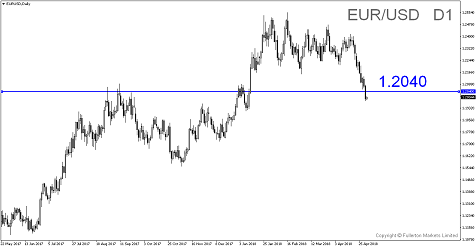

EUR/USD breaks 1.20 for the first time since January, consider to short EUR/USD at peak.

Dollar index rose above 200-DMA (daily moving average) and ongoing trade conflicts around the world pushed EUR/USD below 1.20 overnight.

- Chart below shows the Dollar index broke above 200-DMA for first time since May 2017.

- European Union and businesses warned of more market uncertainties following the Trump administration’s decision to delay US steel and aluminium tariffs for the next month.

- US decision prolonged market uncertainty, which is already affecting business decisions around the world. For example, China Caixin PMI exports orders in April fell below 50, data showed this morning.

- Treasury Secretary Steven Mnuchin is leading a contingent of cabinet members to China tomorrow.

- We are seeing EUR/USD immediate resistance level at 1.2040.

Fullerton Markets Research Team

Your Committed Trading Partner