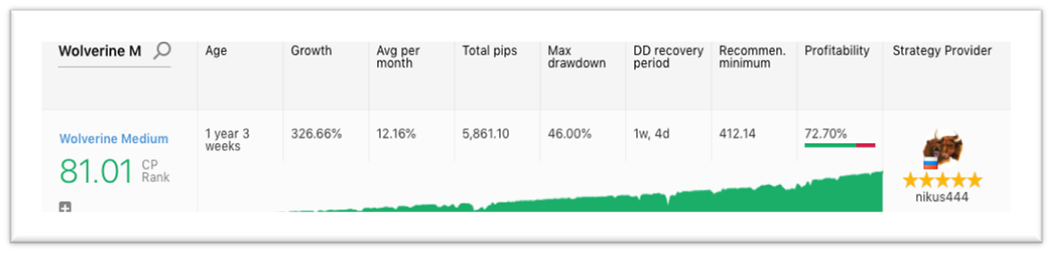

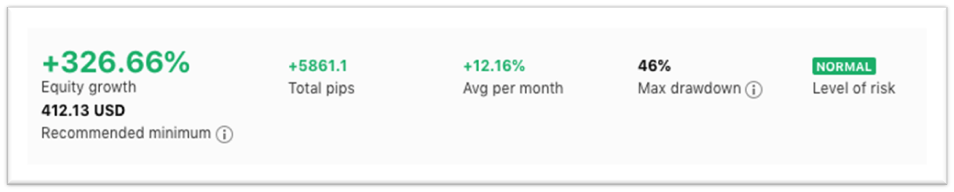

Today, we look at strategy provider “Wolverine Medium”. This strategy provider’s equity growth since inception is 326% and has a total of 5861.1 pips.

Their account has been running for 1 year and 3 weeks and has an average returns per month of 12.16%.

In their Russian description, they mentioned that they trade with an EA and aim to make 5% per month. However, they did better than that with an average profit of over 12.16% every month. I consider them as a medium-risk trader, since their Maximum Drawdown is only 46%.

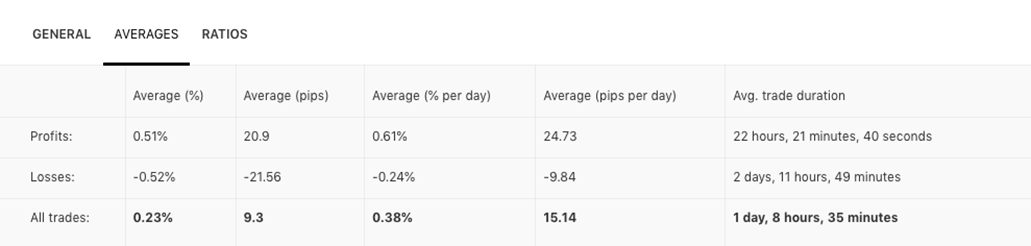

Under the trading statement, you can see that they do not set a stop loss for their trades. This is because they use a price averaging strategy, which keeps their account growing steadily. However, with this strategy, it is possible to have a large drawdown when the market moves against the trend of the trade. So in this case, it is advisable that you set the required advanced stop loss to protect your account.

Their average profit is at 9.3 pips, which means that as a Strategy Follower, the 0.7 pip commission CopyPip charges will be negligible.

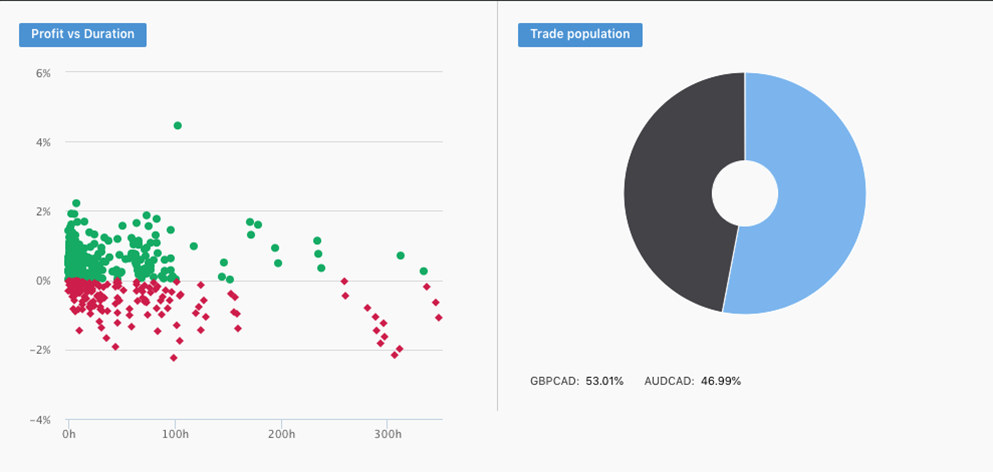

Finally, they only trade on 2 main market pairs, GBPCAD and AUDCAD. This is in line with their trading strategy to avoid large drawdowns. Besides, the risk level of each trade order only fluctuates in the range of -2%. I would advise to use a comfortable capital to follow them, to give yourself some buffer in the case that they let their losing trades float to an unprecedented level.

Fullerton Markets Research Team

Your Committed Trading Partner