The previous shutdown in October 2013 which lasted for 16 days has the dollar weakening halfway through before bottoming. With US weak data following the shutdown, do we long EUR/USD?

This shutdown means that many US government´s activities will come to a halt until the funding for such activities is approved

The dollar has been under selling pressure since the mid of December. This was due to disappointing data with consumer confidence slipping, housing starts and building permits falling and manufacturing activity in the NY and Philadelphia regions slowing. Although we saw a gap down this morning in dollar once the market opened, the gap was filled up eventually as time goes by. The reason was because the dollar dip had been overstretched for the past few weeks and signs of bottoming can be seen. The shutdown of the US government will only exacerbate the current selling of greenback but it would not be the long-term factor that leads to it.

The last time a shutdown occurred in October 2013, the dollar declined leading up to the shutdown but bottomed out halfway through as traders moved on. This clearly showed that the shutdown of the US federal government does not impact on its currency as much as we thought it would. In addition, the shutdown did not have a great impact on the greenback as US produced strong NFP and retail sales data 2 months prior to the shutdown in 2013.

However, we still see no reason to return to the greenback. Traders will still require a boost from either strong economic data and hawkish statements from Fed before gaining confidence in the greenback. We should expect the dollar to regain strength once Fed’s new chairman Powell takes over in March. For this week, there are no major US economic reports scheduled until next week Friday whereby the fourth quarter GDP numbers are due.

Lastly, Euro stayed steady after Sunday’s meeting by Chancellor Angela Merkel with the Germany’s social Democrats which went well, inching them a step closer to forming a new government after the Social Democrats voted in favour of entering formal coalition talks with her conservative camp. The next upcoming big news which will determine if EUR/USD can jump through the new high of 1.2322 will be ECB’s meeting this Thursday by President Draghi.

Our Picks

EUR/USD – Slightly Bullish.

If the Thursday ECB’s meeting turns out hawkish, we should see this pair to rally to the next resistance in sight.

USD/JPY – Slightly bearish.

This pair may fall to 110, a psychological barrier which is heavily supported.

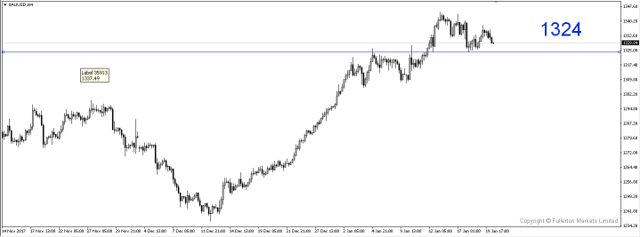

XAU/USD (Gold) – Slightly Bearish.

We are expecting a slight correction in price level before looking for a clear direction.

Fullerton Markets Research Team

Your Committed Trading Partner