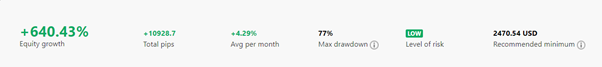

Today, we are looking at a strategy provider called “Goldmuch”. The first thing that catches our attention is the max drawdown of 77%, putting them as a high-risk strategy provider.

Emphasising this would be the statistics showing equity growth of 640.43% with an average per month at 4.29%.

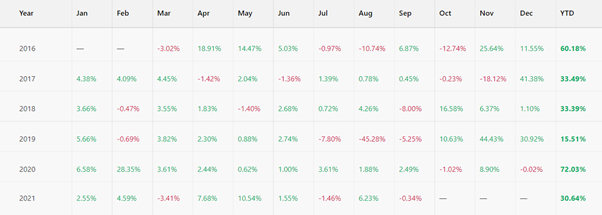

From their track records below, it’s impressive that they have been trading since 2016 and even though there are several losing months, they were always able to finish the year with a positive result. In one of the largest losing months when they lost 45.28%, they were able to gain 44.43% and 30.92% in the following months, bouncing back from their losses.

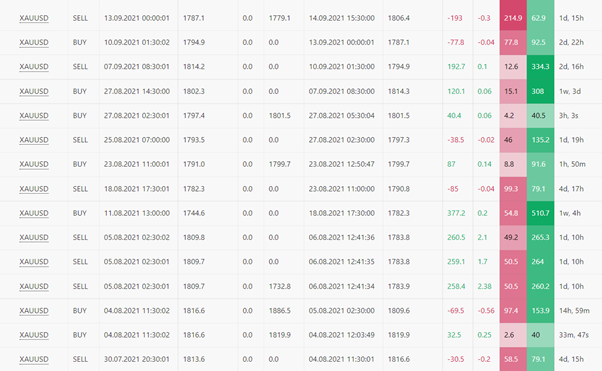

As we look at their trading statements, we realised that they do not put a stop loss, which is a red flag. However, we can use the advanced settings to set a fixed stop loss.

We can also see that the duration of each trade was over a few days, so if we want to follow this SP, we must consider putting more capital buffer to cover any potential losing position.

Overall, they are at an average of 12.92 pips, which is sufficient to cover the 0.7 pip fee from CopyPip.

Lastly, they only trade XAUUSD, so if you prefer a trader who trades only Gold, you should consider following this strategy provider.

Fullerton Markets Research Team

Your Committed Trading Partner