Fed will keep hiking pace regardless of NFP result, sell EUR/USD?

Fed is likely to continue the hiking pace even as stocks are selling off

Financial market volatility and US labour market results are likely to dominate headline news in the coming week.

Fed officials have downplayed the significance of recent market developments, but the tightening of financial conditions over the past few weeks could have meaningful implications. More restrictive conditions will reassure Fed officials that their gradual approach to policy normalisation is gaining traction. However, if this tightening becomes excessive, officials may begin to ponder the need to dial back on their intended course of action. However, the recent Fed speech suggested that this tipping point remains a long way off. In other words, a dollar retreat may take time to happen.

Even though the key economic data released in the coming week will be the October jobs report on Friday, the economic signal is likely to be distorted due to recent hurricanes in the Southeast. The initial 3Q GDP results painted a less-than-compelling picture that tax reforms are boosting the productive capacity of the economy, as evidenced by weaker business investment trends; this will intensify negative market reactions to signs of firming labour inflation.

Undoubtedly, the October jobs report will be disrupted by hurricane-related distortions. The recovery efforts from Hurricane Florence are likely to have boosted hiring in sectors such as construction. We should refrain from casting judgment on the health of the labour market without taking into consideration weather-related absences and hours of curtailment, both of which showed significant deviations from the norm in September. If the October results paint a similar picture, the significance of the headline payroll change should be downplayed.

We estimate that the underlying trend in job creation remains near 150,000 per month, and this is unlikely to change until either labour costs pick up or economic momentum slows. We believe neither of which is likely to occur to any material degree before year-end. The risk remains for a further sell-off in the US bond market pushing yields above 3.25% and there is very little in the way of technical levels above 3.25% to about 3.50%. Dollar remains attractive if US Treasury yield were to break higher and higher.

Our Picks

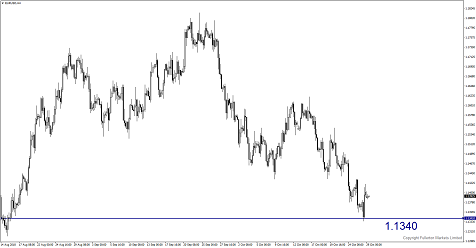

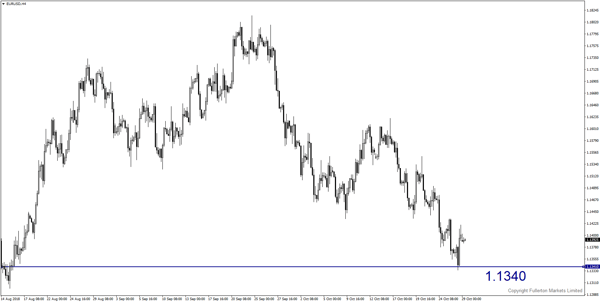

EUR/USD – Slightly bearish.

Volatility in euro stands slightly above its year-to-date average and we may see fresh short positions emerging next week that features the release of euro-area growth and inflation data as well as US payrolls. This pair may drop towards 1.1340 this week.

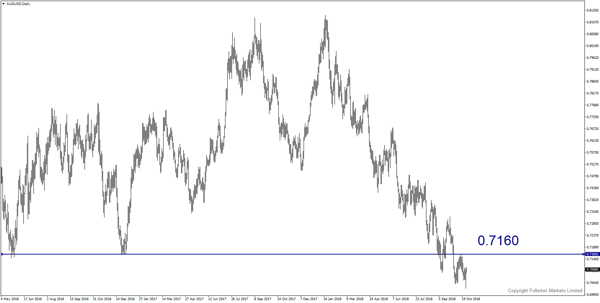

AUD/USD – Slightly bullish.

This pair may slightly rebound to 0.7160 this week as China’s policymakers seem to be doing whatever it takes to bail out the nation’s stock market.

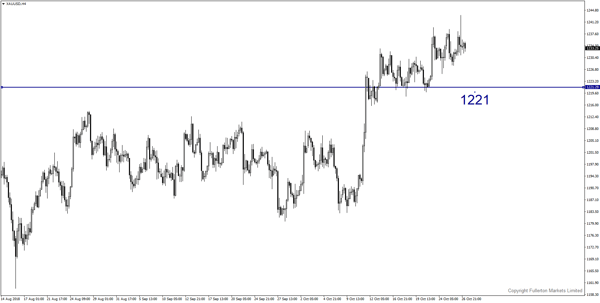

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1221 this week.

Fullerton Markets Research Team

Your Committed Trading Partner