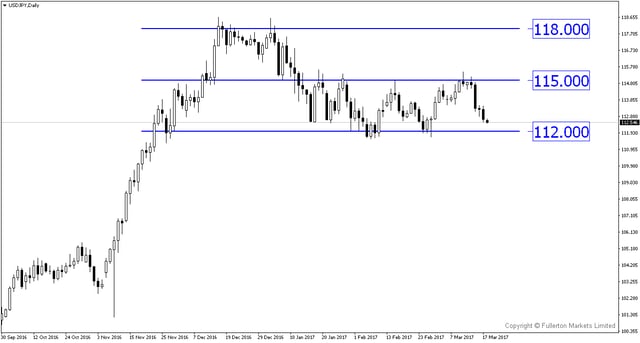

USD/JPY plunged after Fed’s first rate hike in 2017. USD/JPY heading towards 112, when will we see it going back to 115 or even 118 level?

Some traders were left bewildered by how the USD/JPY free-fell more than 100 pips in the first hour after the rate hike announcement. Isn’t rate hike supposed to strengthen the respective currency? Generally, the answer is “yes”. But, what precedes is “market expectation”. The rate hike was expected to happen by the market. As mentioned in last week’s research, market is looking beyond to the next possible rate hike in June. Market was expecting Fed Chair Janet Yellen to give a clear indication of the next rate hike but she failed to live up to expectation. In addition, the rate hike decision was not unanimous; Minneapolis Fed president Kashkari voted to keep rates unchanged. The chance of the next rate hike in June was revised downwards from 60% to less than 50%. The next FOMC is scheduled on 3 May without any press conference after the statement. We expect the dollar bull to take a back seat for now, unless there are renewed speculations to bring the chance of June rate hike back to 60% or more.

BOE, The Surprise Hawk

Bank of England (BOE) could well be the next major central bank to raise interest rate after Fed. This caught traders by surprise the second time in a week. MPC voting member Kristen Forbes voted for an immediate rate hike, citing there are little reasons to overlook inflation beyond their target. Some other MPC members also believe a rate hike may be needed sooner in their minutes. With the weak economic data, on-going Brexit saga and Article 50 on track to be invoked this month, there were little signs of a possible hawkish BOE prior to the announcement. GBP/USD rallied for 3 consecutive days towards 1.24.

Besides a surprisingly hawkish BOE, the twist in the possibility of a second referendum in Scotland and a delay in UK parliament’s approval to the Brexit plan fuelled the rally in GBP/USD too. News reported it would be tough for Scottish First Minister Nicola Sturgeon to call for a second referendum. The majority of the Scottish is against the idea of remaining in the EU without being part of the UK. This lifted the political risk off the sterling. Although there is a slight delay in the approval of the Brexit plan, Article 50 is still on track to be invoked this month. However, the immediate downside risk on the sterling could be short-lived as the actual impact is likely to come after all the negotiations, which could complete many months later.

Our Picks

NZD/USD – Cup & Handle Formation. Consider to go Long after price broke above the Cup & Handle formation. The downside risk is dovish RBNZ on Thursday.

GBP/USD – Slightly bearish. We expect 1.24 resistance to hold if Article 50 is on track to be invoked by end of this month.

XAG/USD (Silver) – Consolidation. We expect Silver to consolidate between 17.45 and 17.25. Upside risk is further scaling back on the expectation of June’s rate hike.

Top News This Week (GMT+8 time zone)

UK: CPI y/y. Tuesday 21st March, 5.30pm.

We expect figures to come at 2.0% (previous figure was 1.8%).

New Zealand: Official Cash Rate. Thursday 23rd March, 4am.

We expect figures to remain unchanged at 1.75% (previous figure was 1.75%).

Canada: CPI m/m. Friday 24th March, 8.30pm.

We expect figures to come in at 0.4% (previous figure was 0.9%).

Fullerton Markets Research Team

Your Committed Trading Partner