inflation remains muted and below their targets. All of them are watching each other to ensure that their policy isn’t running in front of their peers and this can be seen in ECB meeting last week. While ECB’s Draghi said on Thursday that he has grown more confident that inflation would eventually rise to the central bank’s goal, ECB’s own staff forecast doesn’t even see that happening by 2020. These sentiments would eliminate the gain in euro.

Our Picks

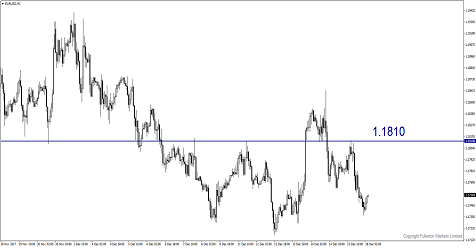

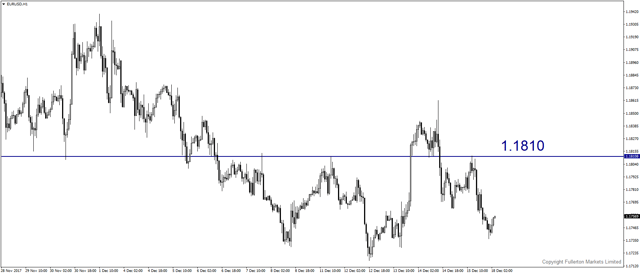

EUR/USD – Slightly bullish.

Trump’s tax reform debates may continue to weigh on greenback. Expect this pair to rise towards 1.180 this week.

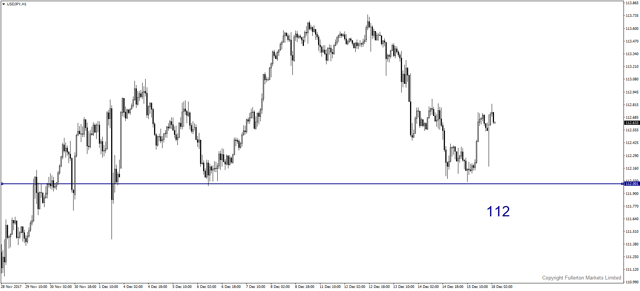

USD/JPY – Slightly bearish.

We expect this pair may drop towards 112 amid price consolidation

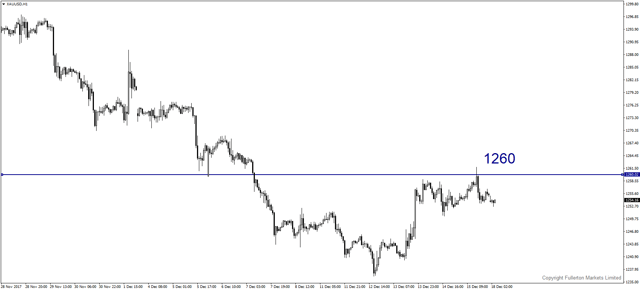

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1260 this week.

Top News This Week (GMT+8 time zone)

New Zealand: GDP QoQ. Thursday 21st December, 5.45am.

We expect figures to come in at 0.7% (previous figure was 0.8%).

US: Core Durable Goods Orders m/m. Friday 22nd December, 9.30pm.

We expect figures to come in at 0.6% (previous figure was 0.9%).

Fullerton Markets Research Team

Your Committed Trading Partner