Market will continue to pay attention to Fed’s policy, short gold?

We expect dollar index to gradually rise for the next 6 months

The euro rebounded from a six-month low after the Italian president refused to appoint a euro-skeptic candidate as finance minister. The possible resumption of talks between North Korea and the US also spurred risk appetite. Nonetheless, we expect the Fed’s monetary policy to drive the FX markets in coming weeks instead of geopolitical events.

Surprisingly, Fed’s policy normalisation is likely to benefit most of the Chinese tourists who spend yuan overseas. If we look at the CFETS RMB index, which tracks yuan’s value versus a basket of currencies, its direction is seen largely similar to the dollar index. Having said that, a stronger dollar is likely to push the yuan to appreciate against many major currencies. Indeed, dollar index depreciated 3.6% in second half of last year, CFETS RMB index gained 1.7% in this period. Since the end of last year, Chinese yuan is one of the top performers among 31 global major currencies, while dollar was nearly up 2% in this period. Based on the data in 2017, China outbound tourist to US only counted at 1.7% among the others. In other words, higher dollar may benefit most of the Chinese tourists who spend yuan overseas.

There are two reasons behind such a phenomenon. Firstly, most of major currencies are free-traded without much central banks’ guidance. Unlike those currencies, yuan’s daily move is still capped at 2% to PBOC’s fixing rates by either side. Thus, any impact on yuan from any sharp moves in dollar is limited. Secondly, market believes that a relative stable yuan is in authorities’ favour. When dollar rises too much, market may expect the PBOC to defend the yuan at some levels. On the other hand, when dollar substantially drops, investors would believe the authorities would cap the gains in yuan as a strong yuan hurts the growth such as exports.

Over the next six months, we expect dollar index to gradually rise, mainly due to the monetary policy divergence between the Fed and the rest. Political uncertainties in euro zone and the possibility on ECB to delay the tightening will further influence the dollar higher. Speculators have cut bearish bets on the dollar for a fifth week, according to data from the CFTC. Aggregate net short positions against major pairs have now dropped to the lowest since January. We expect the Chinese yuan to continue depreciate against dollar in the second half, with moderate gains versus most of the currencies in the yuan’s basket.

Our Picks

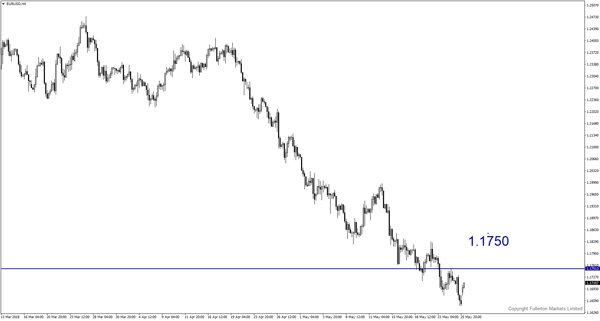

EUR/USD – Slightly bullish.

This pair has rebounded from a six-month low as the Italian president’s rejected a Eurosceptic finance minister that overshadowed Spain’s political turmoil. EUR/USD may climb towards 1.1750 this week.

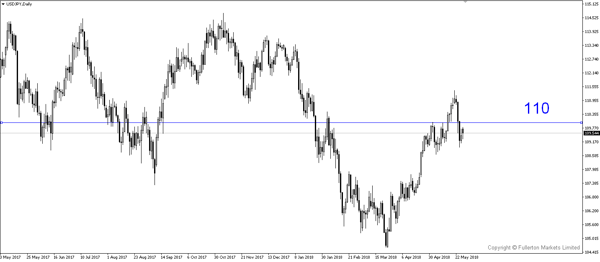

USD/JPY – Slightly bullish.

This pair appears to have more upside than downside from current levels as risk appetite has picked up after prospects of a US-North Korea summit got back on track. USD/JPY may rise towards 110 this week.

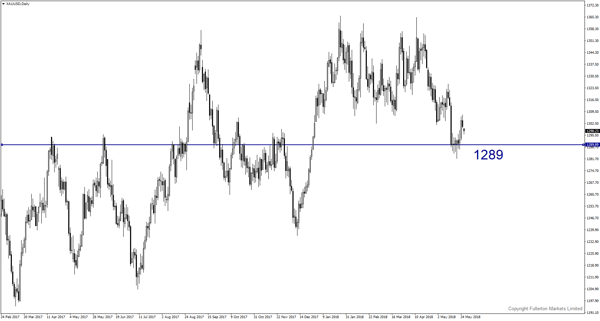

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1289 this week.

Fullerton Markets Research Team

Your Committed Trading Partner