China and US negotiation may continue to hurt risk sentiment, short USD/JPY?

Fed to take a break looks certain for now

The Federal Reserve signalled that it is done raising interest rates for at least a while and will be flexible in reducing its bond holdings, a sweeping pivot from its bias towards tighter monetary policy just last month. Regardless of the jobs report for the month of January, dollar’s outlook does not look positive in the near term.

The FOMC said that it will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate, opening the door for the next move to also be a possible rate cut. In a separate special statement, the Fed said it is prepared to adjust any of the details for completing balance sheet normalisation in light of economic and financial developments.

From the macro point of view, the US economy is now in a bad place. This is due to slowing growth in China and Europe, Brexit, trade negotiations and the effects of the five-week US government shutdown that had sent conflicting signals on the outlook. As such, common-sense risk management suggests they will patiently wait for greater clarity, an approach that has served policy makers well in the past.

When asked if the Fed is still biased toward hiking rates, Powell said he would want to see a need for further rate increases, and a big part of that would be inflation. It would not be the only factor, but it would certainly be important. FOMC dropped previous language calling for further gradual increases in interest rates and opened the door for the next move to be either up or down, as it cited global economic and financial developments and muted inflation pressures. Policy makers also omitted a line saying risks to the outlook are roughly balanced.

Trade negotiations have not been concluded, safe haven remains attractive

President Donald Trump said he may soon meet with China’s Xi Jinping to finalise details of a possible trade deal as he declared negotiations in Washington were making progress. Trump said that no final deal will be made until he meets President Xi.

US Trade Representative Robert Lighthizer was leading the negotiations this week with Chinese Vice Premier Liu He, the highest-level talks since Trump met Xi on 1st December and declared a 90-day truce.

While speaking at the White House, Trump said he thinks a deal with China can be reached by 1st March. If not, he will go ahead with plans to double tariffs on $200 billion worth of Chinese imports.

Our Picks

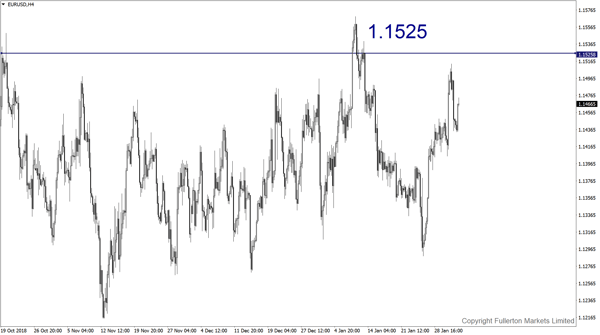

EUR/USD: This pair may rise towards 1.1525 next week amid dollar’s weak outlook.

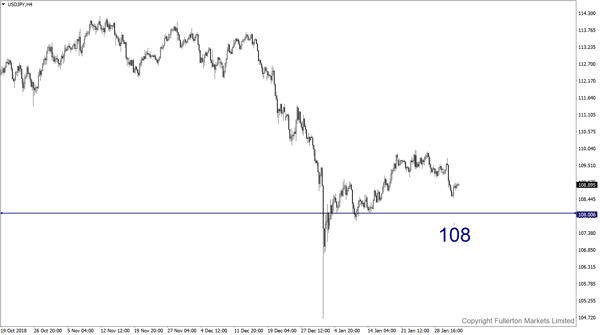

USD/JPY: This pair may fall towards 108 next week as trade negotiations may favour yen’s outlook.

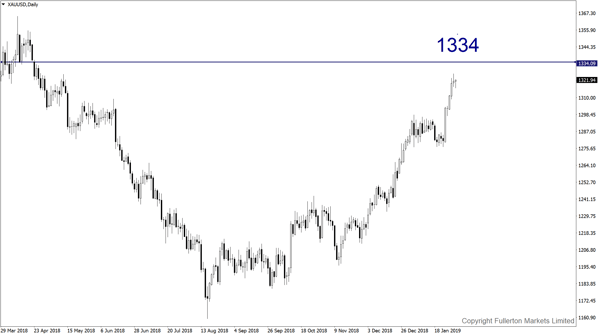

XAU/USD: This pair may rise towards 1334 next week.

Fullerton Markets Research Team

Your Committed Trading Partner