With the slow-moving NAFTA developments and trade tensions, Long USDCAD?

The most important event risk this week will be Wednesday's BoC Rate Statement. After waiting for half a year, Stephen Poloz appears ready to get back on his rate-hiking path this week. Thankfully the rate hike is not controversial and has been fully priced in. The loonie is trading higher ahead of the monetary policy announcement because investors are hoping that the hike will be accompanied with hawkish guidance.

However, Canada is facing a number of trade-related uncertainties, including NAFTA talks, US steel and aluminum tariffs and the threat of more duties on the economically critical automotive sector.

Poloz reverted to a wait-and-see approach to rate hikes in June. The data-dependent economy is now ready for a rate hike as recent data has been healthy such as the Bank of Canada’s own survey on business sentiment, tightened job markets and growth in wages.

Below are some of the economic data that was announced previously:

- CPI fell short of expectations coming in at only 0.1% versus the expected 0.4%.

- GDP rose 0.1% in April compared with economist expectations for it to stay flat.

- Jobs data was mixed as 31.8k jobs were added versus the estimated of 22.3k, while unemployment rate rose to 6% versus 5.8% estimated.

- Canadian trade balance in May came out at -2.77B vs -2.2B expected. This was after the steel and aluminum tariffs went into effect at the end of May, so a softer data should be not surprising.

- Canadian inflation rate in May was at 2,2%, though below market expectations for 2.6% advance, but is well above the Bank of Canada inflation target of 2%. Higher inflation figures gave Poloz the green light to hike the interest rates.

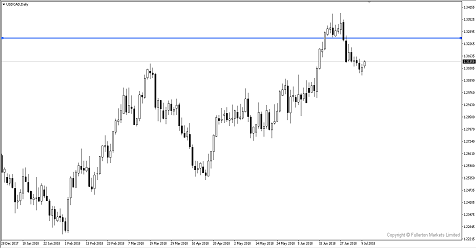

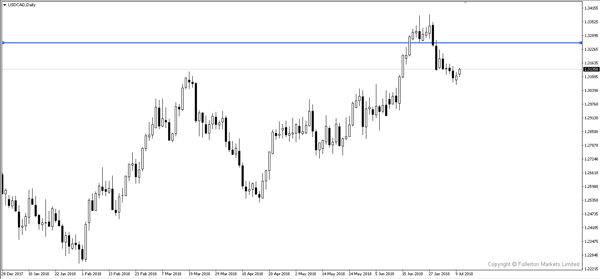

- As USDCAD is hitting a potential resistance at the 1.314 price regions, we could expect a fall once rates are announced but those gains could fizzled once the forward guidance shed light on Canadian plans in the future.

As the economy is operating close to full capacity, it would only make sense that it starts to raise rates now then to wait for trade tensions to simmer. Furthermore, raising rates now give BoC the flexibility to lower it if the trade tensions escalate in the future as well. As the market has already priced in the interest rate hike, they are more curious on the forward guidance of BoC and see if BoC’s overall economic view is on track.

Fullerton Markets Research Team

Your Committed Trading Partner