With the market expecting Fed to act slightly neutral, dollar could rise higher this week.

Besides strong performance in the US stock market, the Fed may find another four reasons that refrain them from leashing further easing measures for now, which could offer dollar some boost this week.

The S&P 500 ended the week at 3,193, a gain of 4.9%, and now traders are watching to see if it can scale up to the psychological 3,200 level. The Dow closed Friday at 27,110, up 6.8% for the week, and the Nasdaq Composite was up 3.4%, at 9,814 after reaching an intraday record high of 9,845 on Friday.

Four often-cited reasons for exceptional monetary policy actions:

Market functioning: After notable disruptions, the US financial markets are liquid and functioning well. This is due to Fed's emergency policy interventions – according to Chairman Jerome Powell last week – which has "crossed a lot of red lines that had not been crossed before" as the central bank found itself in a "situation in which you do that, and you figure it out afterward."

Market volatility: Government interest rates have been rather range bound in recent weeks with the 10-year yield ending May broadly unchanged from a month ago. The portions of the yield curve that the Fed can more easily influence have also been well behaved. For example, the spread between two- and five-year Treasuries, the so-called 2s-5s, is at a comforting 14 basis points. And all this comes in the context of record borrowing by the government and also record corporate bond issuance by investment-grade companies.

Credit flow: Most companies with capital market access have had no problems issuing bonds. In fact, at more than USD1 trillion, the pace of issuance for the last few weeks has been the highest on record. Moreover, this issuance has been undertaken at a relatively low cost given both repressed Treasury yields and risk spreads.

Economic activity: While the economy is challenged in multiple ways, it's hard to argue that this is due to financial conditions that the Fed influences. Take housing as an example. As noted by the St. Louis Fed, the average rate on 15-year fixed-rate mortgages was at its lowest level (2.62%) since May 2013. The Fed could well be tempted to do more anyway, on the view that it is essentially a free option.

By continuously intervening in market pricing, adopting negative policy rates, or both, the Fed would risk creating not just additional distortions, but also "zombie markets".

“Zombie markets” refers to markets that no longer send accurate price signals and fail to play an efficient role in mobilising and allocating capital. This undermines productivity, hurts the potential for growth and risks financial instability.

Our Picks

EUR/USD – Slightly bearish

This pair may drop towards 1.1235 this week.

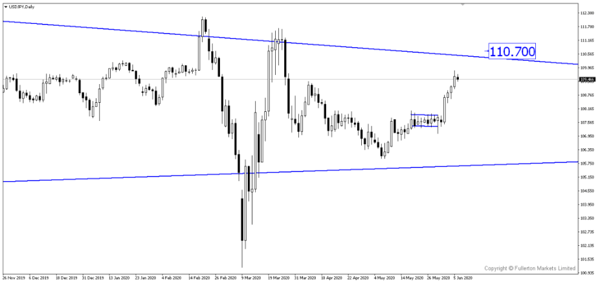

USD/JPY – Slightly bullish

This pair may rise towards 110.70.

XAU/USD (Gold) – Slightly bearish

We expect price to drop towards 1660 this week.

U30USD (Dow) – Slightly bearish

Index may drop towards 26605 this week.

Fullerton Markets Research Team

Your Committed Trading Partner