Trade size plays a vital role in managing risks when trading Forex.

As we've mentioned in our previous article on lot sizes, the larger the lots, the higher the profit and loss per pip. Thus, the need to determine your position size when trading currencies.

So, what’s the best lot size for you?

It depends on four things:

-

- Equity/capital you have in your account

- Risk you're willing to take with your trading account

- Number of pips you are willing to lose

- Pip value of the currency pair you are trading

First, let's take risks into account.

You've probably heard of the 1-percent risk rule that will keep you from losing more than 1% of your capital. But what if you’re a bit of a risk-taker?A good way to calculate your risk percentage against your account balance is to use the formula:

Starting Balance x Risk = Loss

Therefore, if your account balance is USD10,000, you can lose:

USD100 at 1% risk per trade

USD200 at 2% risk per trade

USD300 at 3% risk per trade

Remember that these numbers represent your gains and losses in a single trade. Imagine if you risk 2% or more. The general rule of thumb, however, is to not risk more than 5% of your account size per trade.

Learn how to boost profit when investing in Forex while keeping risks at a minimum.

Next, calculate the pip value and loss in pips. If you haven't read our post on lot sizes, we strongly suggest you check it out as we provided formulas and examples to help you work out the math.

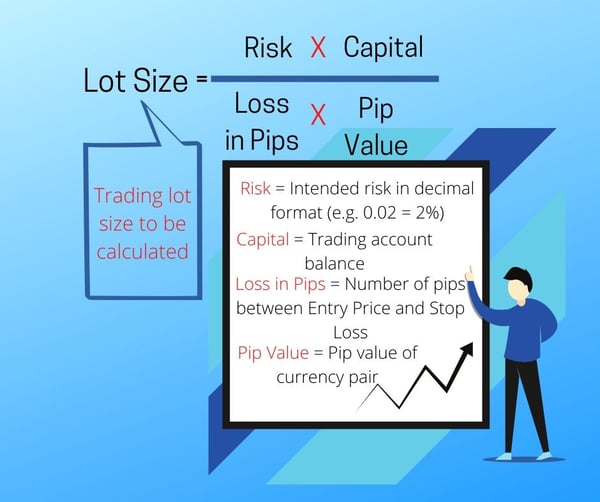

Once you get the required values, you can then use a lot size calculator or, if you like a mental challenge, use the formula below to determine the appropriate lot size to trade.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: The 3 Laws of Successful Trading