When risk-off continues, selling AUD/USD could be appropriate.

Market Needs to Prepare for The Worst

The President of the Federal Reserve Bank of St. Louis predicted that the US unemployment rate could hit 30% in the second quarter due to coronavirus shutdown, coupled with an unprecedented 50% drop in the US GDP. Not only is this situation worse than every prior war that the US has (officially) waged, but more than twice as dire as the worst days of the Great Depression.

Meanwhile, Bullard, one of the biggest Fed doves, said that the Fed is ready to do anything. Bullard called for a powerful fiscal response to replace the USD 2.5 trillion in lost income that quarter to ensure a strong eventual US recovery, adding that the Fed would be poised to do more to ensure markets function during a period of high volatility.

Bullard’s grave assessment "underscores the critical need for Congress and the White House to quickly find agreement on a massive aid program" especially after the Fed restarted financial crisis-era programs to help the commercial paper and money markets, after cutting interest rates to near zero and pledging to boost its holdings of Treasuries by at least USD 500 billion and of mortgage securities by at least USD 200 billion.

While this hardly needs to be spelled out, but 30% unemployment – or 50 million Americans out of a job – basically means that the society will begin to disintegrate, and this would be a world that nobody can possibly fathom. Besides the obvious, there are two additional problems here: First, the Fed's massive response has failed to stimulate risk appetite or to ease the massive dollar short squeeze which has sent the Dollar index to multi-year highs, sparking debate whether the Fed's credibility is now gone as the world awaits helicopter money. Second, and perhaps far more ominous, as of this moment the US is reliving the darkest moment of the financial crisis – when the Congress failed to pass the first TARP iteration, sending the market into a frenzy. Indeed, as we reported earlier.

Nonetheless, it is still opening old wounds from the 2007-2009 economic crisis over who deserves what, whether corporations should get help, and how generous the government should be with workers.

The spread of the coronavirus has touched off those discussions worldwide, but with an urgency that is shredding old hesitancies.

Our Picks

AUD/USD: Slightly bearish

The pair may fall towards 0.56 this week

Hang Seng Index: Slightly bearish

Index may drop to 21360 this week

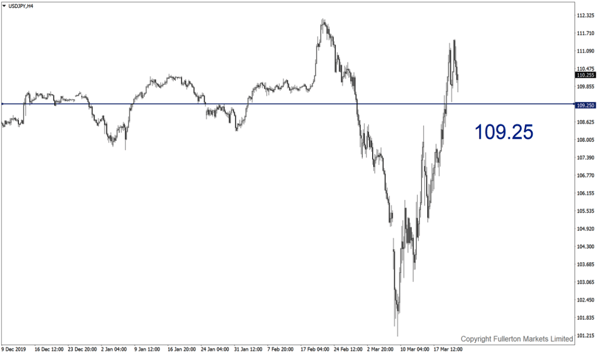

USD/JPY: Slightly bearish

This pair may drop towards 109.25 this week

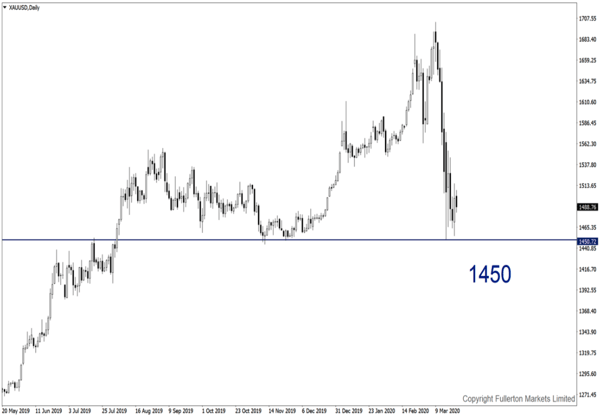

XAU/USD: Slightly bearish

This pair may drop towards 1450 this week

Fullerton Markets Research Team

Your Committed Trading Partner